The following is a contributed article by Steve Wright, former CEO, Bonneville Power Administration and Chelan County PUD, and Hassan Shaban, chief technology officer at WattCarbon

Crypto mining has experienced significant growth in the past decade, consumes more energy every year and is increasingly located in the United States. Given the growth in cryptocurrency production in the U.S., there is growing federal, state and local interest in the crypto-mining impacts on electricity costs and carbon emissions.

In January, Steve testified at a U.S. Congressional hearing on cryptocurrency production and its impacts on electric utility operations, a complicated relationship that is worth deeper consideration.

An option explored here is to examine whether coordination between crypto miners and utilities can be a win-win for both parties. A recent Utility Dive article laid out the nuances of treating crypto mining as a grid resource and, in a nutshell, “it’s complicated”.

The crypto-grid dilemma

For the most part, electric utilities have the obligation to serve customers and do not choose whether or not to provide load service to specific customers. But the high energy intensity and portability of crypto-mining machines creates a unique and challenging business relationship between crypto miners and electric utilities.

Utilities around the country have been hesitant to offer long-term cost-of-service pricing to loads that can easily relocate and that also have a high regulatory risk and commodity price volatility. Crypto-mining machines are not aluminum plants that, once built, are not likely to move elsewhere.

One approach that mitigates these risks and supports the partnership between crypto-mining and electric utilities is to use short term wholesale market energy pricing with upfront capital cost contributions for transmission for crypto-mining loads.

The focus on short-term wholesale energy pricing creates opportunities to find areas of collaboration between crypto-miners and utilities, particularly given the increasing adoption of variable energy resources (wind and solar) on utility systems. Load modulation that reflects the value of wholesale energy markets can be attractive to both parties. But there are limits to how far these synergies can be pursued before it works to the detriment of one or the other.

This relationship can be managed from the utility’s perspective using demand response — either active demand response through incentive programs or contractual mechanisms that require load curtailment, or passive demand response using price signals (e.g., time-of-use or hourly retail pricing).

When does crypto demand response make sense?

Two types of decisions are typically considered by crypto miners: planning decisions around where to site their facilities and how to structure utility contracts, and operational decisions that define hour-by-hour or minute-by-minute choices in controlling the mining machines.

We performed an analysis to identify the operational conditions that support crypto demand response. We looked at the effect of several factors on the demand response potential: cryptocurrency prices, wholesale electricity prices, building energy efficiency, and retail rate schemes (time-of-use vs. hourly pricing).

In general, the crypto demand response business case is larger for both utilities and crypto miners when more hours of the year have a higher electricity cost than miner revenue. If mining is always profitable, it makes sense to run the miners as much as possible — although crypto demand response can still be beneficial by allowing miners better control over their electricity costs.

The business case for crypto demand response is strongest during periods of

(i) low crypto prices

(ii) high electricity prices

(iii) when the miners use older machines

(iv) when the miners are housed in energy-inefficient facilities.

How much crypto demand response makes sense?

Crypto demand response works when both miners and utilities are better off financially with coordinated load curtailment than without it.

When utility contracts are negotiated, the big question for crypto-miners is around the lifetime return on investment for mining machines. How many hours can mining machines be reasonably turned off without affecting that rate of return, accounting for both fixed and variable costs?

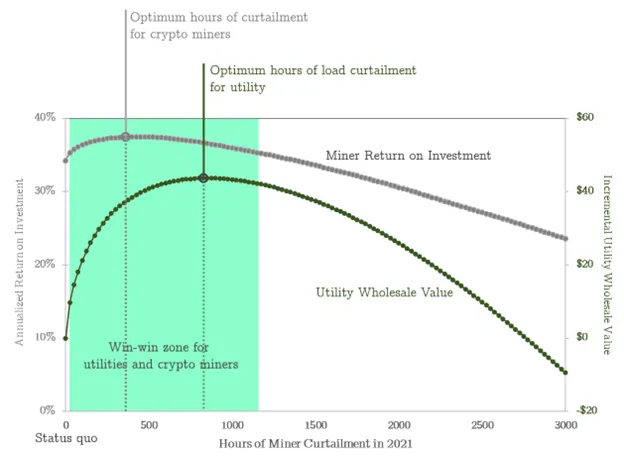

Assuming an average miner lifetime of four years and taking into account the capital costs, we calculated the return on investment (ROI) for an Antminer S9 miner in 2021, with different levels of load curtailment and using ComEd’s hourly retail rates. We also calculated a simplified incremental utility value as the difference between the hourly wholesale electricity price and the retail revenue for the utility from a miner on a fixed rate.

As we see below starting from zero curtailment, the ROI of our selected miner (gray line - left axis) initially increases as it is turned off during hours with the most expensive electricity. The ROI peaks at about 400 hours of curtailment and then decreases with additional curtailment.

The incremental utility value of curtailment (green line - right axis) is initially zero with no curtailment. It increases as the miners are curtailed during hours of high wholesale prices — during those hours, the utility’s savings on the wholesale market exceed its lost retail revenue. The utility value peaks at around 850 hours of curtailment then decreases beyond that.

While these numbers are illustrative and depend on several assumptions, they do indicate that there is a win-win range of curtailed hours, when both the utility and crypto miner are better off than the status quo of no coordination and no demand response. This type of analysis can also identify the optimum number of curtailed hours that maximizes the overall benefit for both parties or the societal benefit (including emissions or resource adequacy, for example).

We anticipate that market changes in mid-2022 (lower cryptocurrency prices, higher wholesale electricity prices) should further strengthen the incentives to coordinate on load curtailment and widen the zone of positive ROI for both utilities and crypto miners.

The value to the grid

There are several important grid and societal benefits from crypto demand response:

- Reduced utility system costs. With the right demand response signal, miners are incentivized to curtail load during periods of high wholesale market prices or grid congestion and to maintain load during periods of low or negative pricing.

- Load flexibility. While crypto demand response is not quite a battery, since it does not feed energy back into the grid, it can act as a flexible load, with more flexible load curtailment benefits since the demand response can potentially be extended beyond a few hours. This characteristic is valuable to the system and should be encouraged.

- Emissions reductions. Wholesale pricing is generally correlated with grid emissions intensity, and crypto demand response can reduce emissions as a side effect or even as a primary goal. We plan to investigate how an emissions intensity signal can be used to modulate crypto load and contribute to reducing grid emissions.

The value to crypto miners

Demand response also has tangible benefits for crypto miners:

- Increased return on investment. A demand response price signal or incentive allows for more profitable mining during hours with low electricity prices. This can extend the useful and profitable life for older mining equipment with lower efficiency.

- Crypto demand response can be especially important as a hedge against low crypto prices, when more hours of the year can be unprofitable.

- Demand response can also be useful to cut costs when mining in energy-inefficient or retrofitted facilities that are more sensitive to electricity rates.

Collaboration is key

This analysis demonstrates that crypto demand response can be a win-win for utilities and crypto miners. Similar, more detailed types of analysis can help define public policy for encouraging efficient production of cryptocurrency and can help utilities evaluate potential programs or rates when there is net societal value.

In conclusion, we encourage more formal, organized dialogue between the crypto-mining and electric utility industries for better public policy formulation and program/rate designs that are a win-win for both parties.