Steady course

Figures on early-stage data center projects remain “very fluid” and the company has seen “modest attrition” since June, PG&E Corp. CEO Patti Poppe said during a third-quarter earnings call Thursday.

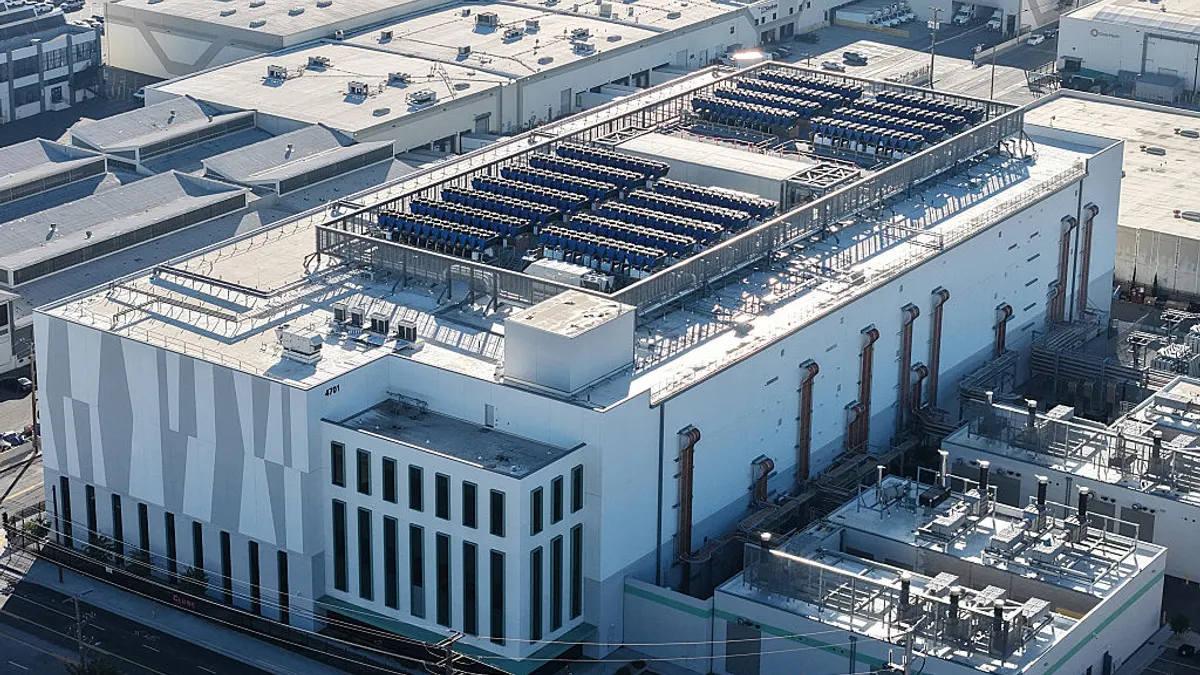

But of the 9.6 GW in the company's data center queue, 18 projects totaling 1.6 GW have entered final engineering — up from 1.5 GW at the end of the second quarter, according to PG&E. The company expects 95% of projects that reach final engineering to enter service by 2030; several may begin service as early as 2026.

PG&E holds that it can cut customer bills by 1% to 2% per gigawatt of new load by using revenue from new large load customers to offset its five-year, $73 billion capital investment plan.

But CFO Carolyn Burke said it was unlikely that PG&E would expand its capital plan to try to attract additional large load customers given the company's low stock valuation. Instead, she said, the company would stick to a “no big bets plan” and focus on upgrading existing assets and investing in safety and reliability while working to improve PG&E's credit rating.

Burke said the company's financial metrics meet the credit rating agencies' criteria for investment-grade ratings, but that the agencies are watching regulatory developments in California for signs that it is time to upgrade the utility.

Wildfire progress

The recent passage of Senate Bill 254 in California should shore up the state's wildfire fund — a key area of focus for the rating agencies and the company's investors. And the utility expects the state legislature to pass additional legislation in 2026 to reform insurance markets and reduce wildfire risk, though Poppe said it was still too early to discuss specific possibilities.

Meanwhile, Poppe said, “there's no better protection for our customers and our investors than predicting and preventing catastrophic fires in the first place.”

PG&E recently buried its thousandth mile of underground power lines, which Poppe said remains the most affordable and effective means of preventing wildfires in high-risk areas within PG&E territory. The company is awaiting regulatory approval for its next 10-year undergrounding plan.

The company also cleared vegetation from a 50-foot radius at the base of nearly 4,000 transmission structures. Internal analysis concluded this would have prevented a majority of the last three years' ignitions, Poppe said.

Fire ignitions within the PG&E service territory have fallen 35% since 2024, and 2025 is on track for the lowest number of ignitions since the company began collecting data in 2015, Poppe said.