Dive Brief:

- Small modular reactor company NuScale Power aims to have “hard contracts” with “two or three major customers” by the end of 2025, CEO John Hopkins told investors and analysts on Thursday.

- Hopkins’ comments came as the company reported a significant jump in expenses in its Q2 2025 earnings update. It attributed the change to “higher business development costs associated with NuScale’s transition from a research and development-based company to a commercial company.”

- Though NuScale and its developer partner Entra1 have yet to finalize a deal, “we’re getting inundated now” with prospective customers following the Nuclear Regulatory Commission’s May 29 approval of NuScale’s 77-MW power module, Hopkins said.

Dive Insight:

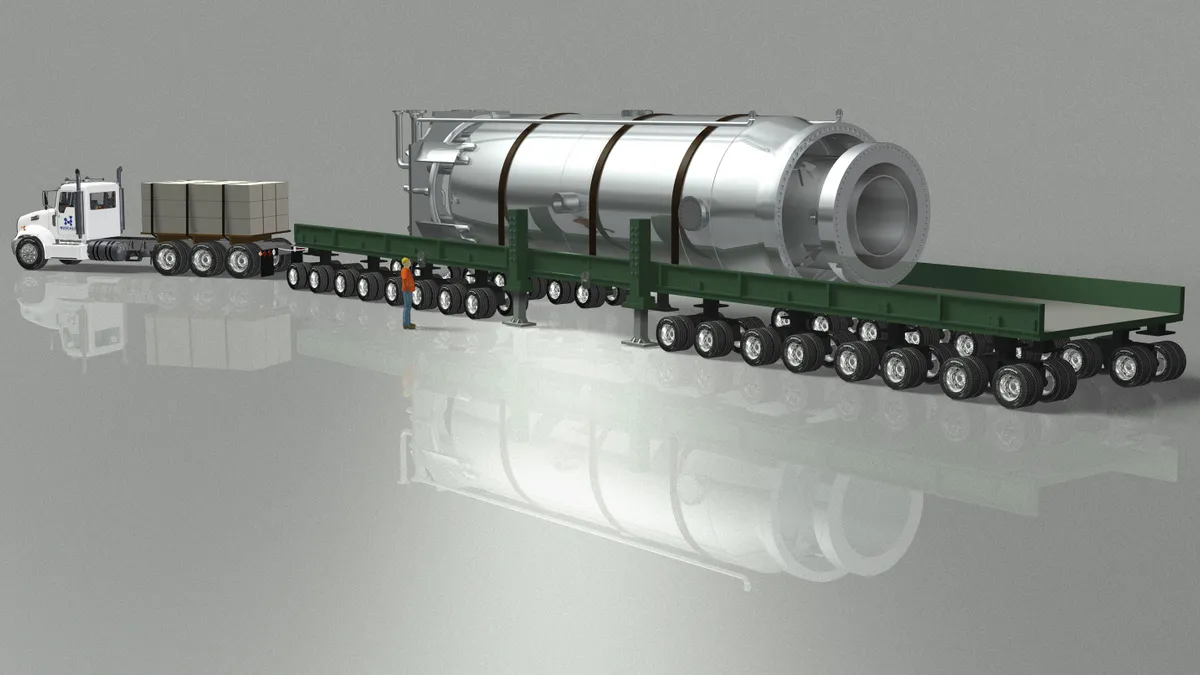

NuScale’s 77-MW module supplanted an earlier 50-MW design the NRC approved in 2023. Some prospective customers had been in a holding pattern as the commission considered NuScale’s application for the uprated module, Hopkins said, adding, “It was accomplished. We’re there.”

NuScale Chief Financial Officer Ramsey Hamady said the May approval puts NuScale in a class by itself among advanced nuclear technology companies.“We’re the only company with two NRC approvals for small modular reactors. There’s no other company with even one … and there [were] a lot of people out there doubting [us], saying, ‘Hey, you’re not gonna get through.’”

For NuScale, the NRC decision amplified regulatory tailwinds supporting the wider nuclear industry, Hamady said.

In an investor presentation Thursday, NuScale executives said four executive orders President Donald Trump signed in May would shorten regulatory timelines for new reactor deployments, bolster domestic nuclear supply chains and enable reactor development on military and other government-owned lands.

The Trump administration “is pressed to get success stories quickly” on new nuclear deployments, Hopkins said, and it has “a limited period of time to make that happen.” That bodes well for NuScale and other advanced nuclear companies, he said.

Hopkins’ comments about notching one or more customer deals by the end of the year echo recent company guidance and his comments on NuScale’s two previous quarterly earnings calls.

In March, NuScale said it was in “advanced commercial dialogue with major technology and industrial companies, utilities, and national and local governments.” In May, Hopkins said the company was “in the process of submitting and negotiating term sheets” with potential customers.

Hopkins and Hamady said Thursday that customer interest has increased since May, led by large technology companies, utilities and the U.S. military. NuScale also continues early work as a subcontractor on Fluor Corp.’s proposed 462-MW power plant in Romania, though the timeline for that project has slipped; NuScale now expects a final investment decision in late 2026 or early 2027, Hopkins added.

Neither executive nor any of the stock analysts on the call mentioned an independent developer’s proposal to build a 462-MW nuclear power plant in southern Idaho using NuScale’s technology.

Sawtooth Energy and Development proposes using six of NuScale’s 77-MW modules to power the plant, according to local news reports and a draft environmental impact statement. Project manager Dan Adamson said in an email last month that the company had “talked with NuScale, and [we] like their equipment and design, but [we have] no written deal as of yet.”

A NuScale spokesperson told Utility Dive that “we are not engaged with Sawtooth Energy and Development Corp.” and that NuScale “remains committed to working with our exclusive partner, Entra1, to commercialize, deploy, and distribute” its reactors.

The relationship with Entra1 gives end users of NuScale technology more operational flexibility than they would have if they owned and operated their own power plants, Hopkins said Thursday. They can simply purchase power from Entra1 or through a utility, he said.

“It’s like buying a computer with an Intel chip,” Hamady added. “We’re the Intel chip inside — in this case, [inside] the power plants” that Entra1 builds and, in some cases, may own and operate, he said.

In that sense, it’s more accurate to say Entra1 is NuScale’s customer rather than an end user like a hyperscaler or a utility, Hamady said.

“We don’t sell electrons,” he said. Instead, he likened NuScale to an original equipment manufacturer selling a piece of equipment.