Dive Brief:

- The Securities and Exchange Commission on Tuesday served SCANA Corp. with a subpoena for documents as part of an investigation it is conducting related to the cancelled expansion of the V.C. Summer nuclear plant in South Carolina.

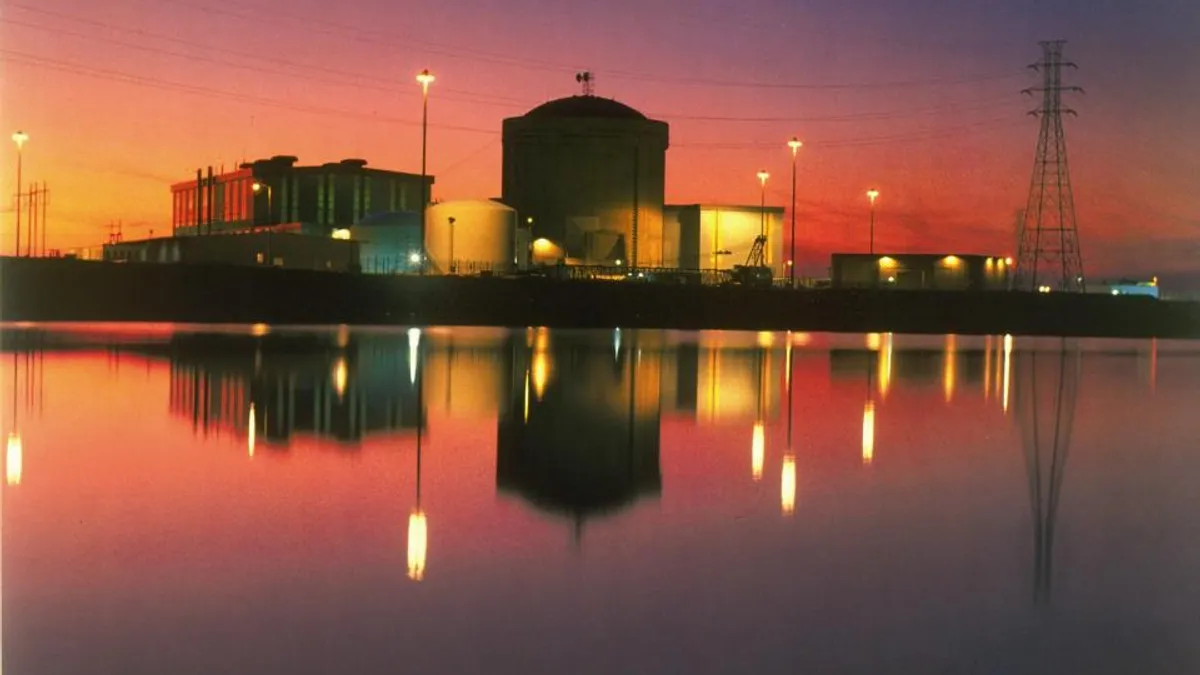

- SCANA officials said in a statement that they will "fully cooperate" with the SEC investigation. Company subsidiary South Carolina Electric and Gas owns 55% of the plant and abandoned its two-reactor expansion project with partner Santee Cooper in July.

- The SEC investigation comes on the heels of a shareholder class action lawsuit that alleges SCANA executives made "false and misleading statements" on the Summer project. Determining when company officials knew of construction problems at the plant is expected to be crucial in that case and two other shareholder suits filed against the utility.

Dive Insight:

When it was proposed in 2008, the expansion of the V.C. Summer nuclear plant was supposed to cost less than $12 billion. But in July, SCANA and Santee Cooper abandoned the project, already having spent $9 billion. They said completing construction would take years and costs could spiral to $25 billion.

Delays and cost overruns were driven by design problems with the new AP1000 reactors intended to be installed at the Summer plant. Westinghouse, after years of delays at Summer and the Vogtle nuclear project in Georgia, declared bankruptcy in March, and internal documents from the company reveal executives had grave doubts about the nuclear projects dating back to 2011.

Exactly when executives at the utilities learned of those issues is now the subject of scrutiny from state lawmakers and the central question in multiple shareholder lawsuits filed against SCANA.

The class action suit, filed by Motley Rice LLC, focuses on a Feb. 2016 internal report to senior utility management from contractor Bechtel on progress at the Summer plant.

The report warned SCANA that the Summer project would likely not be successful, citing flawed engineering documents, low morale at the work site, frequent construction changes, high turnover and generally slow progress.

That was about a year and a half before the utilities agreed to scrap the project, and the Motley Rice suit argues that SCANA executives went on "assuring investors that costs spending was prudent and substantial progress was being made, even when cost overruns and other delays began to materialize."

"As a result of defendants' false statements and/or omissions, SCANA's common stock traded at artificially inflated prices," the firm wrote in a release last month.

The class action suit charges SCANA executives violated the Securities and Exchange Act of 1934 and now the SEC is investigating as well.

In a brief Monday statement, SCANA officials reported they had been served with an SEC subpoena for documents relating to Summer and intend to "fully cooperate" with the investigation. "No assurance can be given as to the timing or outcome of this matter," they wrote.

In the face of lawsuits, SCANA and Santee Cooper are reportedly turning on one another. The Post & Courier reports SCANA executives alleged this month that Santee Cooper officials misled state leaders for years about its role in the Summer plant.

As a state-owned entity, Santee Cooper is not dealing with shareholder lawsuits, but Gov. Henry McMaster (D) and some state lawmakers have endorsed selling the company to cover the costs of the abandoned plant.