Ryan Hledik, Kala Viswanathan and Kate Peters are energy analysts with The Brattle Group.

The North American Electric Reliability Corp. recently warned that two-thirds of North America face the risk of electricity supply shortages during periods of extremely high demand this summer. Prolonged summer heat waves — increasingly observed in many parts of the U.S. — could cause these types of spikes in electricity demand.

More recently, power system operators raised concerns that greenhouse gas emissions standards for power plants could reduce grid reliability, warning that advances in clean energy technology may happen too slowly to replace the reduced use or early retirement of fossil units. In short, we’re facing an ongoing need to mitigate the risk of blackouts due to electricity supply shortages.

There is an enormous amount of generation capacity waiting to be built to help with this problem. According to Lawrence Berkeley National Lab , 680 GW of battery capacity and 82 GW of gas capacity was sitting in U.S. transmission interconnection queues at the end of 2022, in various stages of development. To put that in perspective, the total installed capacity of the U.S. generation fleet was 1,270 GW in 2022.

The problem is that it will take a very long time for this capacity to receive approval to connect to the transmission system. In most U.S. markets, proposed generation projects must go through a lengthy review process that can take years to complete. According to LBNL, average interconnection wait times have increased from less than two years during the period from 2000 to 2007 to almost four years during the period from 2018 to 2022. This is a challenge not only in the near term but also the longer term, given expectations that electrification will accelerate load growth.

Efforts are underway to address these challenges. Last month, FERC issued Order 2023 directing transmission providers to revise interconnection queue rules to help relieve backlogs. Some market operators, such as the Electric Reliability Council of Texas, the California Independent System Operator and the Midcontinent Independent System Operator, already have found ways to accelerate the interconnection process by focusing upgrades on local transmission needs, proactively planning for long-term transmission needs, and facilitating the sharing and transferring of existing generation interconnection rights by separating the process from new interconnection rights.

While these types of initiatives can significantly help to relieve both short-term and the long-term challenges, more will be needed. So, what else can be done?

The role of virtual power plants

Virtual power plants can be a novel and powerful solution to address resource adequacy challenges. Leveraging the rapid growth in consumer adoption of flexible distributed energy resources — such as smart thermostats, electric vehicles, home batteries and smart water heaters — a VPP manages and controls those technologies in an orchestrated way to provide high-value services to the power system. For example, slight, infrequent adjustments to the temperature settings of a smart thermostat (i.e., a couple of degrees) can provide hundreds or even thousands of megawatts of peak demand reduction if aggregated across enough participants within a power market region.

Here’s the key: VPPs are not subject to the interconnection queue delays that are limiting deployment of large scale resources. As an aggregation of small individual resources that are distributed across the grid, VPPs do not impose an acute local impact on the transmission system. Essentially, VPPs can be “built” as quickly as customers can be enrolled in the VPP program. And, unlike building new generation resources, which can be a 20- to 40-year investment commitment, VPPs also can be scaled down if it turns out we’ve overestimated our capacity requirements, thereby avoiding investment in a resource that isn’t needed.

Companies focused on scaling VPPs have demonstrated that they can grow quickly. Voltus, a demand response aggregator, reports that they can build over 500 MW of controllable VPP capacity within one U.S. power market in a single year. The company has connected nearly 5 GW of DER capacity to electricity markets since its inception in 2016. Uplight, a company focused on engaging households in energy programs, was able to enroll nearly 50,000 customers of a single utility in a smart thermostat demand response program within a three-month span, quickly providing nearly 30 MW in controllable load to the utility.

VPP programs can reach impressive scale. For example, Otter Tail Power — an investor-owned utility in the upper-Midwest — has 15% of its system peak demand under control through VPP-like demand response programs. Duke Energy has over 1,500 MW of demand response capacity from nearly 1 million residential customers across its various jurisdictions. Xcel Energy has over 500 MW of capacity from an increasingly diverse portfolio of innovative residential programs. Arizona Public Service has over 50,000 customers enrolled in its smart thermostat-based Cool Rewards program, with ongoing progression toward its goal of 100,000 participants.

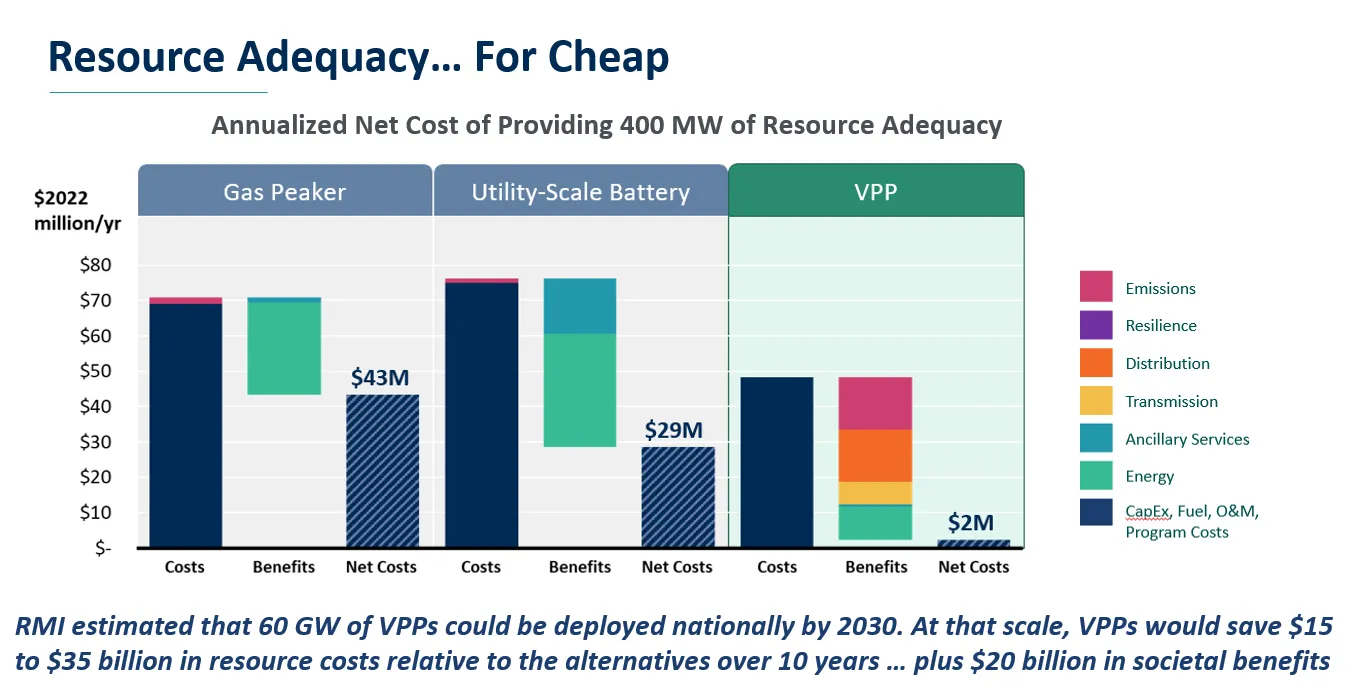

The economics of VPPs are attractive as well. Our recent study found that VPPs can provide the same reliability benefits as other conventional resources — such as gas peakers and utility-scale batteries — at only 40% to 60% of the cost. On a national scale, 60 GW of VPP deployment could meet resource adequacy needs at a cost that is $15 billion to $30 billion lower than the supply-side alternatives, while also providing over $20 billion in additional societal benefits (primarily greenhouse gas emissions reductions) over a 10-year period.

Lastly, but importantly, VPPs are unique in that they are the only resources that put money directly back in the pockets of consumers. Rather than charging customers to build power plants, VPPs pay participants directly for their contributions. That opportunity to engage consumers in the clean energy transition is extremely powerful.

Realizing VPP potential

VPPs can be implemented today, but much more needs to happen to accelerate this transition at scale. Here are a few recommendations:

- Understand the opportunity. VPP opportunities are market-specific; VPP potential in California differs from Massachusetts or Georgia, for example. Jurisdictions that don’t already have a good handle on the opportunities should conduct a market potential study to understand how utilities and aggregators can create programs that maximize VPP value, while considering achievable adoption rates, customer and market characteristics, and the operational nuances of VPPs. Typically these VPP potential studies can be completed in a matter of months.

- Pilot with a plan. Piloting a VPP can help iron out technological details and consumer engagement strategies before scaling. However, too often successful pilots never leave the pilot stage. Each pilot should be conducted under the assumption that it will succeed and be accompanied with a plan to scale as soon as the pilot’s objectives are achieved. Further, it’s important to thoroughly understand prior VPP experience from other jurisdictions. In cases where the technology or approach has been proven elsewhere, pilots may not even be needed.

- Make VPPs worth it for participants... We need innovation around models for attracting consumers to VPP programs. Can VPP enrollment be coupled with other attractive offers, like subscription pricing? Should new technologies arrive at the consumer’s doorstep pre-equipped and even pre-programmed for VPP participation? How do we maximize the value of VPPs to the grid, in order to justify higher incentive payments to participants?

- … and make VPPs worth it for implementers. This means aligning utility incentives with the VPP opportunity, such as through performance incentives or including the operational costs of VPPs in the utility’s rate base. For third party aggregators, it could mean better access to wholesale markets, more opportunities to participate in distribution investment deferral opportunities (also known as “non-wires solutions”), or the wide-scale introduction of more granular time-varying rate structures.

- Establish an (informed) VPP target. Many states have legislatively established targets or requirements for procuring various large-scale resource types, such as wind, solar and energy storage. Similar targets can be established for VPPs. This will require clearly defining the qualifying elements of a VPP and its intended use cases, and ensuring that the aforementioned market potential studies inform the target procurement levels.

These are non-trivial yet highly feasible options for quickly advancing VPPs. We can make progress before we stare down the next potential blackout. Given the opportunity, the remaining question is… who will be the VPP champions and pioneers who step up and embrace this challenge?