Dive Brief:

-

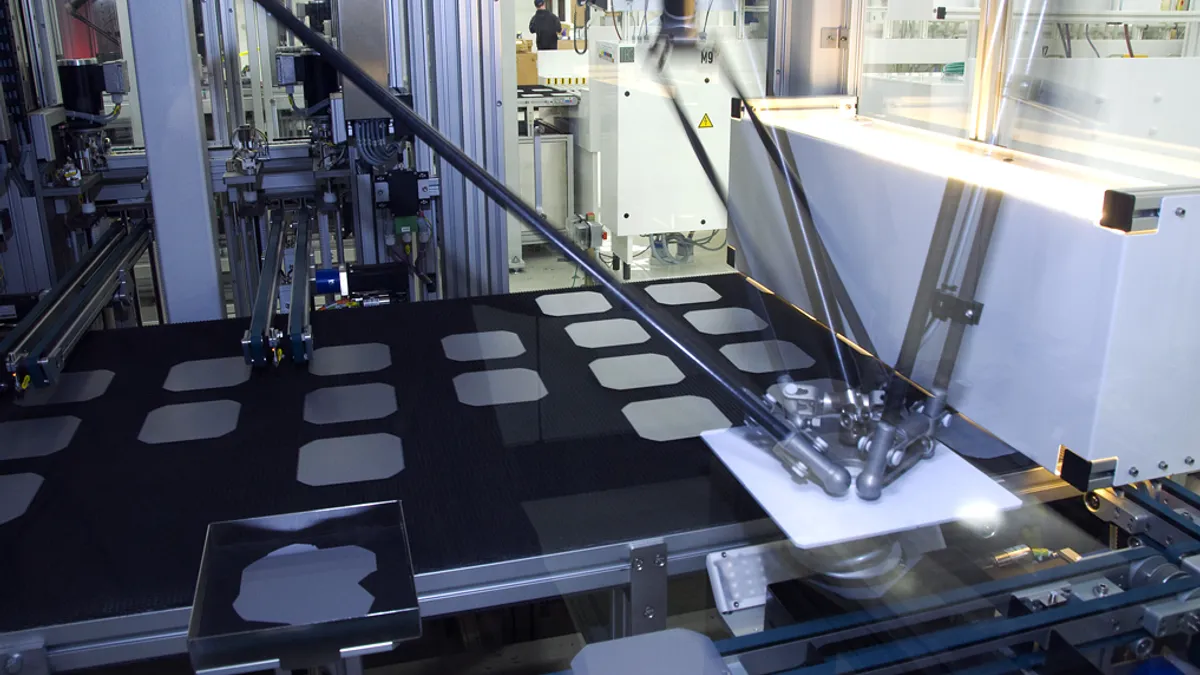

China currently controls more than 80% of all manufacturing critical to the production of solar panels, and could produce more than 95% of the world’s polysilicon and wafers in the near future, according to a new report from IEA.

-

The reliance of the industry on individuals companies and even plants within China leaves the solar sector vulnerable to disruptions that could be triggered by a single event such as a natural disaster, a war, technical failures or decisions by a single government or company, according to IEA. Many of these circumstances have already materialized, the report notes, resulting in price escalations and extended timelines for solar deployment.

-

Expanding and diversifying the solar supply chain could create 1,300 manufacturing jobs for each gigawatt of production capacity, according to the report. However, cost competitiveness remains a challenge — manufacturing costs are 20% lower in China than in the United States.

Dive Insight

China hosted 79% of global polysilicon capacity as of 2021, according to the report, 97% of global wafer manufacturing, and produced 85% of the world’s solar cells. But even within that nation, IEA finds solar manufacturing is not evenly dispersed.

China’s Xinjiang province accounts for 40% of global polysilicon manufacturing, and one in seven panels produced worldwide contain components from a single facility, according to IEA.

This concentration is largely the result of Chinese industrial policies that identified solar PV as a strategic sector, according to IEA. These policies fostered economies of scale and innovations that have made solar one of the most affordable forms of electrical generation, cutting costs by more than 80%, and made solar an important export for China, representing 7% of the nation’s trade surplus.

However, IEA notes that the concentration of the industry not only to a single nation, but to specific regions within China, has contributed to global bottlenecks that resulted in a quadrupling of polysilicon prices over the past year. And despite this, the report anticipates that China’s share of polysilicon, ingot and wafer production is likely to grow through 2025.

The report also finds that diversifying the solar supply chain could create numerous new jobs and reduce the carbon footprint associated with the production of solar panels. But because manufacturing costs remain lower in China than in other nations, IEA concludes that this diversification is unlikely to occur without policy action.

“In the absence of financial incentives and manufacturing support, the bankability of manufacturing projects outside of panel assembly remains limited outside of China and a few countries in Southeast Asia,” the report determines.

The IEA report calls on policymakers to make supply chain diversification a higher priority and create a formal industrial policy while maintaining open markets and avoiding barriers to trade. It recommends creating financial and tax incentives for manufacturing, expanding research and workforce development efforts, and strengthening support for recycling efforts.

President Joe Biden last month invoked the Defense Production Act to spur the domestic production of solar panels and other energy-related equipment.