Dominion Energy provides regulated electric service to about 3.6 million customers in Virginia and the Carolinas, and regulated natural gas service to about 500,000 customers in South Carolina. Its Contracted Energy segment operates the 2,098-MW Millstone nuclear power plant in Connecticut, various solar generation facilities and the Charybdis offshore wind installation vessel.

In the third quarter of 2025, Dominion’s regulated electric sales rose 3.3% year over year. Quarterly operating earnings grew to $921 million, up from $836 million in the third quarter of 2024.

Dominion’s 176-turbine, 2.6-GW Coastal Virginia Offshore Wind project is about 66% complete, the utility company said Friday. The project, which will be the largest offshore wind farm by capacity in the U.S. once complete, is a 50-50 venture between Dominion and Stonepeak, an infrastructure investment firm that purchased its stake in the project in early 2024.

Dominion expects to finish onshore work and deliver the project’s first electrons to customers by the first quarter of 2026, executives said during an earnings conference call with analysts. Full completion remains on track for the end of 2026, though CEO Robert Blue said that installation of the final turbine towers could slip into early 2027 due to delays in commissioning Charybdis, Dominion’s turbine installation vessel.

Including an unused contingency of $206 million, total project costs stand at $11.2 billion, down about $15 million from last quarter, Blue said. According to its updated forecast, Dominion expects U.S. tariffs to increase the offshore wind project costs $690 million through 2026, with $218 million borne by Dominion and the remainder by Stonepeak.

Dominion now expects the levelized cost of electricity generated by the plant to come in at $84/MWh, up from $63/MWh in August due to expected lower revenue from renewable energy credits. That estimate is within the $80/MWh to $90/MWh range Dominion envisioned in its 2021 initial filing and would support a net monthly customer bill savings of 63 cents, it said.

On the call, Blue expressed confidence that “bipartisan support at all levels of government” would endure for Coastal Virginia Offshore Wind after Virginia’s statewide elections this week.

“It's the fastest way to get 2.6 GW on the grid that’s going to serve AI and technology companies, defense and security installations,” Blue said. “It’s critical to important infrastructure upgrades at the Oceana Naval Air Station. And if you stop it now, it causes energy inflation.”

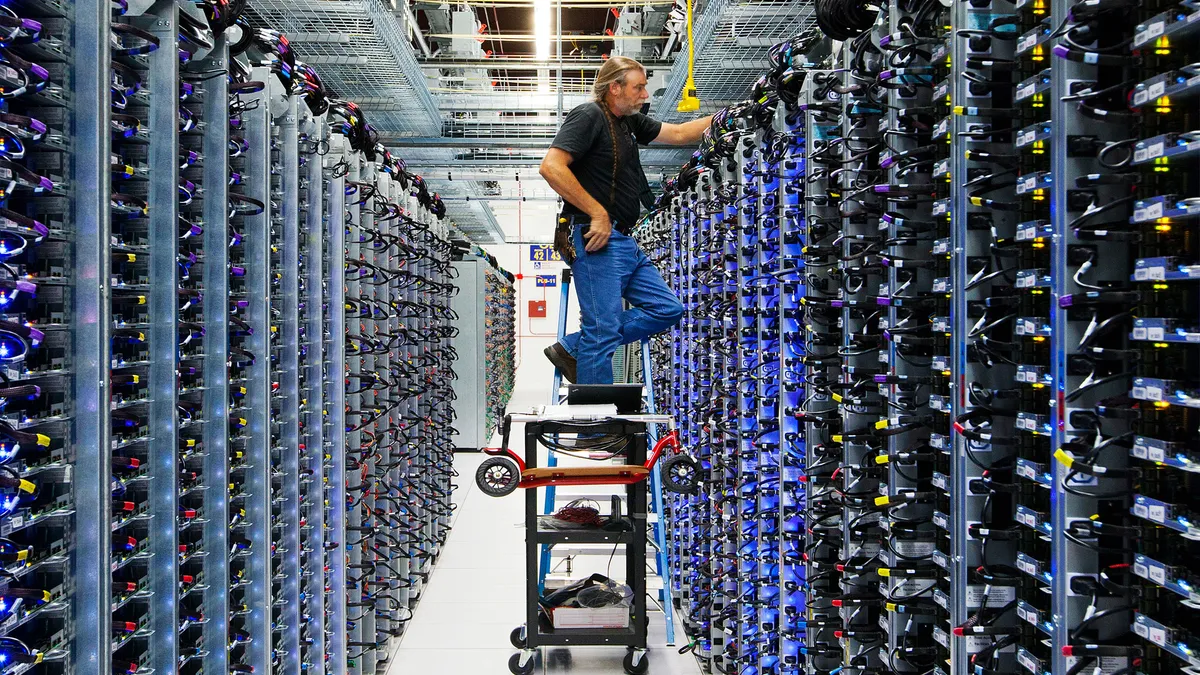

Virginia data center boom continues

Dominion’s data center contracted capacity rose about 7 GW, or 17%, since December. Capacity with an electric service agreement rose from 8.8 GW to 9.8 GW while capacity with a construction letter of authorization jumped from 5.2 GW to 9 GW during the period.

Both project categories involve guaranteed payments to Dominion, even when a customer walks away from construction or fails to meet expected load levels.

Across its entire service territory, Blue said Dominion has received 17 GW of delivery point requests from data centers so far this year and more than 58 GW since 2020. It has “communicated firm rates” for more than 25 GW of capacity expected to energize through 2031, he added. The typical data center project takes four to seven years from delivery point request to meter hookup, he said.

“Our data center load just continues to grow, and the demand continues to grow, which is something considering that we have connected 450 data centers already and we’ve got more than 25% of our sales going to data centers in Virginia,” Blue said.

Dialing in an ‘all of the above’ resource strategy

Dominion executives on Friday detailed the utility’s “all of the above” resource strategy. The utility’s roughly $50 billion five-year capital investment plan includes a mix of transmission, thermal and renewable power projects, they said.

Notable regulatory and process milestones in the third quarter include submitting transmission project proposals to the PJM Interconnection in August; filing post-hearing briefs for the 1-GW Chesterfield Energy Reliability Center, a Virginia gas-fired peaker plant with four 250-MW turbines; submitting an application for 845 MW of solar and 145 MW of energy storage projects across its territory, part of what Blue said would be a planned “cadence roughly of a [gigawatt] of solar a year”; and filing its latest Virginia integrated resource plan.

Dominion said PJM’s transmission selections could come in early 2026. If approved by the Virginia State Corporation Commission, likely by the end of this year, the Chesterfield plant could begin construction next year and come online in 2029. Blue said Dominion’s size and long supplier relationships positioned it well to secure turbines and other long-lead equipment for gas and data center projects.

Measured caution on new nuclear

Dominion’s Virginia proposed IRP pushed back the date of a possible small modular reactor in the state by five years.

Blue cautioned against “[reading] too much into that” and reiterated his company’s memorandum of understanding with Amazon to explore an SMR at its North Anna nuclear power plant in southeastern Virginia. He described Virginia as “the most nuclear-friendly state in the country” thanks to strong policy support, existing civilian reactors and its naval nuclear supply chain.

But fiscal prudence dictates a measured approach to new nuclear investments, Blue added.

“As we think about new nuclear, cost overrun risk being borne by our customers and our shareholders is a concern,” he said.