It's no secret that electric utilities, traditionally, have not been the most innovative companies. Their business model worked for about a century, the technology didn't change much and most consumers didn't have options beyond the local power company.

Clearly, this is all changing. But instead of slowly evolving, the electric sector is now caught up in a mad dash to innovate and modernize. As markets become more competitive and consumers have more control, major utilities are pushing the envelope in their grid technology and customer offerings.

"For the first time in probably forever, utilities have to start taking risks in developing new business models, and they have to be prepared to fail," Navigant Principal Research Analyst Stuart Ravens told Utility Dive. "And then to move on and learn from those failures.

U.S. Utilities Find Multiple Avenues for Innovation

- State Initiatives Several states are pressing utilities to innovate with new business models and integration of grid-edge technology. Best-known is New York's Reforming the Energy Vision, which launched in 2014.

- Investment Utilities are investing in companies developing new technologies. It is not always about an immediate financial return so much as gaining insight into the next generation of energy technologies.

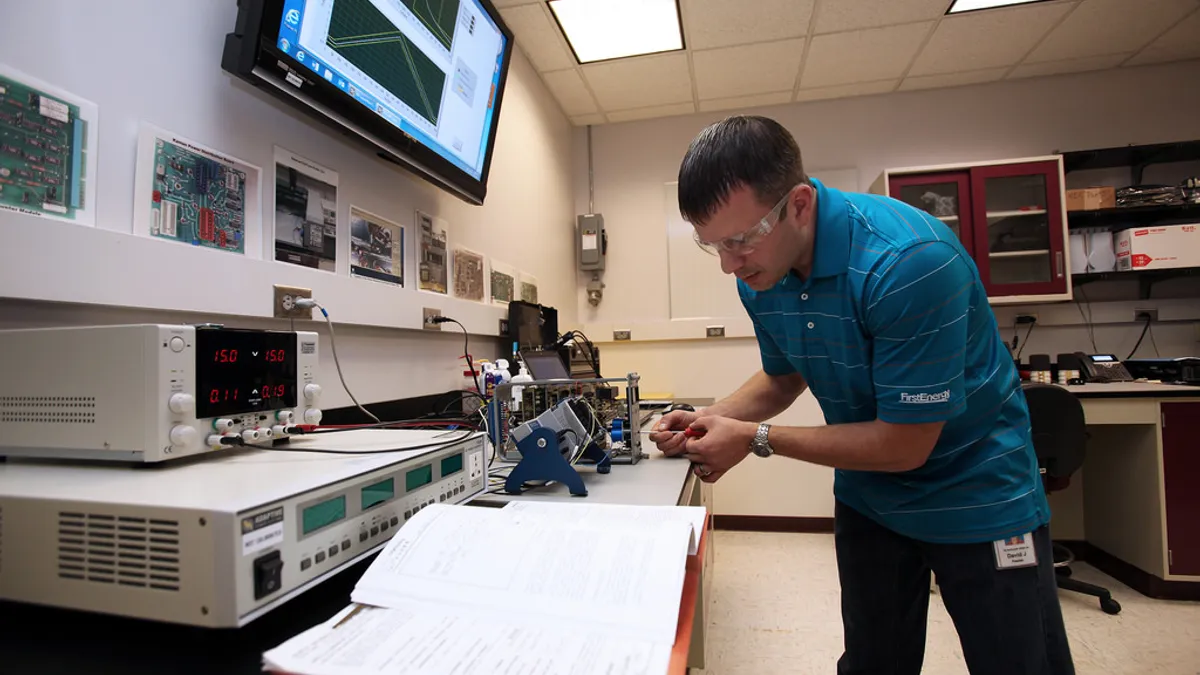

- Innovation Centers Utilities are developing their own technology development centers alone or with others. FirstEnergy's Center for Advanced Energy Technology can help utilities increase cyber protections.

As a percentage of revenues, Ravens said utility investment in research and development has historically been lower than tech companies. "Up until recently, it's been a relatively sleepy industry — there wasn't much call for innovation, and the way utilities are rewarded, it's usually a good idea to let someone else be the first mover," he said.

As opposed to gaining an advantage by moving quickly, the utility industry has faced a "first mover disadvantage," said Ravens. "You can waste a lot of money doing R&D. It's sometimes better to let someone else do it and make a product out of it."

States push innovation

Some states are pushing innovation through policy. New York's Reforming the Energy Vision is the most well-known proceeding, where the state has pressed investor-owned utilities to transform into platform providers enabling new products and businesses. California and Hawaii are also looking at expansive modernization efforts while pursuing aggressive clean energy goals.

But major utility companies are embracing innovation through non-traditional routes as well, taking minority positions in new companies, banding together to invest in research, and building campuses where new equipment and approaches can be tested.

There have been previous periods of innovation in the industry, Energy Impact Partners CEO Hans Kobler told Utility Dive: deregulation in the late 1990s followed by the growth of clean technology.

"But this time it seems different. It's almost like it's different for the first time in 100 years," said Kobler . "The business model is really changing and utilities — the smart ones — are heavily adapting in order to innovate on technology and redefine their business."

EIP is a venture capital firm backed by more than a dozen major utilities, including Southern Co., National Grid, Xcel Energy, Ameren, Alliant Energy, TransCanada and TEPCO. Each year, the firm recalibrates its focus: Last year, the emphasis was on distributed energy resource management systems, behind-the-meter storage and cybsersecurity. This year, Kobler says the firm is focused on electrification and EV charging.

"Electric vehicles are the biggest opportunity we see right now," said Kobler, noting that some analysts believe electrified transportation and indoor agriculture could add 20% to 30% to utilities' EBITDA.

"When the transportation sector is fully electrified, it will result in around $6 trillion in investment," said Kobler. "Half of that is on the infrastructure side of the utility." And the other half can benefit utilities as well, he added, through ratebasing charging stations, smart demand management, and ultimately higher kWh sales.

A force multiplier for utility innovation

Energy Impact Partners represents the new ways utilities are seeking to innovate. The vertically-integrated nature of the utility sector means companies can collaborate rather than compete. It is an unusual turn, and one that could change as markets become more competitive.

"We just didn't see something like [Energy Impact Partners] a few years ago. It's no surprise that it is largely U.S. utilities, since they are not competing, operating in different regions in a vertically-integrated model."

Stuart Ravens

Principal Research Analyst, Navigant

The typical innovation partnership, said Ravens, involves a utility working with a technology vendor to solve a specific problem. But utilities are casting a much wider net these days, and are working together.

"We just didn't see something like [Energy Impact Partners] a few years ago," said Ravens. "It's no surprise that it is largely U.S. utilities, since they are not competing, operating in different regions in a vertically-integrated model. This is less likely to happen in Europe, where everyone is at each others' throats."

It is just that ability to cooperate that makes EIP so effective, said Kobler.

Utilities working with EIP are both strategic and financial partners, but Kobler said a financial return is not the primary reason for their investment.

"They want to put their money where their mouth is — to look over the horizon and see emerging technologies, business models, opportunities and threats. We offer them the ability to collaborate with a group of like-minded peers, almost like a force multiplier," said Kobler. "They benefit from the experience of other utilities in markets that may be different."

Earlier this year, EIP led the Series C funding round for ecobee Inc, to assist the development of a suite of smart home technologies. Last summer, the firm invested in electric vehicle charging company Greenlots.

Kobler said EIP reaches out to its utility partners every year to see what they are looking for. "The theme is always the same: new revenue opportunities, getting closer to the customer, and hardening infrastructure. ... The underlying premise is not going to change for them — they have to keep the lights on, which becomes harder when you have DC Fast charging stations going up in massive amounts."

Utility innovation centers

Another tool utilities are eyeing is the campus-style innovation center.

FirstEnergy broke ground in March on its 88,000-square foot Center for Advanced Energy Technology, in Akron, Ohio. The facility will be used to evaluate and test new grid-edge technologies, and to train staff to use the new tools.

There, researchers will be "looking at different smart technology .... that we're starting to deploy all across the grid," FirstEnergy spokesman Doug Colafella told Utility Dive. The center gives FirstEnergy "one facility to do all that testing and training that is secure," he said.

The center will help with evaluating new technologies and training employees on how to deploy them. "What the facility is going to provide is a hands-on training environment where we can not only test and train, but also store spare relays," said Colafella.

The North American Electric Reliability Corp. has been developing new security and reliability standards, in the wake of a growing cybersecurity threat to the grid, and Colafella said they are a major reason for the new center.

"The primary driver [of the innovation center] is the Critical Infrastructure Protection standards," said Colafella. "It is important as we deploy new programs and devices, that they are validated to ensure they comply."

In another example of the innovation center approach, earlier this year, Nokia announced a new collaboration aimed at helping utilities test equipment and apps. The company has linked its Energy Innovation Center in Plano, Texas, with the University of Strathclyde's Dynamic Power Systems Laboratory in Glasgow, Scotland.

The collaboration will allow for condition-based monitoring and predictive maintenance of wind turbines, validating secure and reliable communications, and other technology testing.

Utilities "want to put their money where their mouth is — to look over the horizon and see emerging technologies, business models, opportunities and threats. We offer them the ability to collaborate with a group of like-minded peers, almost like a force multiplier."

Hans Kobler

CEO, Energy Impact Partners

Dave Christophe, director of energy solutions marketing at Nokia, told Utility Dive that the company is in talks with three utilities to utilize its testing services, and that in September Strathclyde will roll out its first use case for testing, focused on frequency response. As more utilities utilize the partnership, additional data will be added to the use cases — essentially allowing utilities to collaborate and learn from one another.

"Utilities today aren't competitors so they share a lot of information," Christophe said. "This is a way for utilities to leverage the knowledge and some of the testing their peers already do."

FirstEnergy is also considering the possibility of partnering with device manufacturers and transmission customers at its new center, said Colafella, though he cautions, "we're still exploring." Once completed, the center will include a real substation control room where FirstEnergy can test devices.

Market driven innovation

While the United States' vertically-integrated model allows utilities to collaborate, Ravens said the industry should not expect that to continue. He believes the North American utility sector will be much more competitive in a decade, meaning utilities will need to be ready and have in place funding mechanisms to continue development of new technologies.

Ravens authored a report last year focused on the challenges utilities face in transforming their business models, noting a wide range of funding approaches to innovation efforts. Nisource, he found, spends a "small but significant part of its budget" on transformative initiatives. Southern has developed an innovation center and budgets for allocated projects and discretionary spending.

"There is a corporate-wide realization that Southern Company’s existing business model will not last forever," Ravens wrote.

"Every U.S. utility should be worried about what is happening in Europe," Ravens said. "Few utilities are resting on their laurels — they recognize the need for change, but they change within the vertically-integrated structure. In 10 to 15 years, vertical integration won't be around," he added.

"If U.S. utilities aren't careful, if they are complacent and competition is thrust on them before they are ready to cope with a competitive market, you're going to see far bigger European utilities moving over" into the North American market, Ravens warned.

Utilities are fiercely competitive in Europe, and Ravens said about 20% of customers are switching energy providers every year. "It's kind of scaring the hell out of utility executives," he said.