Rising ratepayer burdens from costs to meet new large loads from hyperscalers and other load growth can be limited by utilities that use newly available flexibility to manage demand peaks, power system stakeholders told Utility Dive.

Due to growing demand for power from data centers and industrial customers, total U.S. generation by the electric power sector will grow by 2.3% in 2025, according to September data from the U.S. Energy Information Administration. And the average U.S. residential electricity rate rose over 5% from July 2024 to July 2025, EIA’s data browser showed.

Investing in an expanded power system to meet new large load demand and limiting rate impacts while paying for the investments may seem contradictory, but it can be done, stakeholders said.

Large loads increase rates if they induce utilities to make expensive grid infrastructure upgrades to meet higher demand peaks, said University of California, Berkeley, Haas School of Business Professor Severin Borenstein.

But with policy incentives to “restrain” peak demand, large loads can avoid the costs that drive higher rates, he added.

State policymakers and stakeholders can design and enact those incentives and other policies to strengthen power system flexibility, affordability and reliability, analysts said.

“Rate increases are capturing politicians’ attention because costs, and especially energy costs, are emerging consumer issues,” said former Arkansas Public Service Commission Chair Ted Thomas, founder of Energize Strategies. “That makes resisting rate increases important enough for politicians to expend political capital on now.”

Though the amount of load growth is still uncertain, investments to meet it already threaten affordability. But data shows the right regulation can limit its impacts and potentially stabilize customer costs.

The rising prices

Investor-owned utilities, which meet 57% of U.S. electricity use, will invest of about $1.1 trillion from 2025 to 2029 in infrastructure, up from $765 billion in the previous five years, according to a September Edison Electric Institute report. There are 91 GW of new capacity under construction, and 488 GW planned or proposed, it found.

The data center electricity demand has created “a new category of costs” for expanding and modernizing the system that threatens “bills for all customers,” observed a September Union of Concerned Scientists policy brief. Regulatory practices at the state level “allow for this — the worst — outcome” of growth, it added.

But new policies that encourage growing large loads like data centers to be flexible and shift usage away from demand peaks can improve outcomes, stakeholders said.

Large load flexibility

Large loads can increase rates because system operators and utilities must make capital expenditures, or CapEx, for infrastructure to meet demand peaks, Haas Institute’s Borenstein said. Those peaks are 50 hours or fewer per year but the infrastructure costs for meeting them go into and drive up customer rates, he added.

The most important way to prevent the rate increases is for large loads and system operators to use demand flexibility to manage those infrequent new peaks, Borenstein said. Interconnecting new data centers and large loads “could be contingent on flexing their demand during those peak hours,” he added.

Using flexibility to reduce new large load demand peaks spreads utilities’ increased sales across times when infrastructure and supply are adequate, Borenstein said. Even with some distribution system investment, “rates don't meaningfully increase, he said.

Using “flexible demand strategies,” U.S. power systems can meet over 98 GW of new demand from data centers and other large loads, according to a paper from Duke University’s Nicholas Institute. “Only a 0.5% annual curtailment” during demand peaks is needed, it added.

Greater flexibility “could transform data centers from passive customers to grid assets” to improve reliability, lower costs, and speed connection, agreed an August 31 analysis from the Electric Power Research Institute. Using purpose-designed NVIDIA chips, an Arizona pilot in May led by software designer Emerald AI verified data center flexibility’s potential.

Using only generation to meet infrequent peak demand spikes could also drive up investment in “rarely-used capacity” to meet resource adequacy standards, said Mike Hogan, senior advisor and consultant with the Regulatory Assistance Project. It is instead “more valuable than ever” to take advantage of low-cost demand-side options, he added.

Regulators can also impose large load tariffs with contractual commitments that ensure the new demand is paid for by those who cause it, said former Commissioner Thomas.

Policymakers want to both support economic development and protect consumers from rising electricity costs, Thomas said. Some “will be betting their next election on the decisions they face,” he added.

Distributed generation’s flexibility

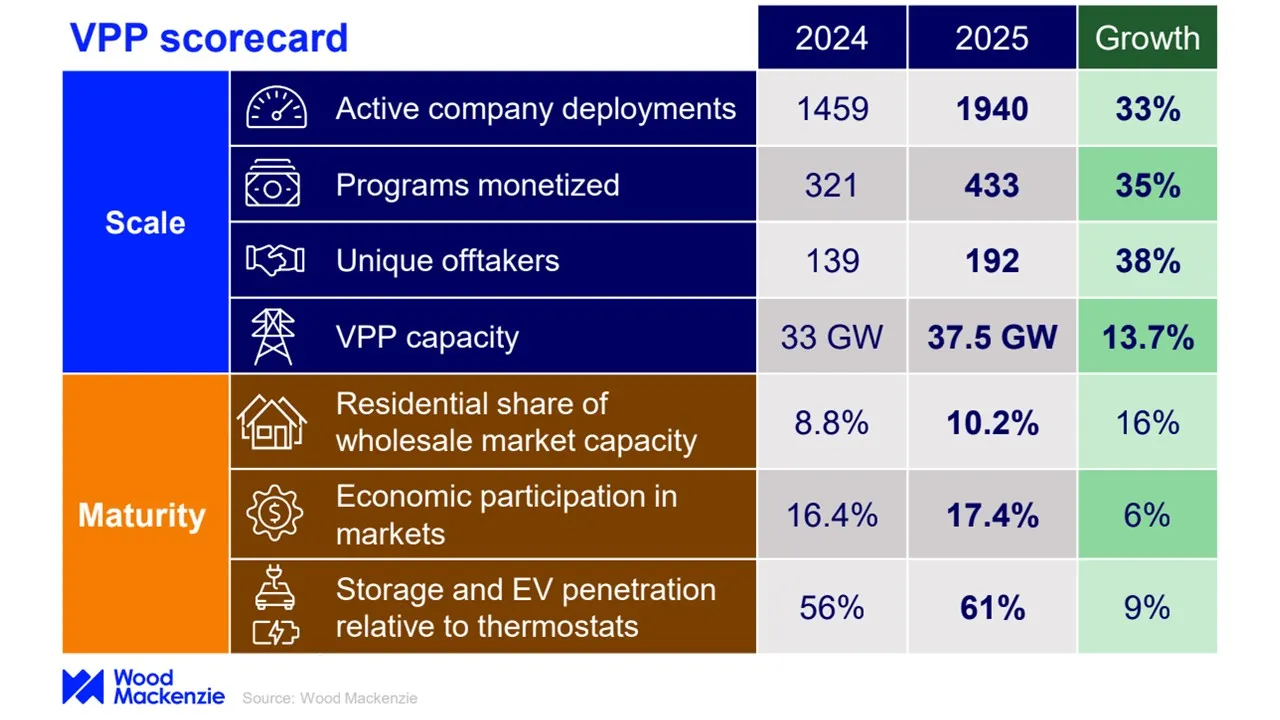

Use of flexible distributed energy resources, or DER, aggregated in virtual power plants, or VPPs, is growing significantly, analysts, utilities and other stakeholders said.

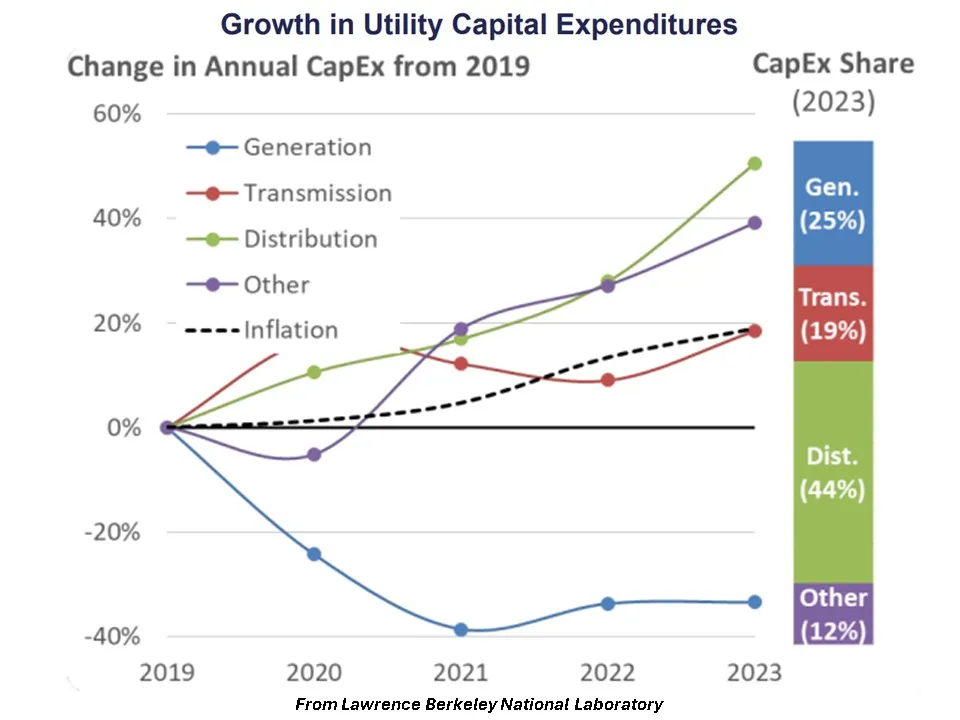

Shifting distribution system peaks would likely have the most impact on customer costs because 44% of utility CapEx goes to distribution system spending, a 2024 Lawrence Berkeley National Lab study found. And the aggregated DER and VPPs that can shift distribution demand peaks are growing, a September Wood Mackenzie study showed.

“The VPP market grew over 33% from 2024 to 2025” and aggregators monetized “433 utility and market programs, a 35% increase over last year,” Wood Mackenzie reported.

In Illinois, Commonwealth Edison, or ComEd, proposed a “bring your own device load reduction program” to “take advantage of customers’ energy storage resources,” said Scott Vogt, the utility’s vice president of strategy, energy policy and revenue initiatives. CapEx for the program will be “minimal” and it will begin with competitive bidding by DER aggregators, he added.

The aggregators would receive signals to reduce electricity usage during peak times and the goal is to get at least 10 GWs of the 47 GW of DER in ComEd’s territory enrolled, Vogt said. There is compensation for DER aggregators and owners, but for the utility and its non-DER owning customers, “the value is in reducing the demand curve,” he added.

Shifting significant load away from peak demand periods reduces both new distribution system infrastructure and system maintenance costs, former Commissioner Thomas stressed.

Regulators around the country are increasingly being asked to recognize the value of demand flexibility at all levels of the system.

Regulations to scale demand flexibility

Current regulatory processes and requirements have utilities “boxed in” and not using forward-looking “outside-the-box thinking,” said Association of Edison Illuminating Utilities Vice President Elizabeth Cook. To meet today’s load growth, utilities need to advance their analytics and “practically reinvent the way they see their systems,” she added.

“Hyperscalers need to readjust their attitude to utilities, too, even though they can buy the utilities they are working with,” Cook continued.

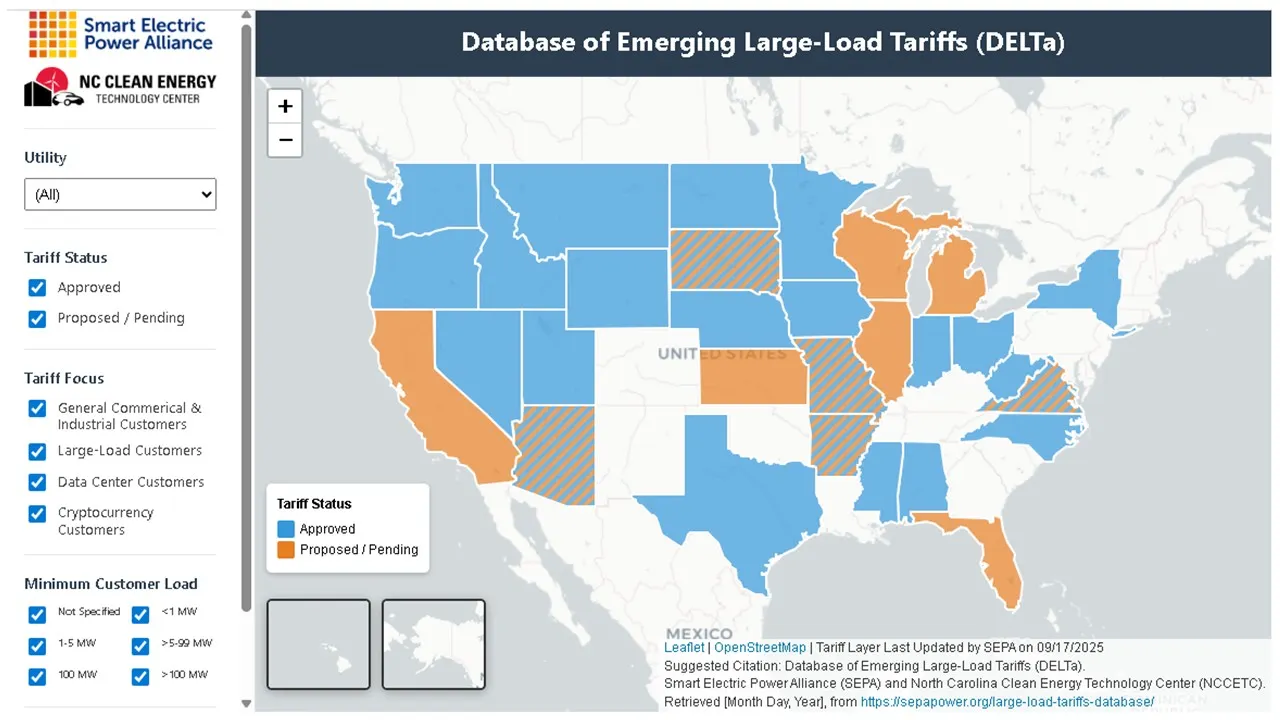

In the last three years, 30 states have designed 49 newly approved or proposed large-load tariffs for 44 investor-owned and public power utilities and cooperatives, according to the DELTa database from the North Carolina Clean Energy Technology Center and the Smart Electric Power Alliance, of SEPA.

There is “a substantial effort to balance the many objectives at play — energy affordability, economic development, reliability, and clean energy,” said Ann Collier, SEPA’s senior manager of emerging technologies.

Provisions in the new tariffs may include requirements to curtail during extreme demand peaks, build onsite generation or storage, or make long-term contractual commitments to cover infrastructure costs.

Scaling demand flexibility can lower costs and make participation easier, but regulatory processes create too much friction for residential customers, said Josh Keeling, chief commercial officer for UtilityAPI, which helps utilities aggregate and use DERs.

Few utilities make the customer-level data needed to integrate VPPs easily accessible, Keeling said. But initiatives like EPRI’s Open Power AI are developing ways to share data and protect data security, he added.

Utilities like Eversource, Pacific Gas & Electric and Consolidated Edison, and their regulators, have streamlined data access, Keeling said. Maryland, New Jersey, Illinois and New Hampshire are following successful work done by New York, California, and Texas on data access, he added.

For demand flexibility to have the most impact, program designs must include meaningful compensation and be clearly understood by customers who enroll, said Schneider Electric Senior Vice President and Chief Technology Officer Scott Harden. And program assets must be dispatchable, he said.

The new load growth will give regulators reasons to resolve utilities’ traditional biases against expensing software technologies for distribution system management, Harden added.

Regulators could formalize the use of aggregated DERs to reduce demand peaks and the costs they impose through distributed capacity procurements, or DCPs, said Sparkfund Vice President Brendan Reed. The DCP would be considered as part of the utility planning process along with other peak capacity resources for cost recovery, he added.

An alternate metric is data from trandomized control trials, said Renew Home Director of Market Innovation Will Baker. Randomized control trial data can approximate the value of avoided transmission and distribution costs, ancillary services and energy, he added.

State policymakers could impose mandates on utilities to reduce a percent of their overall peak loads through load flexibility programs, said Hannah Bascom, chief growth officer for DER aggregator Uplight.

But even without a mandate, utilities facing load growth are beginning to see flexibility as the most prudent investment to protect affordability and reliability, Bascom added.

Flexibility as prudence

Failing to adequately consider flexibility in utility planning and rate cases violates basic prudence and reasonability principles of electricity regulation, several stakeholders said.

Publicly available standardized data in utility planning and rate cases is more important with demand growing, said Mark LeBel, principal for research and strategy at the Regulatory Assistance Project.

A regulatory decision approving a utility’s rate case investment proposals but lacking adequate justifying information is not prudent, he added.

For a proposed rate case investment to be reasonable and prudent, the utility must make a business case that addresses its need, value and accountability to customers, according to Commissioner Abigail Anthony of the Rhode Island Public Utilities Commission.

A utility may argue its regulators’ requirements are impeding vital modernization, but it has to show the modernization investment has net value to ratepayers, Anthony said.

It is especially important to show the value of new investments while significant uncertainty remains about how much load growth is coming, Anthony and others said.

But whatever the coming load growth, “in this world of computational power, utilities need hyperscalers to create AI analytics and hyperscalers need utilities to deliver electricity,” Edison Illuminating Companies’ Cook said. “Regulation that leads to collaboration could be a complete win-win that strengthens overall reliability and affordability.”