Dive Brief:

- Inflation Reduction Act incentives have the potential to reduce building greenhouse gas emissions through 2035 more than emissions in any other end-use sector, according to a recent report from the U.S. Environmental Protection Agency.

- IRA incentives are expected to help cut building emissions 52%-70% from 2005 levels, a median decline of 66%, by 2035. The report compares that with a “no-IRA” scenario in which the sector would reduce emissions 36%-51% from 2005 levels, a median decrease of 45%.

- The IRA-driven transition from fossil fuel equipment to electrification, the incorporation of distributed energy sources like solar and energy storage, and energy efficiency strategies will drive these emissions reductions, the EPA report states.

Dive Insight:

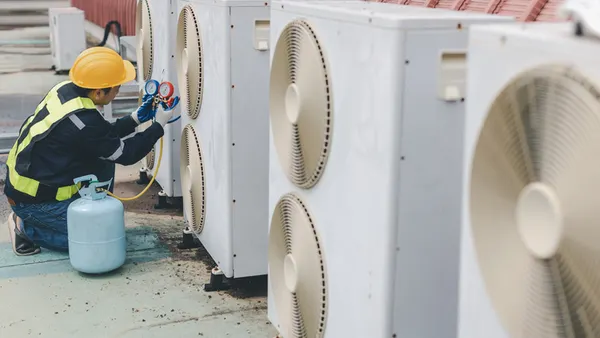

On-site fossil fuel combustion in buildings accounts for 11% of total U.S. carbon dioxide emissions, while about 22% are from the electricity buildings use, the EPA report states. Most of those emissions come from building heating, cooling and water heating as the biggest sources of building emissions, it says. The most effective strategies for substantially reducing building emissions involve installing energy-efficient equipment; installing electric equipment, when possible, to avoid fossil fuel combustion; and ensuring that buildings are constructed and operated in a way that uses energy efficiently, the report says.

Although some buildings are deploying the needed technologies, many are not currently using equipment like air-source heat pumps “at the scale necessary for substantial reductions” in emissions, the report said. This trend is slowly shifting, however, the EPA said, noting that air-source heat pump sales surpassed the sale of fossil fuel furnaces by over 10% last year. Sales of heat pump water heaters lag behind, however. They represent only 0.4% of commercial water heaters, the report said, noting that IRA tax credits, rebates and programs can reduce adoption barriers and offer the potential to significantly increase the deployment of heat pumps. Given the long life of buildings and equipment, the agency calls for installing efficient and lower-carbon-emitting technology an immediate priority in both retrofits and new builds.

One IRA program that can catalyze sizable building emissions reductions is the Section 179D tax deduction for energy-efficient commercial buildings. Under this program, building owners and developers can qualify for a tax deduction of 50 cents to $1 per square foot, based on the level of energy efficiency improvements their buildings have made. These deductions can increase to a maximum of $5 per square foot if specific wage and apprenticeship requirements are met.

Section 179D has faced criticism in the past due to its limitations and frequent expiration. “In recent years, the deduction has not been strong enough to significantly change the market,” the U.S. Green Building Council’s federal legislative director, Ben Evans, wrote on the group’s website earlier in October. With an improved version of the tax deduction signed into law under the IRA, Evans writes, Section 179D can now potentially be a pathway for renovating existing buildings.

Although certain IRA programs have been implemented, others are still awaiting final rules and regulations, Evans wrote earlier Oct. 24. Thus, the EPA report relies on hypothetical scenarios created through modeling to make predictions and assessments due to a lack of real-world data.

The EPA report also draws attention to uncertainties regarding how widely and in what ways building owners and operators will make use of the IRA incentives. Their success may depend on the removal of barriers that include sufficient clean energy generation and transmission, relatively high upfront costs of implementing energy-efficient technologies, supply chain issues, workforce capacity and equipment availability.

Other uncertainties exist in the form of limitations in representing IRA policies that target buildings in multisector models and inadequate representation of capacity building and technical assistance programs within these models, the report states. It calls for analytical methods that can more accurately reflect buildings in economywide modeling and federal- and state-level program design that can have “a significant effect on the impact of IRA initiatives.”