Kushal Patel, Gregory Gangelhoff, Tali Perelman and Amber Mahone are colleagues at Energy and Environmental Economics.

The U.S. electric system is embroiled in a phase of rapid change and great uncertainty. Demand growth is accelerating and sudden policy changes threaten project viability. The path forward will hinge less on predicting exact outcomes and more on preparing for a wide range of possibilities.

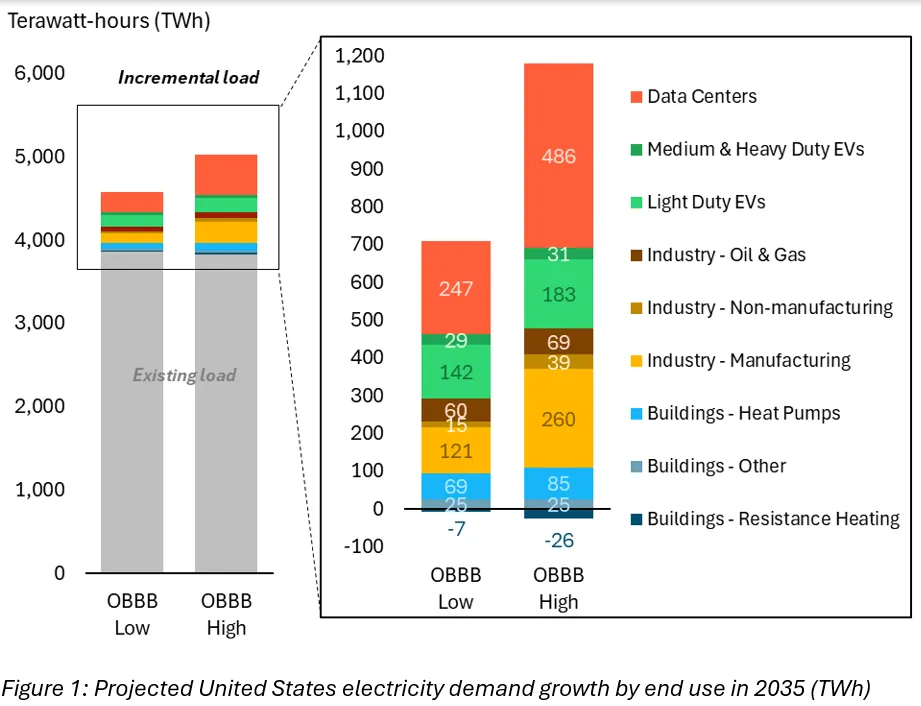

After years of relatively flat load growth at the national level, electricity demand is growing at the fastest rate in decades. E3’s modeling projects national growth of between 1.1% and 2.2% annually through 2035, driven by data centers, electric vehicles, heat pumps and manufacturing. These sectors continue to expand robustly, despite federal rollbacks on clean energy and advanced manufacturing incentives.

But just when new generation development is becoming indispensable for meeting rapidly increasing demand, the economics of building resources have been thrown into turmoil. Federal actions, most notably the One Big Beautiful Bill Act, combined with recent tariffs, have reshaped costs and created unprecedented uncertainty around answering a seemingly simple question: “How much do new renewables, energy storage and natural gas generation cost?”

Restrictions associated with Foreign Entities of Concern, or FEOC, in the OBBBA also cast doubt on federal incentives in the near term, separate from the cost impacts above. Trade restrictions are especially affecting the economics of solar and wind. Reciprocal tariffs and Anti-Dumping and Countervailing Duties, or AD/CVD, have been finalized on imported solar equipment and are still in progress for storage, both aimed at addressing concerns about international pricing and supply chain dependence.

These shifting policies are already reshaping project timelines and market behavior, with developers responding in markedly different ways. In the near term, the rush to build before incentives expire is driving extreme price dispersion, even for identical technologies. Price dispersion reflects project realities: some projects are racing to lock in equipment and secure contracts before tariff step-ups or tax credit cliffs, while others are holding off, unsure how long the current conditions will last. In this environment, two wind or solar projects that look the same on paper can exit construction with very different cost profiles and pricing risks. Even projects already selected through requests for proposals are not immune, as unexpected cost pressures are leading developers to request offtaker contract protection upfront or via renegotiation.

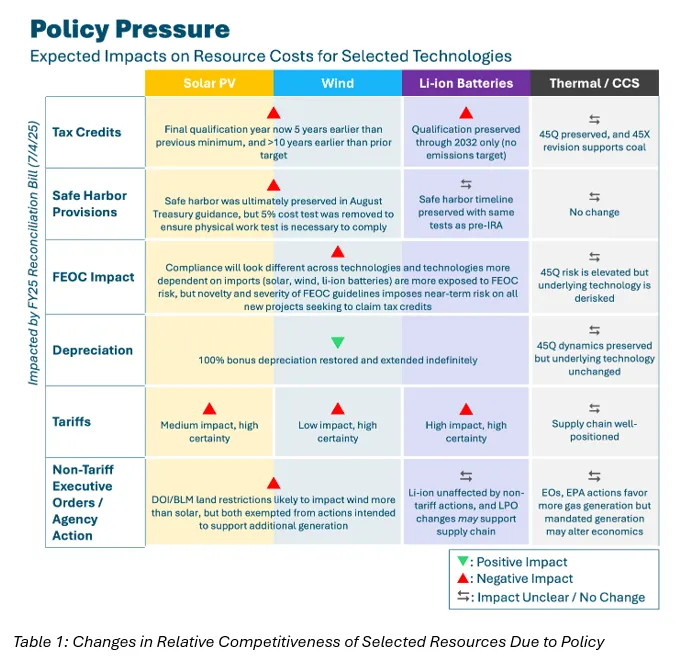

Below are the results of E3’s updated resource cost forecasts incorporating recent federal and congressional action. The arrows represent how OBBBA and tariffs change costs for each technology relative to prior expectations. For instance, tax credit expirations and FEOC rules create added risk for solar and wind, while batteries face high but more predictable tariff exposure.

Solar: Exposed to trade policy more than any other resource, solar faces a wide range of cost impacts. Capital costs could increase by 30% to over 300%, depending on AD/CVD tariffs. Corresponding levelized costs could rise by 44% to 470%. Solar also faces reduced long-term certainty from OBBBA’s shorter tax credit timeline. If projects experience only reciprocal tariffs and minimum AD/CVD tariffs announced by the Commerce Department, E3 would expect levelized costs to increase by up to 114%. This is before incorporating FEOC dynamics, however, which E3 would expect to further increase costs all else being equal.

Wind: Wind is similarly affected by earlier expiration of production and investment tax credits, which introduces uncertainty around project economics in the 2030s. While not as tariff-sensitive as solar, policy changes still shift wind’s relative cost-competitiveness. Furthermore, increasing federal hostility to wind development, such as restricting development on federal land and revoking permits for projects already under construction, seem to pose greater risk to wind than solar.

Battery Storage: Tariff impacts are smaller in range but more certain, largely due to dependence on imported lithium-ion cells. Battery projects are less affected by OBBBA’s tax credit revisions, with eligibility extending through 2032. Under safe harbor provisions, which let developers preserve credit eligibility based on when construction begins, some projects could still qualify through 2036 before a credit phase-out period begins. Storage may be more susceptible to risk of FEOC non-compliance, however, given the dependence of the current supply chain on China. Slower solar development may also hamper battery economics in the medium to longer term.

Gas: Under the highest tariff assumptions, the competitiveness of new gas combined cycle plants is enhanced, most notably for projects requiring around-the-clock power. These dynamics could influence build decisions through 2029, with the greatest effect on projects still in early planning or pre-construction phases. The rapid increase in data center load also enlarges the market for CCGTs due to higher run times. Gas CTs may also maintain an advantage over battery storage for peaking applications, at least until battery supply chains can adapt to the new tariff regime.

For most resources, tariffs introduce greater potential cost pressures than OBBBA's shortened tax credit windows. Critically, we must avoid over-indexing to recent policy and tariff actions or assuming a smooth return to Inflation Reduction Act incentives post-2028. America’s polarized political environment points strongly to continuous policy volatility, with frequent swings that can lead to sudden market accelerations, crunches, pauses, or complete reboots.

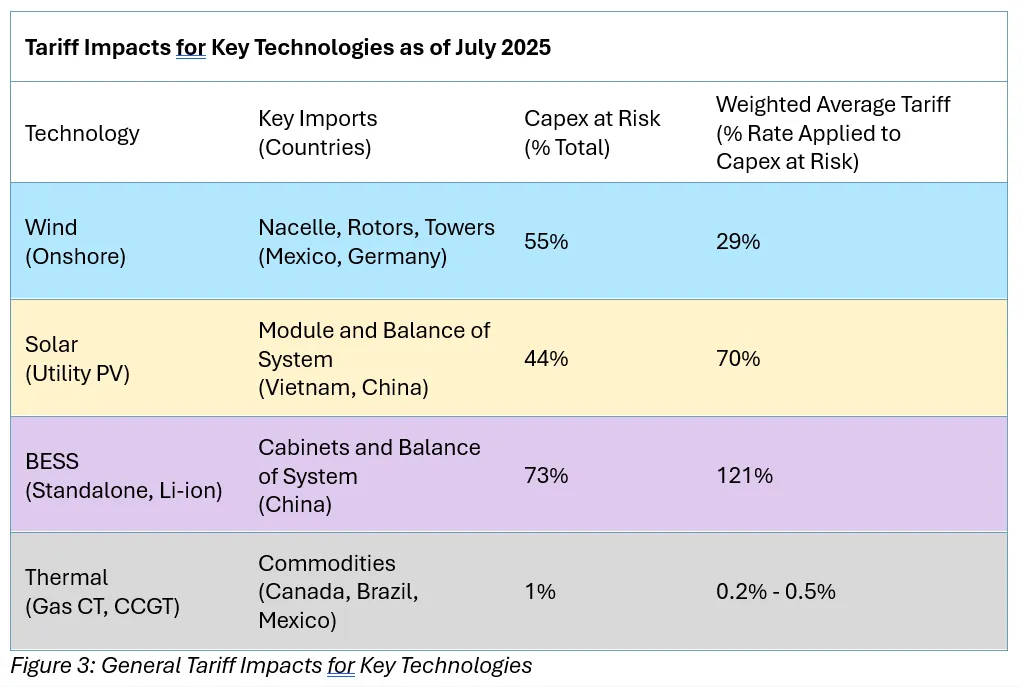

This table shows tariff impacts for key technologies as represented in E3’s RECOST model and market report for July 2025. Tariff inputs shown here should be interpreted as reasonable points on a wide spectrum of potential tariff rates that could apply to projects.

The net effect of these changes indicates a near-term rush to develop existing renewable projects seeking safe harbor from changing credits and tariffs. Meanwhile, accelerating load growth will continue to drive development of battery energy storage and new thermal generation projects.

This pattern is likely to generate a boom-and-bust cycle for developers of both renewable and conventional projects: rapid deployment while incentives last, potential pauses in expiration years as developers wait to see if extensions are authorized, and the risk of a lasting slowdown if federal tax benefits are not renewed.

This investment climate will also trigger changes to planning, procurement, permitting and development strategies:

- Resource planning will need to encompass a wider range of load and price possibilities. Flexible plans will lead to better outcomes for ratepayers in an uncertain world.

- Procurement strategies will tilt toward established and reputable developers, while preserving contractual and technological optionality through flexible contract structures, like power purchase agreements with reopener clauses or development options that allow adjustments if costs or policies change unexpectedly. We’re seeing greater reliance on quantitative triggers in contracts that set clear thresholds associated with trade policy changes or load forecast deviations that automatically prompt contract or planning updates. This makes contract and policy monitoring more structured and less ad-hoc.

- Development sites are likely to be planned with surplus interconnection capacity, phased build schedules, and adjacent parcels to create modularity, leaving open the option for storage add-ons, fuel switching, or clean-firm upgrades as needs arise and as technology costs change.

Anticipating and managing uncertainty has always been key to making prudent energy investment decisions about what, when and where to build. In today’s volatile climate, success will hinge less on predicting the future and more on preparing for it. Those who embed flexibility, optionality and speed into their planning and development strategies will emerge strongest from this turbulent period.