Dive Brief:

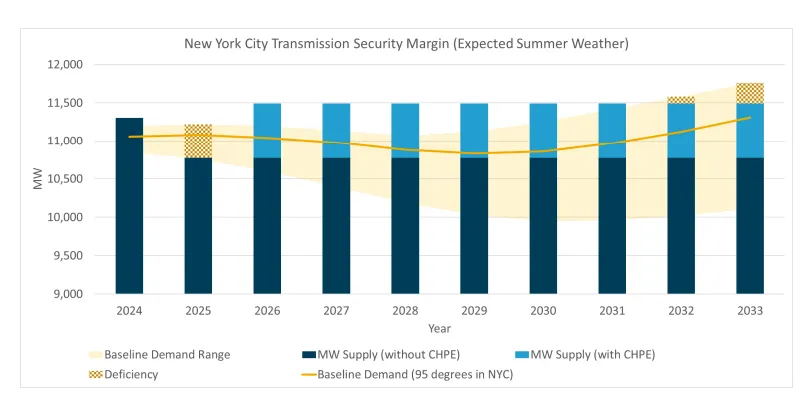

- New York City faces a 446 MW deficit in its reliability margin beginning in the summer of 2025 due to rising demand and the retirement of peaker plants facing new limits on nitrogen oxide emissions, according to a quarterly report released Friday by the state’s grid operator.

- The assessment “reflects the extraordinary challenges of the grid in transition,” said Zach Smith, vice president of system and resource planning for the New York Independent System Operator. Completion of the Champlain Hudson Power Express transmission project in 2026 is expected to improve the situation.

- Fossil power generators say plant retirements are happening too quickly and must be aligned with the pace of new resource additions. Improvements to the ISO’s permitting and interconnection processes and the addition of more transmission capacity will also help maintain reliability, Noah Shaw, a partner in Foley Hoag’s energy and climate practice, said in an email.

Dive Insight:

There is some uncertainty in NYISO’s projections, but the nation’s largest city faces potential reliability issues in two years as beneficial electrification loads come online and drive demand higher.

Specifically, the ISO said its New York City zone is deficient by as much as 446 MW “for a duration of nine hours on the peak day during expected weather conditions when accounting for forecasted economic growth and policy-driven increases in demand.”

The reliability need is based on a deficiency in transmission security, analysis of which evaluates the grid’s ability to withstand disturbances.

Building electrification and electric vehicle charging are key drivers behind the reliability deficit, along with the retirement of dirtier power generators that run only to meet peak demand. New emissions limits adopted in 2019 by the New York State Department of Environmental Conservation went into effect in May.

As of May 1, more than 1 GW of peaking capacity had been “deactivated or limited” because of the new emissions limits, according to the ISO. And an additional 590 MW is expected to become unavailable beginning May 2025, “all of which are in New York City.”

The grid operator will “now work to identify solutions to the reliability need,” Smith said in a statement. The finding of a reliability need triggers an ISO-administered process that will involve the grid operator, local utility Consolidated Edison and the energy marketplace.

The report acknowledges “uncertainty” in the demand forecast surrounding assumptions including population and economic growth, the proliferation of energy efficiency, the installation of behind-the-meter renewable energy resources, and EV adoption and charging patterns.

Generators say blame for the reliability deficiency lies with plant retirements, which are advancing too quickly.

“The pace of play is not keeping up with [the] pace of promises, and this report makes that clear,” Gavin Donohue, president and CEO of the Independent Power Producers of New York, said in a statement. The group primarily represents gas generators, and said the ISO must find “market-based” solutions ensure sufficient resources.

“There have been repeated cautions from the NYISO regarding grid reliability, and this report highlights the reality that generator retirement cannot outpace the addition of new generation,” Donohue said. “This report should draw attention from state officials in shaping realistic public policies.”

According to the ISO, the reliability margin for New York City will improve once the Champlain Hudson Power Express transmission line is in service in spring 2026. However, “the margin gradually erodes through time thereafter as expected demand for electricity grows,” the report said.

The new transmission line will run from Quebec to New York City but it is not expected to provide winter capacity.

“To get ahead of potential future gaps,” the state should support development of additional transmission infrastructure and “ensure that project permitting and interconnection processes are efficient and provide the certainty necessary to support investment,” said Foley Hoag’s Shaw.

The confluence of increased electricity demand and calls to shutter the state’s oldest and dirtiest power plants “underscores the imperative that we expedite and even hedge with respect to support for the resources needed to bridge these likely growing gaps between electricity generation and need — not only in 2025 but also beyond,” he said.