Dive Brief:

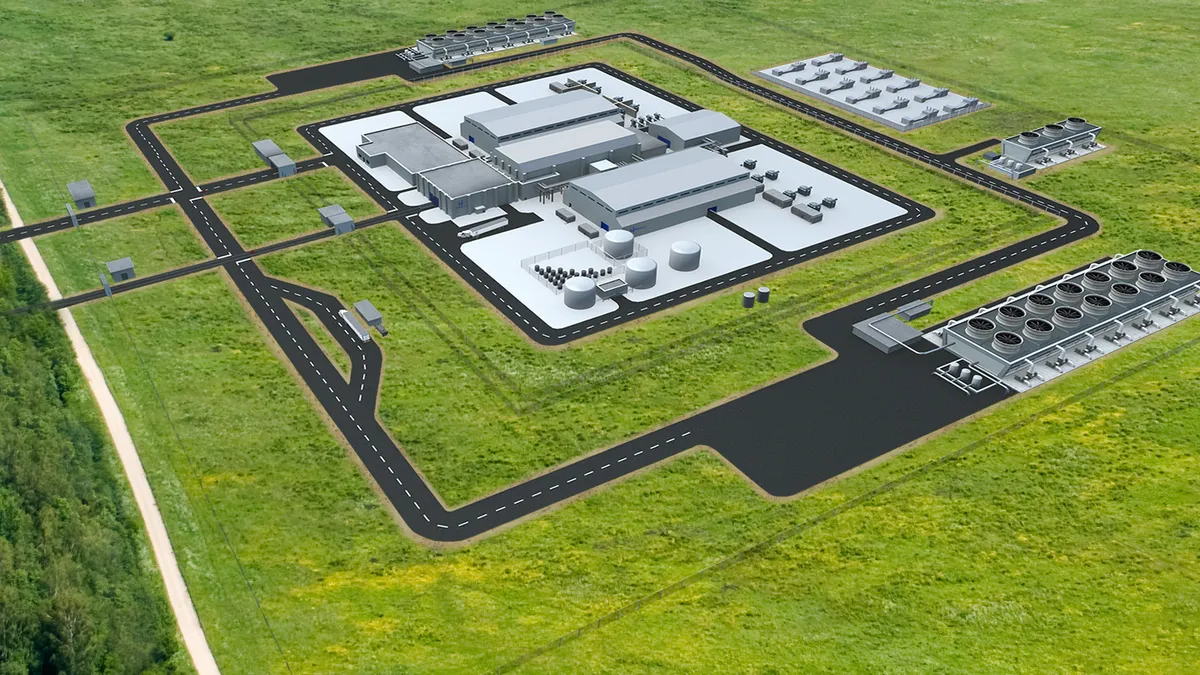

- NuScale Power, a developer of advanced nuclear reactor technology, plans to go public next year by merging with Spring Valley Acquisition, a publicly-traded special purpose acquisition company, to form NuScale Power Corp.

- The combined entity received a pro forma enterprise valuation of $1.9 billion, NuScale announced Tuesday. The nuclear reactor company has had a $1.3 billion cumulative capital investment, including through the Department of Energy's cost-sharing program, as of July, 2021.

- The NuScale announcement is "an inflection point" in investments for small modular reactors, according to Alex Gilbert, project manager at the Nuclear Innovation Alliance. "That's the exit that venture capitalists dream of... From this point on, the gas pedal is to the floor."

Dive Insight:

As the first advanced nuclear reactor company to announce plans to go public, NuScale's leadership touted the importance of a design that is familiar to utilities and potential partners: its small modular reactor design, approved by federal nuclear regulators in 2018, is a light water reactor.

Nuclear advocates expect the billion-dollar valuation for a more familiar technology will prompt venture capital firms to look into other technologies in the space.

"Now it's something that investors will have to take into account... are there other advanced reactors out there that might have a different approach?" Gilbert said. According to him, several other advanced reactor technology companies are doing investment seed rounds.

"In addition to a proliferation of technology, we're also seeing a proliferation of business modeling" with advanced reactors, he said.

NuScale is focused on the design, as opposed to the development and operation of its small modular reactors. "We're really a patent machine," John Hopkins, NuScale CEO, said during an investor presentation on Tuesday.

"Ultimately, utilities will be in the driver's seat" through NuScale's model, Gilbert said.

In 2020, a subsidiary of Utah Associated Municipal Power Systems announced plans to build six NuScale small modular reactors as part of a DOE project. NuScale also announced in August a memorandum of understanding with Xcel Energy to consider the utility a "preferred partner" to operate future reactors.

The company has the only small modular reactor design approved by the Nuclear Regulatory Commission. NuScale, which contends it is "years" ahead of its competition, also has more than 400 patents granted and another 210 patents pending.

Other startup advanced reactor companies, such as Oklo, are considering "build-own-operate" models, while others are seeking to determine ownership models on a project-level basis, Gilbert said.

At close, NuScale said it expects to have gross cash proceeds of up to $413 million, including a private investment in public equity of $181 million backed by investors such as Samsung C&T Corp, DS Private Equity and Segra Capital Management, with participation by Spring Valley's sponsor, Pearl Energy Investment Management.

NuScale would use the proceeds to fund its path to commercialization, according to the press release. NuScale's majority owner, Fluor Corp, expects to control about 60% of the combined company, according to the release.

"Today's announcement is further evidence that cost-shared government funding to build first-of-a-kind commercial[-]scale technology can attract private investment and yield results," Alan Boeckmann, Fluor's executive chairman, said in a statement.

NuScale expects to be able to start commercially deploying its reactors in 2027.