This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Dan Esposito, senior policy analyst in Energy Innovation’s Electricity Program, and Kimani Jeffrey, a 2022 summer intern in the Electricity Program.

The newly-passed Inflation Reduction Act will supercharge power sector decarbonization via clean energy tax credits, financing to help utilities reduce fossil fuel emissions, and incentives to build a domestic clean energy supply chain. Billions in funding over a decade is a generational opportunity — but will utilities cash in to cut pollution?

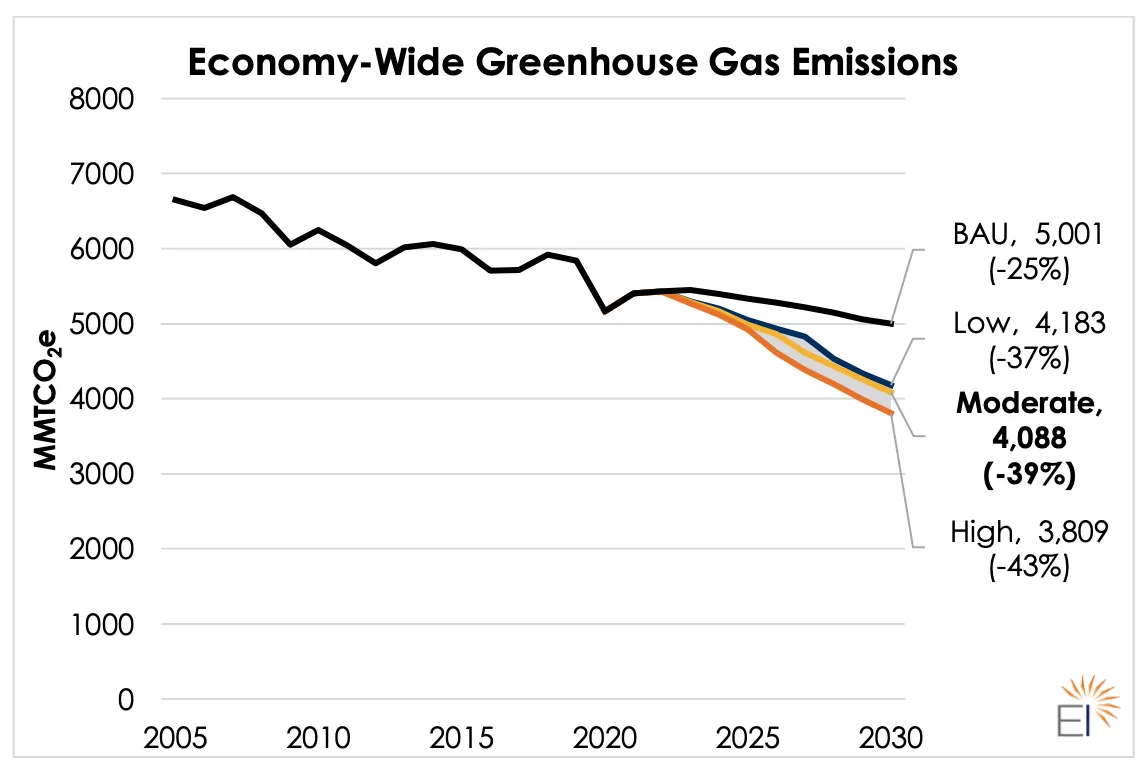

Modeling by Energy Innovation Policy and Technology, the Princeton-led REPEAT Project and Rhodium Group agrees the landmark bill could slash greenhouse gas emissions 40% by 2030. Further, Energy Innovation’s modeling of the power sector provisions finds they would drive about two thirds of the IRA’s GHG emissions reductions and grow 2030 wind and solar capacity by 2 to 2.5 times pre-IRA projections.

However, the IRA does not mandate clean electricity or emissions reduction targets. The legislation makes rapid deployment of wind, solar and storage cheaper than existing coal and new natural gas power plants, but utilities and their regulators will have to choose to walk through the door the IRA opened.

Many states and utilities have committed to 100% clean electricity by 2050, but few have pledged meaningful near-term emissions reductions. That can now change — IRA funding makes states and utilities maximizing clean energy by 2030 a smart economic decision, bringing the United States’ climate goals within reach.

Utilities should use the IRA’s tax credits and reinvestment financing to accelerate their clean power ambitions, replacing risky fossil plants with capital-intensive renewables to boost profits and cut consumer costs. Regulators should require utilities to account for these new energy economics in updated integrated resource plans. And states should enshrine executive orders into law, setting interim targets of 80% clean electricity by 2030 to secure lower electric rates and cleaner air for their constituents.

Bringing cheap electricity home with state targets

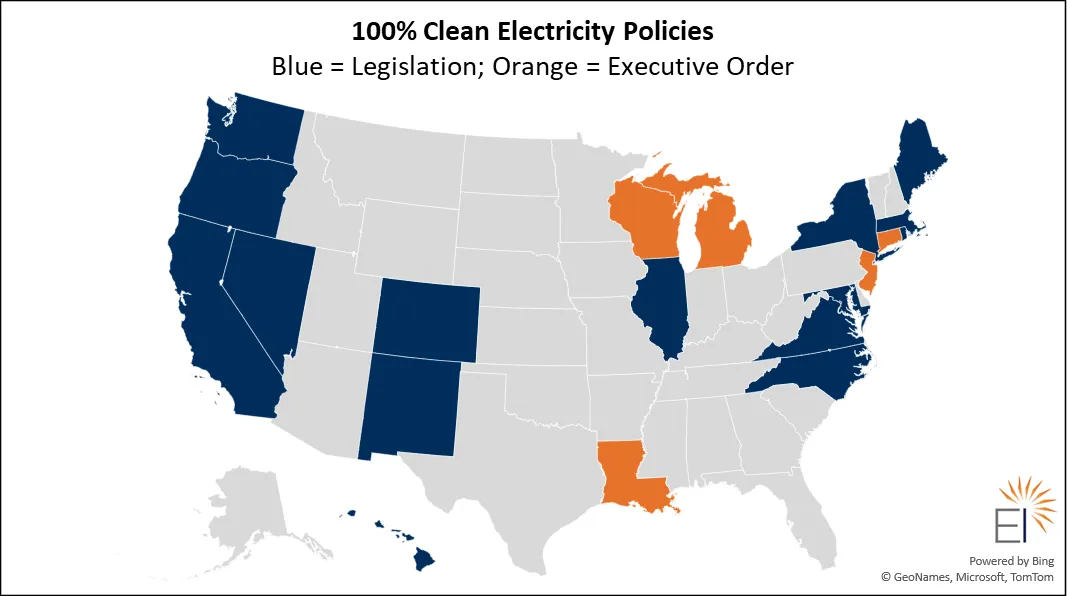

State clean electricity standards, or CES, and federal tax credits have historically comprised the bulk of U.S. clean energy policy. To date, 16 states have legislation committing to 100% clean electricity sales by 2050 or sooner.

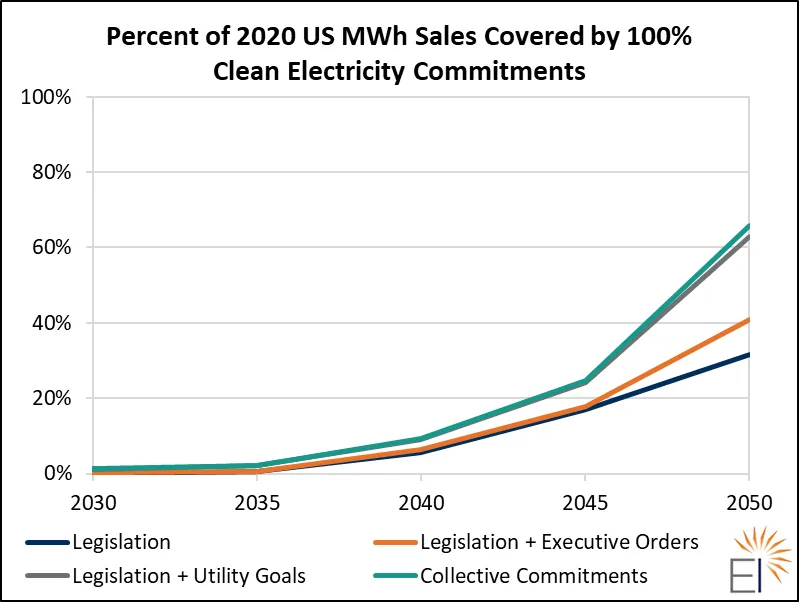

These targets cover roughly 32% of U.S. electricity sales and 40% of our population — though state legislation sometimes excludes or sets delayed targets for smaller utilities and rural cooperatives. Five governors have also issued non-binding executive orders to reach 100% clean electricity, bringing total coverage to 41% of sales and 50% of the population.

However, most of these 100% CES policies have target dates of 2045-2050, often backloading their emissions cuts. Before the IRA, a slow transition was at least rhetorically attractive, but with up to $30 per megawatt-hour production tax credits and up to 50% investment tax credits available for renewables and storage, there’s a clear economic argument for early action.

Now, a 70%-80% clean electricity system by 2030 will be cheaper than business-as-usual, making ambitious 2030 CES targets pro-consumer policies. For example, Resources for the Future analysis suggests the IRA will reduce retail electricity costs up to 6.7%, saving consumers up to $278 billion over the next decade.

Because the IRA’s historic tax credits and refinancing programs may only last through the early 2030s, states and utilities should frontload progress toward 100% clean electricity goals. It’s already happening: The California Public Utilities Commission has adopted a preferred system plan that would take the state to 86% clean electricity by 2032, exceeding the state’s requirement to reach 60% renewable energy by 2030.

Boosting profits and customer savings with utility action

Of the top 41 U.S. utilities by MWh sales (including all utilities with at least 5 million MWh annual sales), all but two have net-zero commitments. When including utility commitments along with state legislation and executive orders, 66% of 2020 U.S. electricity sales fall under a net-zero target. But while regulated utilities have made significant voluntary commitments to a net-zero future, they largely lack meaningful near-term targets.

Until lately, committing to net-zero 25-30 years from now satisfied investors demanding climate action. But achieving these targets sooner is good for business — building new renewable resources like wind and solar are cheaper in many cases than continuing to run existing coal plants.

Because renewables are more capital intensive than existing and new fossil fuel infrastructure, building new renewables also empowers utilities to increase returns through the energy transition. Morgan Stanley researchers found that coal-heavy utility stocks have major potential for revaluation if utilities embrace near-term “coal to clean” investment strategies. New direct pay and transferability options will make it even easier to develop clean energy projects.

Utilities have not demonstrated wide willingness to act upon these promising consumer and investor benefits. Utility plans range from specific, actionable targets with interim goals to high-level statements lacking substance and hedging accountability (e.g., “if affordability and improvements in technology allow”). Some of these statement-only utilities have insisted that investing in volatile natural gas is more prudent than rapidly expanding renewables and storage. The IRA makes these claims untenable.

Lighting the way with actionable near-term strategies

IRA passage means dominoes should fall toward rapid power sector decarbonization, with utility executives acknowledging the paradigm shift. Utilities can leapfrog plans to build new gas, relying instead on least-cost portfolios of wind, solar and storage. Industry leaders provide clear blueprints for how utilities can implement near-term goals while delivering savings to customers.

NextEra Energy — the third-largest investor-owned utility by MWh sales — has a transparent, specific plan to fully decarbonize their generation by 2045, with interim targets every five years and without reliance on carbon offsets. Their “Real Zero” plan will decarbonize 77% of NextEra’s generation by 2030, consisting of 62% renewables and storage and 15% nuclear. Last year, NextEra added 2,008 MW of wind, 1,547 MW of solar and 1,017 MW of battery storage, demonstrating serious progress.

Xcel Energy — the eighth-largest IOU by MWh sales — has a net-zero by 2050 strategy including an interim goal of 80% emissions reductions by 2030. By that year, their planned energy portfolio will include 3% coal, 18% natural gas, 13% nuclear and 66% renewables. In 2020, Xcel reported 47% carbon-free energy in its portfolio, a little over halfway to the 2030 goal. This is a faster pace compared to NextEra’s goals, but it does include carbon capture and tax credit offsets to achieve net-zero emissions.

For utilities with excess coal on the books, the IRA provides funding to guarantee up to $250 billion in loans that can be used to close uneconomic coal assets and reinvest in local clean replacement resources. It also provides bonuses for projects built in coal-dependent communities.

Leading utilities are demonstrating the financial and operational feasibility of moving rapidly toward clean generation, but now all utility plans should be updated given the IRA’s new energy economics. With the IRA’s expansion of tax credits for at least 10 years and new infusion of clean electricity finance, utilities have every reason to accelerate their ambition.

Capitalizing on the IRA’s historic investments

States and utilities should embrace the opportunity to set actionable goals to reach 80% clean electricity by 2030. For those states late to the game, the IRA makes a 2030 CES a consumer-friendly policy. These targets can now take advantage of tax credits that make wind, solar and storage the default cheapest new resource nation-wide.

Ensuring the lowest cost resources are deployed as soon as possible means regulators should require utilities to incorporate tax credits and refinancing programs in integrated planning processes. Integrated resource plans should also reflect the current certainty of low-cost renewable projects rather than wait for unproven technologies that may not be economic in the future.

State legislators should feel confident that utilities can now go further, faster thanks to the IRA, and lock in binding 2030 targets wherever possible to ensure utilities pursue a least-cost decarbonization pathway. States with existing executive orders should codify these targets in legislation, insulating clean electricity from political winds as much as possible.

Tapping into IRA clean energy financing isn’t just a pro-climate move. It’s now simply good business for utilities that will help consumers fight inflation.