Dive Brief:

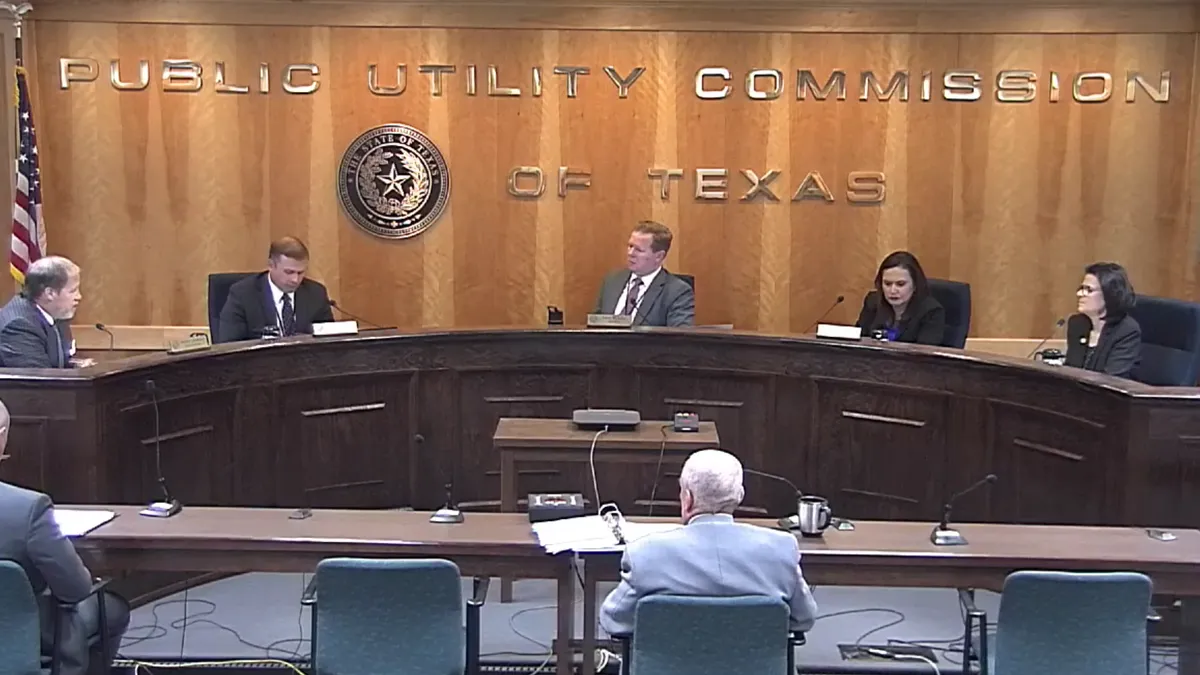

- Texas utility regulators plan to vote next week on whether to recommend the state adopt a controversial Performance Credit Mechanism designed to ensure grid reliability during periods of low non-dispatchable power.

- “I still believe PCM is the best mechanism,” Chairman Peter Lake said at Thursday’s open meeting, adding that criticisms of the proposal “offer opportunities to improve” the credit. Ultimately, the commission will send its recommendation of how to reform the Texas energy market to the state legislature.

- The PCM has been criticized for its complexity, among other factors, and observers say it could take years to implement. The PUCT will also be considering a “bridge mechanism between now and any implementation of any long-term solution,” Lake said.

Dive Insight:

Along with Lake, Commissioner Kathleen Jackson was explicit in her support of the PCM.

The performance mechanism “preserves the energy-only market and will allow Texas to continue to garner the benefits of competition and innovation,” Jackson said.

The credit would be earned by generators in the Electric Reliability Council of Texas footprint, based on their availability during hours of greatest risk to the system and with an aim to incentivize more generation to be available during times of high demand.

ERCOT CEO Pablo Vegas also supported the PCM, saying it “seems to offer the best combination of incentives that move our grid from a system characterized by extreme pricing, physical scarcity and conservation notices ... [to] a place of stable investment.”

Vegas offered one “important modification” to the PCM, which was modeled by consulting firm E3. Instead of basing credit requirements on the top 30 hours of the system's highest reliability risk per year, “the PCM should use a modified peak net load type of concept distributed across the year for the retroactively-settled requirement period,” Vegas said.

There have been criticisms that the PCM mechanism will not sufficiently incentivize new generation, but rather focuses on keeping older plants from closing down.

“What the PCM does ... is mitigate the quantity of exit from the market or retirements,” E3 Director Zack Ming told the commission. “It's primarily an incentive to retain existing dispatchable generation.”

Commissioner Will McAdams appeared to question the focus on retaining generation. “You've got to hit that high risk hour ... less efficient, older, vintage stuff isn't going to have the ramping capability to hit it,” he responded to Ming.

That prompted Lake to jump in, “even if initially it's retaining old units, everything is going to reach the end of useful life. So that dynamic, is it fair to say that dynamic would probably change?”

“Yes,” said Ming.

“A decade later?” Lake continued.

“Yes,” said Ming.

Stoic Energy President Doug Lewin, an energy analyst who closely watches the Texas market, tweeted that the PCM is “convoluted & extremely complicated.”

“Few investors, if any, will put money into long term assets based on this. But existing generators will get a windfall for old power plants,” Lewin said.

“I'm not really sure what problem it truly solves,” Ascend Analytics Director of Market Intelligence Brent Nelson said in a separate discussion of the ERCOT market Thursday.

“You still have a scenario where you have a boom-bust potential,” Nelson said. “When there's a lot of resources available or mild weather you're going to have a very low value of this incentive. When you have extreme weather or tight conditions you're going to have a higher value. It sounds to me a lot like scarcity, just under a different name.”

Whatever the PUCT decides will be “purely a recommendation” to state lawmakers, Lake said. He wants the commission to make a decision at the Jan. 19 open meeting.

In December, lawmakers raised concerns about the commission’s market redesign including that proposals being considered “will not guarantee new dispatchable generation in a timely and cost-effective manner.”