In the newest market expansion efforts by the California Independent System Operator and the Southwest Power Pool, one plus one may equal a much bigger one.

Both system operators are expanding their voluntary real-time energy imbalance markets for meeting last-minute system needs into larger day-ahead energy markets that will handle much of their system loads. And the recognition that larger markets require new transmission is driving SPP and CAISO to take on new and larger challenges, observers say.

The West’s September 2022 power system collaboration that protected reliability against larger-than-anticipated spiking demand during a heat wave “changed everything,” CAISO President and CEO Elliot Mainzer told Utility Dive in November. Western utilities and power providers now realize “collaboration can take the West further,” and are “ready for the next big step,” he said.

Rising reliability threats have also affected how Western power providers see their financial opportunities, analysts and system executives said.

“There is a widening perception that serving customers through a single territory’s system has higher generation costs that lead to higher rates,” said Rob Gramlich, founder and president of Grid Strategies. But “transmission that expands access to a region’s diversity of lower cost renewables can be an affordability strategy” while also protecting reliability and accelerating decarbonization, he added.

Real-world data and projections verify the economic value of real-time and day-ahead markets, both CAISO and SPP reported. And beyond their apparent competition for participants in planned regional transmission organizations, like those in the Northeast and Midwest, a mutual vision is emerging of something even greater, some observers told Utility Dive.

The value of markets: CAISO

Both CAISO and SPP are working methodically from real-time markets toward day-ahead markets.

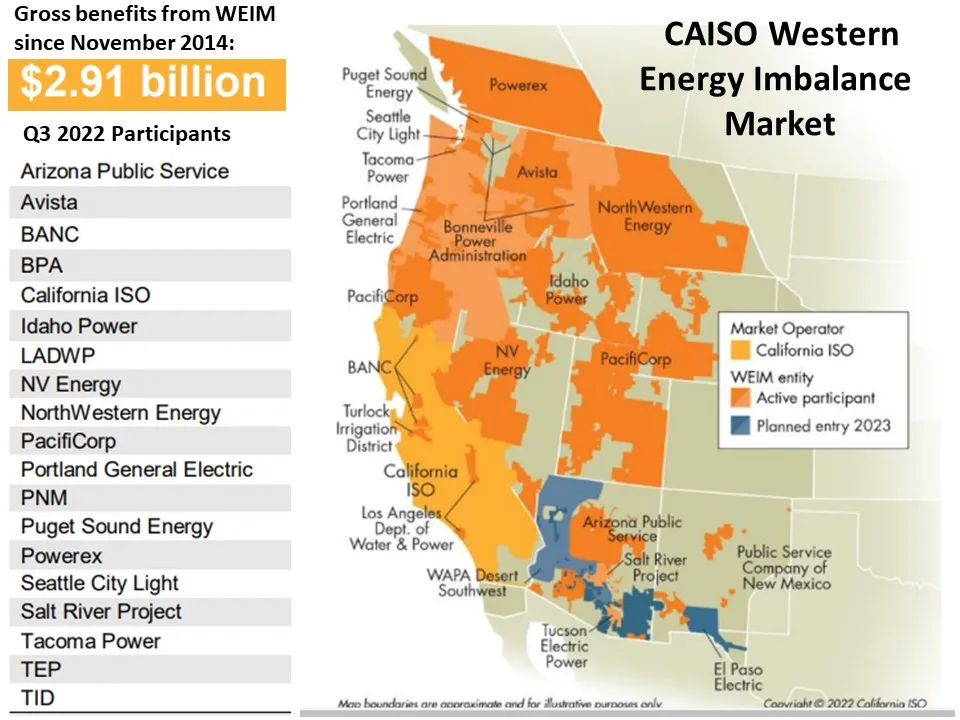

Total benefits from 2014 to 2019 for nine participants in CAISO’s real-time Western Energy Imbalance Market, or WEIM, of $861.8 million jumped, by the third quarter of 2022, to $2.91 billion for 19 participants, CAISO reported Oct. 31.

And WEIM collaboration protected reliability in September 2022 despite supply impediments and an unprecedented 6 GW demand spike across the West, Debra Smith, general manager and CEO of Seattle City Light, and other Western utility executives told a November 2022 CAISO Stakeholder Symposium.

Their recognition of the new magnitude and frequency of reliability threats is driving support for CAISO’s Extended Day-Ahead Market, or EDAM, initiative, CAISO’s Mainzer said. The EDAM final draft proposal, released Dec. 8 for approval at a Dec. 14 CAISO meeting, defines key market structures, tariffs, transmission practices and other rules.

But EDAM’s real breakthrough came with governance changes finalized in September requiring joint authority on WEIM matters by the CAISO Board and WEIM Governing Body, utility leaders agreed at the CAISO symposium.

Offering an early indication of EDAM’s acceptance outside California, PacifiCorp — representing subsidiary utilities in six Western states — became the first to formally announce it would participate on Dec. 8.

Annual savings of nearly $1.2 billion, including $309 million per year for California and $886 million per year for other Western states, can come from a West-wide EDAM, according to a CAISO-commissioned study by Energy -- 6Strategies released Nov. 4.

Savings can come from more efficient dispatch and use of transmission capacity, Energy Strategies found. Costs would also be lower for reserves by using the region’s resource diversity and existing transmission more, leading to a reduced need for transmission investments, it added.

The value of markets: SPP

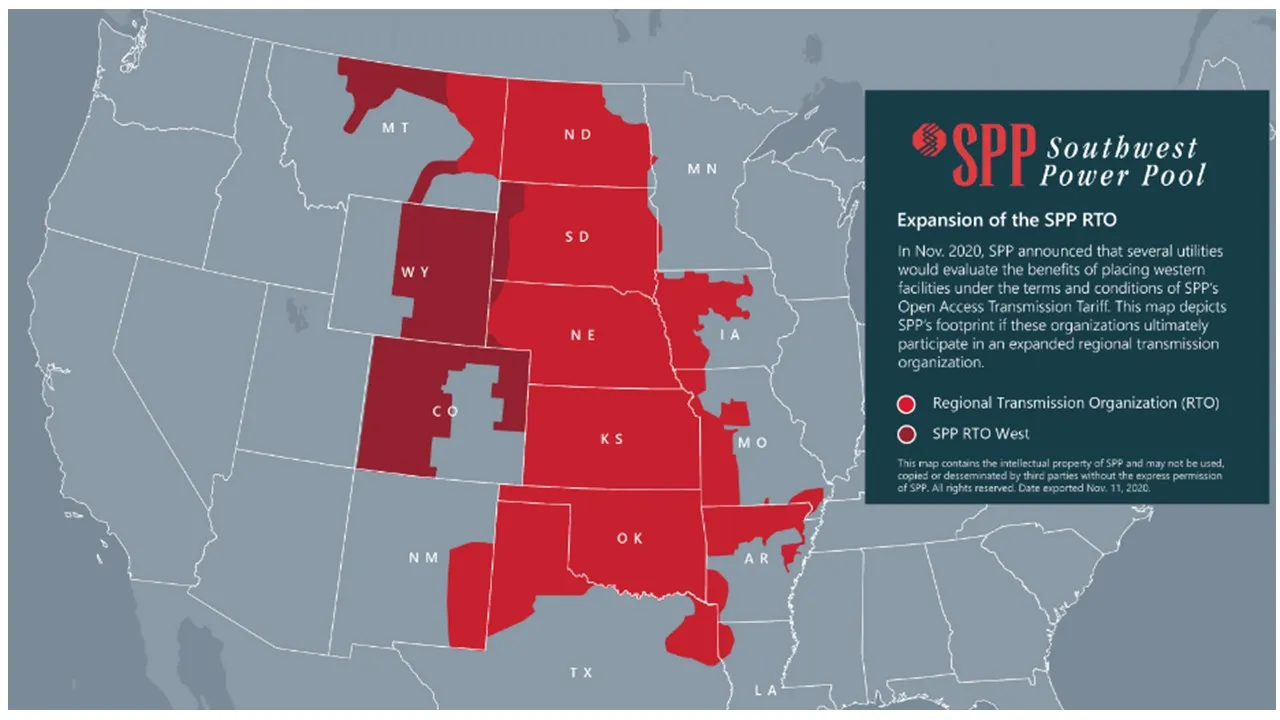

SPP, an RTO to 17 Midwestern and plains states at the Western edge of the U.S.’s Eastern Interconnect, is working to develop and expand its Western Energy Imbalance Services, or WEIS, said former SPP executive Carl Monroe, now principal consultant of Munro Advisors.

WEIS’s nine currently active real-time market participants will be joined by Xcel Energy Colorado, Platte River Power Authority and Black Hills Power and Light in April. Like CAISO’s WEIM, it is designed to reduce energy and capacity costs and support reliability. It will report its first “cumulative benefits” data in January, SPP spokesperson Meghan Sever said.

And a study for the design of protocols and tariffs for SPP’s Markets Plus, or M+, day-ahead market, is scheduled to be completed by March, according to SPP’s Nov. 16 update. Final participation contracts are expected by April 1, with early phase operations targeted for June 2024, it added.

Funding for the M+ study has been promised by some WEIM and EDAM participants, including leading Arizona and Pacific Northwest utilities and the Bonneville Power Administration, Monroe said. “That signaled interest in an alternative to EDAM and added traction for M+, though it was not a commitment to participate,” he added.

Some Western regulators and utilities remain concerned the CAISO joint authority governance “could still lead to decisions about load and generation in the interests of California,” Monroe said. But the new CAISO governance structure does not go as far as changes in SPP “that allow members to have input on matters not disputed by federal regulators,” he added.

Joint authority is a “bridge” that resolved concerns for some WEIM participants, including the Balancing Authority of Northern California, or BANC, but others will not cross it, BANC General Manager James Shetler said.

Factors besides governance may also differentiate the SPP and CAISO day-ahead markets. Transmission may be a key because “any advantage from a market requires sufficient transmission ties,” Monroe said. And market design elements including emissions pricing, transmission access and revenue and resource sufficiency may also determine which market some participants choose, he said.

Tri-State Generation and Transmission Association supplies wholesale energy to utilities in both markets, said Spokesperson Mark Stutz. But SPP’s WEIS governance rules do not prevent it from being “a full participant and voting member,” while WEIM governance rules limit its representation, creating “issues and complexities” and “extremely suboptimal” settlements, Stutz said.

Though WEIS benefits have not yet been reported, they will “significantly” increase with April 2023 additions “roughly tripling the size of the WEIS,” he said. That will increase the appeal of “its independent board of directors and governance structure,” he said. The governance model is also expected to be used for M+.

RTOs and the real need

The hope is that real-time and day-ahead markets will lead to RTOs in which multiple states’ power providers can efficiently share transmission and generation to benefit their customers, SPP and CAISO said.

Several WEIS participants have already agreed to initial terms approved by SPP leaders in July 2021 for an SPP RTO West, Monroe said. Filings are expected to go to federal regulators in early 2023, and operations should follow by the end of 2024, he added.

California’s unanimously passed Assembly Concurrent Resolution 188, requiring a definitive cost-benefit study of a CAISO-led RTO by February, was signed into law in August, Assemblymember Chris Holden, D, who led its passage, told the CAISO November symposium. It will enable the independent CAISO governance needed for a Western RTO, he told stakeholders.

Governance was critical to the formation of the WEIM and it will need to evolve to provide adequate representation for participants as its services and membership expand, said Scott D. Bolton, senior vice president, transmission and market development, with WEIM founding participant PacifiCorp. “There is no scenario where PacifiCorp would be in an RTO without independent governance,” he added.

EDAM is just a step toward the full regional market utilities in California and the West want, Mainzer said. CAISO governance has evolved with the WEIM’s widening footprint from an advisory governing body to the joint authority model, and stakeholders agree it can evolve further to enable greater collaboration across the West, he added.

The need for renewables to meet state and federal policy goals is driving demand for regional transmission to access the West’s resource diversity to protect reliability, Mainzer, Bolton and others said. And RTOs can address the well-known cost and planning obstacles to regional and inter-regional transmission development needed to interconnect renewables stacked in Western queues, they added.

Transmission infrastructure is the critical RTO function not being addressed in CAISO and SPP real-time and markets, said Grid Strategies’ Gramlich. “Market systems make important contributions to diversity, but the greater contributions come with the greater geographic reach provided by transmission,” he added.

Renewables are the lowest cost generation and “utilities that serve customers with only their own resources and transmission will have higher costs that lead to higher rates,” Gramlich said. New CAISO governance can be part of a new “affordability strategy” for member utilities and not allowing it “would be a colossal self-inflicted wound for the state,” he added.

Legislative obstruction of the enabling state code revisions, as happened in 2017-18, is unlikely because the September 2022 events made the value of regional collaboration clear, Mainzer and others said.

“There is much less reason to oppose regionalization than there was five years ago,” said Jan Smutny-Jones, CEO of the Independent Energy Producers Association and former chair of the CAISO Board of Governors. Most Western states now have clean energy policies “that complement California’s goals,” he said. Union jobs and economic opportunities “are everywhere and recent federal funding is likely to accelerate that,” he added.

Expansion of WEIS into an SPP RTO could provide annual cost-saving benefits for the group of Western participants of $68 million to $81 million and for the group of Eastern participants of $3 million to $8 million, a September 2022 Brattle Group study found. Depending on SPP’s complete resource mix, the total annual savings for all participants could be $56 million to $73 million, Brattle said.

Day-ahead markets provide only some RTO market benefits, agreed a July Energy Strategies study for Advanced Energy Economy, with a wider perspective than its November CAISO study.

Compared to WEIM, a Western RTO could add up to 657,000 jobs in Western states by 2030 and save ratepayers $2 billion annually in energy costs, the study reported. Annual gross state revenue could increase across the West by up to $79 billion and deliver as much as 4,400 MW of “additional clean energy,” for the WEIM region, it added.

Eastern RTOs have demonstrated the promise can be impeded by “market power exerted by many investor-owned utilities” and the “potential downside” of inadequate federal control, Joy Ditto, president and CEO of the American Public Power Association, cautioned in June 2020. But new limited real-time and day-ahead markets make RTOs extraneous, she said.

Deference to RTOs “molded by their largest stakeholders” is unnecessary because markets like the WEIS and the WEIM offer similar “efficiencies and cost savings,” Ditto said. And federal regulators and RTOs have not resolved the impediments to transmission expansion in cost allocation and collaborative ownership and planning which now should be the real priority, Ditto wrote.

Others have a similar priority but with an even bigger objective.

The bigger vision

Market duplication could be a problem, but does not have to be in the West, some analysts said.

Market overlaps “could prevent regional coalescence and lead to more balkanization instead of to greater interoperability,” cautioned PacifiCorp’s Bolton. But RTOs show the potential economic and reliability value of closing the seams between individual power providers’ territories where differing rules and tariffs limit energy transfers, he and other transmission and market analysts said.

To explore this potential, an M+ Seams Working Group will be formed in 2023 to optimize its transfers to and from CAISO and “other entities in the West,” SPP announced Nov. 7.

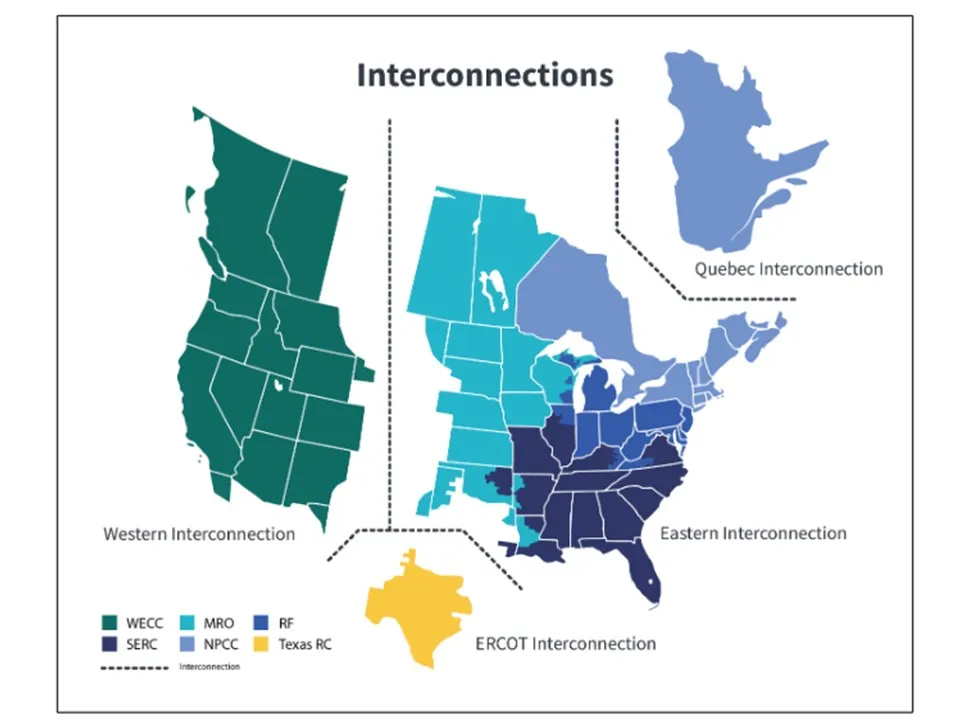

“Limited transfer capacity” across seams between the Western, Eastern, and Texas systems cause them “to operate almost independently,” a 2021 National Renewable Energy Laboratory study observed. But modeling showed benefit-to-cost ratios can be “as high as 2.5,” indicating “significant value to increasing the transmission capacity” between them, researchers concluded.

Markets have shown “verifiable benefits” that could go farther, PacifiCorp’s Bolton observed. “Despite apparent heated competition, the conversation is generally about organizing, rationalizing, monetizing and working together to optimize the markets,” he said.

Many Western utilities will go as far as participating in markets and “may not now be willing to go further, but each step toward regionalization in the electric utility industry has revealed new benefits and led to further steps,” added Grid Strategies’ Gramlich. But “today’s progress on Western regionalization is because utilities see the benefits,” he said.