Constellation Energy has agreed to sell six power plants and a minority stake in a seventh power plant to settle an antitrust complaint filed by the U.S. Department of Justice and the state of Texas, clearing the way for the company’s $26.6 billion deal to buy Calpine, the parties said Friday.

Constellation’s purchase of Calpine — which will make it the largest U.S. wholesale power provider — would reduce competition, allowing the company to withhold power supplies to drive up market prices, according to the complaint, while was filed and settled the same day.

That could have driven up electricity costs by more than $100 million a year in the Electric Reliability Council of Texas market and in PJM’s Mid-Atlantic region, it said.

“When it comes to their electricity bills, Americans deserve the benefit of robust competition among electricity generators,” Assistant Attorney General Abigail Slater said in the press release.

The agreement is the first settlement consent decree the DOJ’s antitrust division has filed in an electricity merger in 14 years, according to the department. It came days after the U.S. solicitor general urged the U.S. Supreme Court to dismiss Duke Energy’s appeal of an antitrust case against it.

The Federal Energy Regulatory Commission required Constellation to sell four of the power plants when it approved the deal in July. Those power plants — all in the PJM Interconnection’s footprint — total nearly 3,550 MW.

The additional power generating facilities covered in the agreement with the DOJ and Texas are:

- Calpine’s 828-MW York 2 Energy Center, a dual-fuel combined cycle power plant in Delta, Pa.

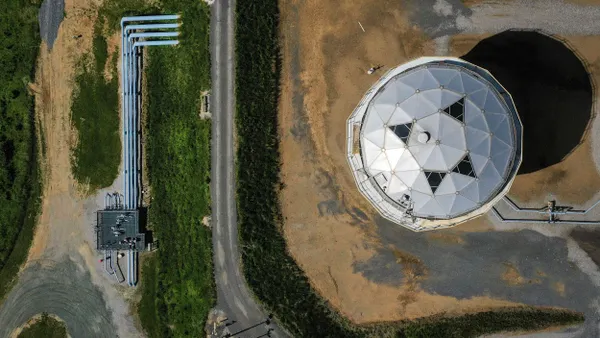

- Calpine’s 609-MW Jack A. Fusco Energy Center, a gas-fired combined cycle power plant near Houston; and,

- Calpine’s 19-MW stake in the Gregory power plant, a gas-fired combined cycle power plant near Corpus Christi, Texas.

Under the agreement, Constellation, headquartered in Baltimore, must enter into contracts to sell the assets within 240 days after it buys Houston-based Calpine.

Constellation said it can close the deal once the court signs the stipulation and order agreed to by the parties and DOJ. The proposed settlement and a competitive impact statement will be published in the Federal Register, triggering a 60-day comment period, according to the DOJ.

After the deal closes and Constellation complies with the divestiture agreement, the power producer will own about 55 GW of nuclear, natural gas, geothermal, hydro, wind, solar, cogeneration and battery storage. Calpine currently owns about 27 GW.