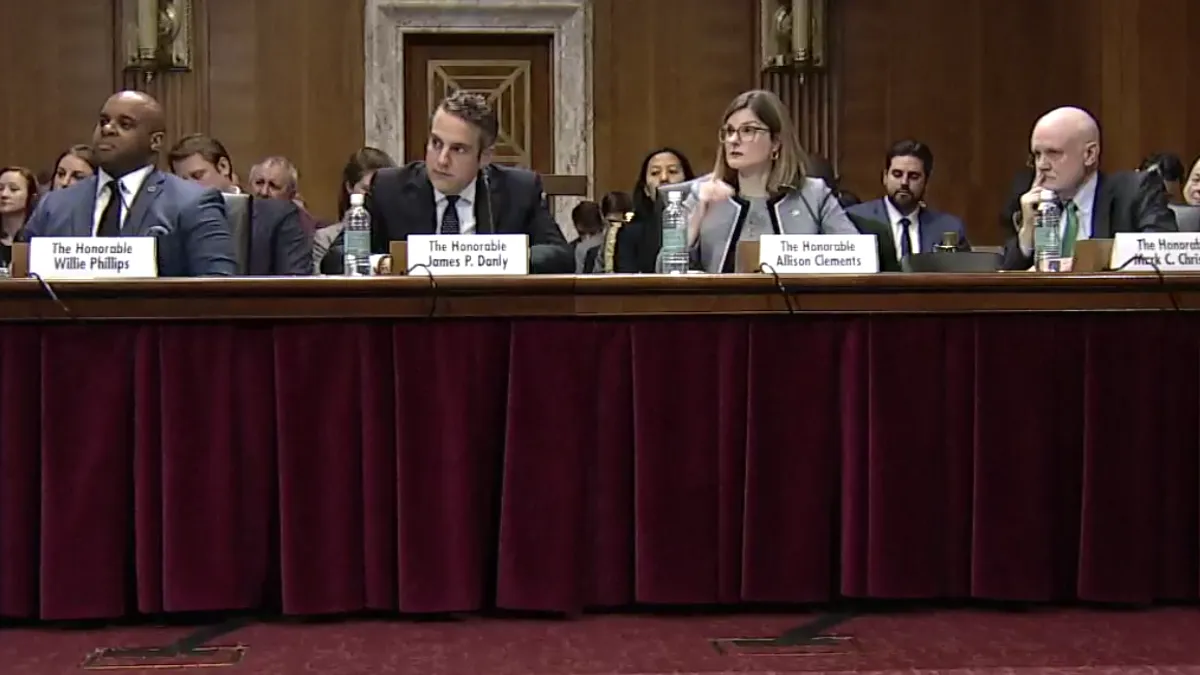

The U.S. grid faces major reliability challenges, according to members of the Federal Energy Regulatory Commission who used the word 34 times in their prepared testimony Thursday at a Senate Energy and Natural Resources Committee hearing.

There is a “looming reliability crisis in our electricity markets,” FERC Commissioner James Danly said.

“The United States is heading for a very catastrophic situation in terms of reliability,” FERC Commissioner Mark Christie said.

FERC Acting Chairman Willie Phillips said, “We face unprecedented challenges to the reliability of our nation’s electric system.”

Growing reliability and resilience challenges from extreme weather and cyber and physical security threats require changes to the U.S. grid, according to FERC Commissioner Allison Clements.

Power plants, markets and subsidies

Christie said the main problem is that power plants are being retired at a faster pace than they’re being replaced, pointing to estimates from the PJM Interconnection.

About 40 GW, or 21% of PJM’s installed capacity, is at risk of retiring by 2030, the largest U.S. grid operator said in a Feb. 24 report. PJM expects only 15.1 GW to 30.6 GW of accredited capacity to come online by 2030.

“The arithmetic doesn’t work,” Christie said. “This problem is coming. It's coming quickly. The red lights are flashing.”

Phillips said he is “extremely” concerned about the pace of power plant retirements. “This is something that we have to keep a careful eye on,” he said, noting that FERC needs to work on the issue with states, which have authority over resource adequacy.

Reliability problems are driven by two main issues: faulty capacity markets and a dearth of gas pipelines, according to Christie. During Winter Storm Elliott in December, PJM was on the brink of rolling blackouts when a large number of gas-fired power plants failed to run, partly because they couldn’t get fuel, he said.

Danly said the culprit is subsidized renewable energy, which he contends undermines the economics of coal-fired and natural gas-fired power plants in organized markets.

“FERC has allowed the markets to fall prey to the price distorting and warping effects of subsidies and public policies that have driven the advancement of large quantities of intermittent renewable resources onto the electric system,” he said.

FERC has taken steps this year to bolster reliability, such as issuing cybersecurity standards, and requiring power plants to prepare for winter weather, Phillips said.

Transmission to the rescue?

Also, new transmission could help ease reliability problems, according to Phillips.

“Transmission plays a critical role in facilitating the interconnection of new resources, while ensuring that the electric system remains reliable,” he said.

Phillips said he hopes FERC can issue an interregional transmission planning reform proposal in the “very near term.”

Also, grid-enhancing technologies and advanced reconductoring can make the transmission system more reliable and less expensive, he said. “They have to be a part of our planning process,” he said.

But utilities may be building too much local transmission at the expense of regional projects that could be more efficient, Sen. John Hickenlooper, D-Colo., said, citing recent analysis by RMI, a nonprofit advocacy organization.

In PJM, 71% of transmission investment since 2014 has been on lines under 230-kV, up from 26% previously, according to the analysis. The faster timelines and lower cancelation rates of local projects increase utility earnings by up to 24% compared to their alternatives, such as multi-zone projects, Claire Wayner, RMI associate, said in the report.

Utilities focus on building local transmission projects because they generally receive little scrutiny by regional transmission organizations or states and they can recover their costs through FERC formula rates, which are hard to challenge, according to Christie.

“Formula rate recovery is almost a plug-and-play type of process,” he said. “It's tremendously financially rewarding to build local projects.”

R Street, NRDC respond

Danly’s criticism of subsidies for renewable energy was off base, according to Devin Hartman, director of Energy and Environmental Policy at the R Street Institute, a free market-oriented public policy research group.

“Capacity markets secure sufficient levels of capacity irrespective of subsidy levels, but they cannot procure resources that governments prevent from being built or retained,” he said.

Also, utility integrated resource planning in RTOs can cause reliability problems, according to Hartman.

“The only region to suffer a capacity shortfall has been [the Midcontinent Independent System Operator,] where over 90% of demand is met by cost-of-service utilities,” he said.

It’s a “dangerous myth” that MISO’s capacity framework was the cause of last summer’s capacity shortfall in its region, according to Hartman.

During the hearing, senators and commissioners failed to note that fossil-fueled power plants have performed poorly during grid emergencies, such as in winter storms Elliott and Uri, according to John Moore, director of the Sustainable FERC Project at the Natural Resources Defense Council.

“Many committee members and commissioners alike took the hearing as an opportunity to cast blame on the energy transition, cheerlead gas and undermine existing environmental review processes,” he said in an email. “Left out or under-emphasized were the reliability problems we've seen with fossil fuels during extreme weather events, the need to expand transmission and ongoing market reforms to manage a shifting resource mix.”