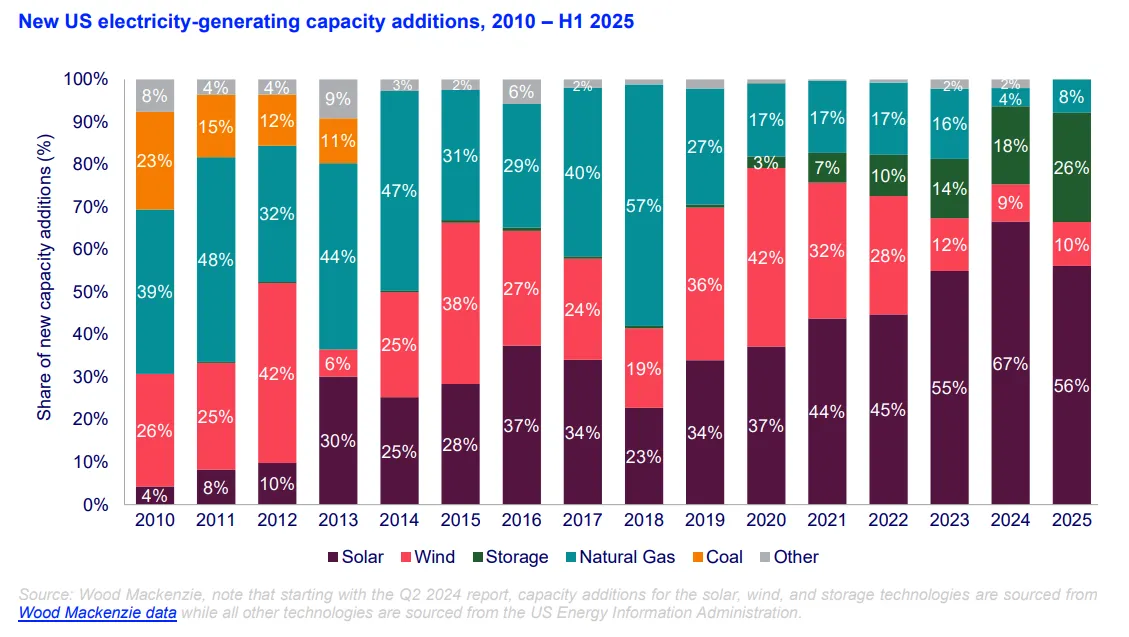

Despite federal policy that has sought to hamper the growth of renewables, solar and energy storage resources made up 82% of new U.S. grid capacity added in the first six months of this year, according to a report from the Solar Energy Industries Association and Wood Mackenzie.

Beyond the solid top-line numbers, however, the One Big Beautiful Bill Act and recent Trump administration actions targeting solar “have significantly reduced deployment forecasts,” SEIA said in a Monday statement.

OBBBA, however, was generally seen as supportive of energy storage. Battery storage projects will have tax credits available through 2033, while the bill phased out solar and other incentives earlier.

The solar industry is also dealing with a Department of Interior memo noting that Secretary Doug Burgum will need to approve federal permits for solar projects, and new Treasury guidance that has altered the formal definition of “beginning of construction” for solar projects to earn federal tax credits.

SEIA and WoodMac’s low-case forecast concludes OBBBA and other policies put the United States at risk of losing 44 GW of solar deployment by 2030, an 18% decline compared to the outlook before the bill was passed. Compared to pre-OBBBA forecasts, the U.S. is “at risk of losing a total of 55 GW of solar deployment by 2030, a 21% decline,” the solar industry group said.

“Solar and storage are the backbone of America’s energy future,” SEIA President and CEO Abigail Ross Hopper said. “Instead of unleashing this American economic engine, the Trump administration is deliberately stifling investment, which is raising energy costs for families and businesses, and jeopardizing the reliability of our electric grid.”

Solar deployment is expected to be 4% lower than the pre-OBBBA base case by 2030, SEIA said. Near-term deployment “is bolstered by projects already underway, a rush to meet tax credit deadlines, and rising demand for power as new gas generation becomes more expensive and less available.”

Highlights from the report include:

- The U.S. solar sector installed 7.5 GW-DC in the second quarter of this year, marking a 28% quarter-over-quarter increase but a 24% decline year over year;

- Solar accounted for 56% of all new generating capacity added to the U.S. grid in the first half of 2025, while storage made up 26% and wind made up 10%. About 8% of the new capacity came from gas generation;

- Texas solar generation additions led all states in the first half, with 3.8 GW-DC, followed by California, Indiana, and Arizona.

Installations continue, but federal policies are driving up costs following the Trump administration's implementation of 10% baseline tariffs in April, the report found. “While a 90-day pause on reciprocal tariffs was announced, the baseline tariffs remained in effect and contributed to price increases across solar market segments,” it said.

Residential solar pricing is up 2% year over year, commercial solar systems are up 10% and utility-scale pricing is up 4% for both fixed-tilt and single-axis tracking, the report said.