Dive Brief:

- A tight supply-demand balance on the Texas electric grid will likely mean power prices remain elevated and some generators see windfalls, according to a Monday research update from Morgan Stanley.

- In particular, the firm sees Vistra as “positively exposed to this dynamic.” Morgan Stanley said it calculated roughly $10 million in earnings before interest, taxes, depreciation, and amortization upside for the company each hour the Texas grid operates at its peak price of $5,000/MWh.

- The state’s grid operator, the Electric Reliability Council of Texas, or ERCOT, has taken a conservative approach to grid management this summer in an effort to boost reliability, and maintains additional generation resources at the ready. But those operational changes could add $1.5 billion to customer bills this year, according to its independent market monitor.

Dive Insight:

Temperatures are expected to remain elevated across Texas this week, setting the stage for electricity demand to hit new peak records.

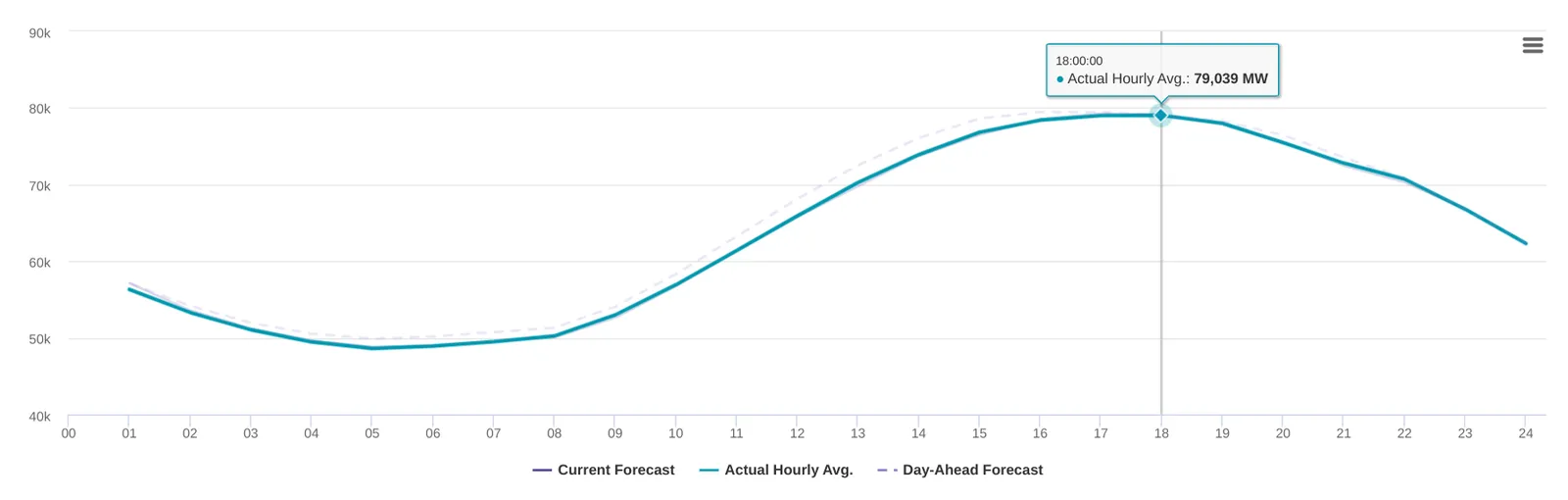

The most recent record was set Monday evening, when at 6 p.m. the grid registered 79 GW of demand, according to ERCOT’s web site.

Last week, ERCOT twice called for conservation and set multiple peak demand records. On Wednesday, wholesale power prices reached the market’s $5,000/MWh price cap as wind output fell and fossil fuel outages increased.

“Prices have spiked in response to very tight grid conditions and similar levels could be hit over the coming week,” according to the Morgan Stanley research note. Under those conditions, some power producers could see windfalls, the firm said.

Vistra is poised to profit, having about 2-2.5 GW of unhedged capacity it can offer into the market, Morgan Stanley noted.

“This unhedged capacity could generate $2m for every hour at $1,000 or $10m for every hour at $5,000/MWh,” the firm sad. “This exposure could quickly add up, and depending on the weather and supply conditions, we could see $100m plus over the next few weeks if similar grid conditions arise.”

For NRG, the firm noted some heightened risk as plant outages could make it difficult for the generator to produce electricity. “Given the operational challenges some of its plants have faced, we think risk is elevated through periods of very high heat,” Morgan Stanley noted.

Constellation’s Texas gas fleet that almost entirely hedged for the year and “we don't see a specific opportunity to the upside or risk to the downside from the Texas heat wave,” Morgan Stanley said.

ERCOT has repeatedly cited thermal outages as a cause for tight grid conditions, along with low wind and higher demand.

“Things have already been sort of breaking on a daily basis,” energy analyst and Stoic Energy President Doug Lewin said. But it is too soon to know what it means for Texas power bills, he added.

“There's been a lot of summers where we’ve gotten prices in the thousands of dollars for, you know, 5, 10, 15 hours. That's not a huge deal. But obviously, this summer looks like it's going to be a lot more than that,” Lewin said.