Molly Podolefsky is a managing director at Clarum Advisors.

The virtual power plant market today is fragmented and inefficient, dominated by technology-specific programs and operating platforms that lack interoperability. As a result, neither the market nor individual VPP providers have achieved significant economies of scale.

The majority of VPPs include single distributed energy resource technologies, such as smart thermostats or commercial battery energy storage systems, and limit participation to a handful of original equipment manufacturers.

Though some providers have developed largely tech-agnostic VPP platforms through APIs, interoperability hurdles can cause latency and connectivity issues. While open protocols are emerging, a small fraction of original equipment manufacturers today employ interoperability standards that would allow their products to communicate seamlessly with a range of VPP and distributed energy resource management systems, or DERMS.

As a result, distributed resource owners and operators face limited opportunities for VPP participation. In fact, fewer than 1 in 5 MW of installed DER capacity is enrolled in VPPs today, meaning the potential of DERs remains largely unrealized.

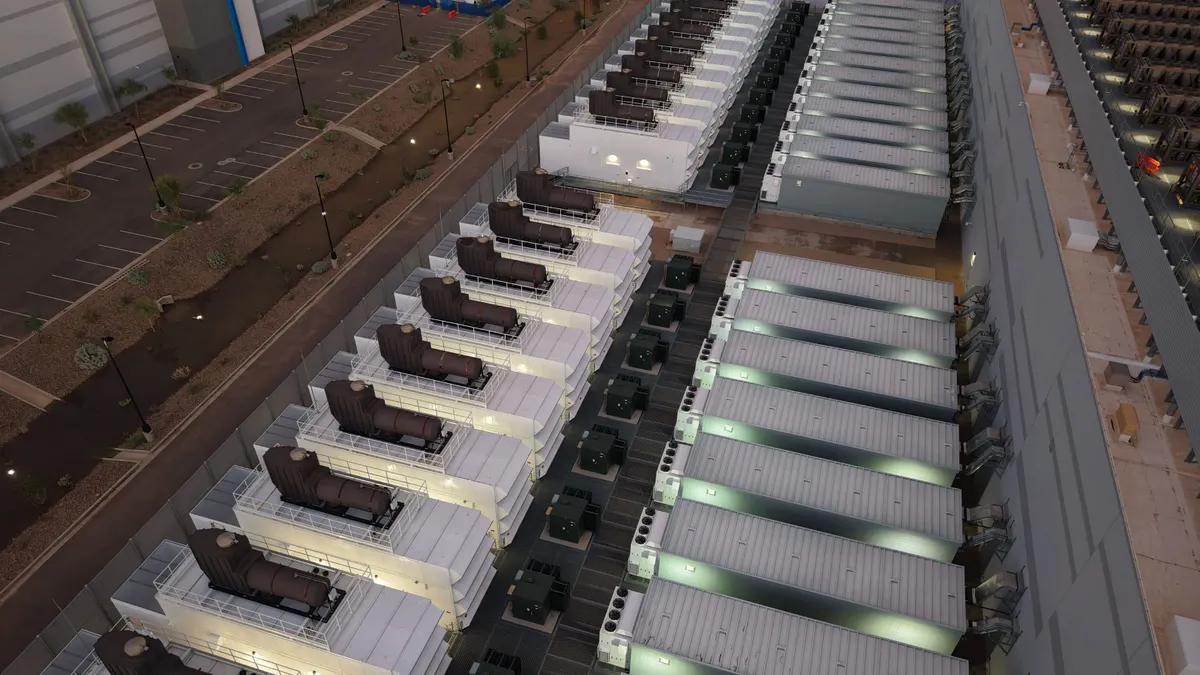

This evolution in the VPP market towards open protocols and interoperability is unfolding against the backdrop of an energy system under tremendous strain. Industrial on-shoring, AI-fueled data center expansion, and transportation electrification are some of the forces shaping today’s energy landscape, contributing to unprecedented load growth and capacity constraints that threaten to overwhelm the system. Now, more than ever, we need to unlock sources of additional capacity on the grid — and load flexibility through tech-agnostic VPPs holds out significant potential to help meet this challenge.

The future is tech agnostic

We believe the future of VPPs is tech agnostic, and a key driver is interoperability.

Interoperability is crucial for deploying certain consumer technologies efficiently at scale. The evolution of EV charging towards interoperability provides an analog to the VPP market.

For EV charging networks to grow and scale effectively, they need to serve a broad range of electric vehicles, and vice-versa — EV charge ports must integrate with a variety of charging stations enabling drivers to reliably get from point A to point B.

In much the same way, virtual power plants must foster cross-technology participation by a variety of DERs and brands to compete with traditional power plants in providing firm, dispatchable power at scale to utilities and wholesale energy markets.

DER manufacturers, in turn, must adopt protocols facilitating communication and integration with a wider set of VPP and DERMS technologies (non-wire alternatives) to augment traditional generation assets and offset costly transmission and distribution investments by utilities and network operators.

Our confidence in a tech agnostic future for VPPs is grounded in economics. In a market populated by single technology programs, some VPP providers will adapt to integrate multiple technology types in order to capture additional market share. On the flip side, a profitable deviation for OEMs is to begin offering DER products that enable participation across multiple VPP platforms, enhancing their appeal to consumers and increasing market share.

This back-and-forth interplay between OEMs and VPPs will move the market towards a tech agnostic state. The transition, however, will not include all VPP providers. It will look different in the short term versus the long run, and may take different forms based on regional, macroeconomic, and regulatory factors.

Sources of variability

While cross-technology VPPs may be dominant five years from now, it is unlikely the market will be uniformly tech agnostic.

Differences in business strategy, technological capabilities, OEM partnerships, customer enrollment models, market share and name recognition will push VPP companies in different directions as they adapt to an increasingly tech-agnostic marketplace. Name-brand OEMs and installers, with in-house VPP technologies and exclusive partnerships, may cordon off their corners of the market, strengthening bilateral agreements with partners and utilities and working to deepen proprietary moats. These VPP providers are less likely to advance the cause of universal interconnectivity.

By contrast, DER aggregators whose business models are built on cross-technology enrollment through non-exclusive partnerships and OEM integrations will champion open protocols and adoption of interoperability standards. Leading VPP providers, utilities, OEMs, industry think-tanks and non-profits are forming working groups, partnerships and consortiums advancing interoperability in the VPP market.

Electric Power Research Institute and Kraken’s Mercury Consortium, the Institute of Electrical and Electronics Engineers’ IEEE 2030.5 DER interconnection standard, Rocky Mountain Institute’s VP3 consortium, Duke Energy’s Open Field Message Bus (OpenFMB) and Linux Foundation’s open source microgrid initiative are examples of this movement towards technology agnostic tools and platforms built around interoperability.

In order for a tech-agnostic market to emerge, VPP platforms and DERs must both adopt open protocols facilitating cross-technology enrollment and interoperability, which will take years. Even once most new DER technologies adopt open protocols, the bulk of legacy DERs on the system will not be fully interoperable. VPP companies leveraging legacy APIs to integrate a variety of DER technologies will play an important role bridging the gap between today’s fleet of non-interoperable assets and the tech-agnostic future market.

Ultimately, regional differences in energy markets, utility governance, clean energy regulation, taxation and economic incentives will largely determine where VPPs take hold and how well they scale. As a result, there are limits to the scalability of VPPs in the US, even as they evolve to be tech-agnostic.

New regulatory policy by states or regulators could accelerate the evolution of tech-agnostic VPPs in certain states or regions by requiring the adoption of open protocols for systems communication and integration, or by mandating utility-sponsored, tech-agnostic VPP programs for customers. Meanwhile, the extension or expiration of tax incentives favoring VPP development could sustain or slow the growth and scaling of VPPs by state or region.

Too big to fail?

It is worth considering what factors could cause the market to remain fragmented and proprietary, rather than evolving towards standardization and interconnection. In other words, what could keep the market from becoming tech agnostic?

If the incremental cost of developing and adopting standardized interoperability protocols exceeds its value, VPP platforms and OEMs will not advance tech agnostic platforms. Given the magnitude and urgency of demand growth by data centers and hyperscalers, the value of additional capacity is increasing rapidly. As utilities begin to face capacity shortfalls resulting from AI-driven load growth, the value of firm, dispatchable resources will rise.

Against this backdrop, and given the sheer volume of untapped DER resources sitting on the grid, the market potential of tech-agnostic VPP platforms likely outweighs the cost. In effect, consumers, aggregators and utilities are leaving money on the table by not connecting these devices to VPPs — an opportunity they cannot afford to ignore.

Advice for utilities

Emergence of a technology agnostic VPP market will take place incrementally over many years. This provides utilities with the advantage of foresight, and the opportunity to prepare in advance for an optimized, tech-agnostic, grid-to-grid-edge future state. There are several steps utilities can take:

- Incremental progress is good. Utilities do not have to accomplish everything at once in the transition to unified, tech-agnostic VPPs. An incremental approach is optimal given the nascent, rapidly evolving nature of the market. As an example, utilities will benefit from working with tech-agnostic VPP aggregators and program providers leveraging product-specific APIs for integration today, rather than waiting for the emergence of market-wide interoperability. Through partnerships with today’s emerging tech agnostic VPP providers, utilities can enroll a broader set of existing customer-sited DERs in the near-term, increasing MW under management and learning how to integrate these resources into existing utility systems optimally.

- Single-technology VPPs are valuable. Utilities should not shy away from proprietary, single-technology VPPs in the near-term, while waiting for interoperable DER technologies and VPP platforms to mature. Single product VPP providers are dominant in today’s market and are valuable partners in enrolling more DER resources, providing utilities valuable load flexibility experience and learning opportunities, and engaging the customers they will need to operate tech-agnostic grid to-grid-edge dynamic systems in the future.

- Foundational systems are key. Utilities must begin working now to implement the systems that will enable them to derive full value from tech-agnostic VPPs. It is important to begin trials, testing and implementation of DERMS, ADMS and other supporting systems that will lay the foundation for their participation in tech agnostic, utility-scale VPPs in the future.

The future of VPPs is technology agnostic, but that transition will take years to achieve and will take different forms depending on regional, political and regulatory differences.

Consortiums and partnerships will play a large role in the emergence of open protocols and interoperability, though not all VPP providers will move towards tech-agnostic platforms. As the market evolves, utilities should undertake incremental investments and projects, building the systems and customer engagement platforms they will need to realize the full benefits of tech-agnostic VPPs in a dynamic, optimized grid-to-grid-edge future.