Dive Brief:

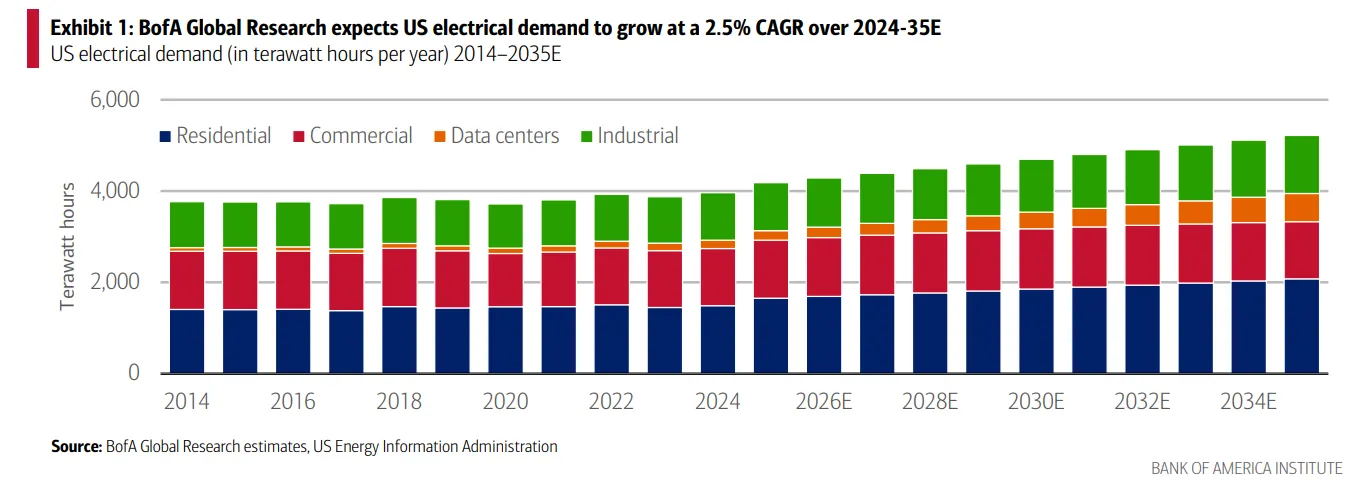

- U.S. electricity demand will grow at a 2.5% compound annual growth rate through 2035 — compared with a 0.5% CAGR from 2014-2024 — according to research distributed by Bank of America Institute on Tuesday.

- Utilities will need to increase spending to expand and replace aging power generation, transmission and distribution assets, and “deregulation and accelerated permitting may further help get more projects off the starting line,” the analysts said.

- The U.S. Senate Committee on Energy and Natural Resources heard testimony on Wednesday about the need to meet the rising electricity demand. Generation interconnection timelines are too long, transmission development lags demand and “permitting is fragmented and sequential,” Jeff Tench, executive vice president, North America and Asia Pacific, for Vantage Data Centers, told lawmakers.

Dive Insight:

There are a range of estimates around future U.S. electricity demand, but all point to a rapid rise after decades of stagnant growth.

Bank of America Institute’s 2.5% CAGR prediction includes historical annual growth of about 0.5%, with another 1% coming from building electrification, 0.5% from data centers, 0.3% from industrial growth and 0.2% from electric vehicles.

“These energy needs pose a challenge: US energy infrastructure is aging quickly and in need of replacement. In fact, today, 31% of transmission and 46% of distribution infrastructure is near (<5 years) or beyond its useful life,” BofA Institute said.

So while more capacity is needed, last year 67% of electric utility spending was on infrastructure replacements, “while only $32 billion was spent on new lines and substations,” according to the report. “Thus, US power outages are increasing.”

Grid Strategies President Rob Gramlich told the Senate panel that an aggregation of utility forecasts by his firm shows the nation needs 15% more capacity, or 120 GW by the end of the decade.

“Utility forecasts may be overstated because, as with generators connecting to transmission systems, there are many more requests from potential projects to connect than actual projects that will be built. There will also likely be a continued trend towards more energy efficient algorithms chips, and cooling systems for these large loads,” Gramlich said.

“On the other hand, we could also see a large rebound effect where more efficiency leads to expanded use of electricity ... On balance, the real observable evidence of very large loads moving forward with construction suggests we will probably experience 2% [growth] per year,” he said.

Transmission investment is a cost-effective solution, Gramlich noted.

“Unnecessary process steps such as the double [National Environmental Policy Act review] required by current backstop transmission siting policy should be removed,” he said, and the expansion of categorical exclusions and lead agency coordination of permitting can help speed the process. Permitting agencies should also be staffed and federal agencies must remain independent, he added.

Vantage’s Tench said his firm “prefers to source power from the grid” for its data centers.

“But when interconnection timelines stretch years beyond our project schedules, and the buildout of grid-connected generation capacity is not keeping pace with the demand growth rate for electricity, we have no choice but to explore alternatives,” he said.

Those alternatives include: deploying on-site generation to serve initial loads, co-locating near existing power plants, planning developments in phases, and coordinating with utilities and state partners to locate scarce near-term capacity.

“These efforts reflect creativity and adaptability,” Tench said. “They do not represent a sustainable model for national infrastructure growth.”