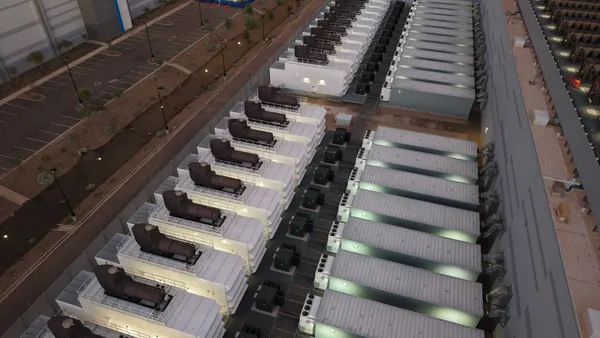

Large loads, including AI data centers, are showing up on the U.S. electric grid and could ultimately add 20% to utilities’ peak demand, most within the next decade, according to new analysis from Wood Mackenzie published Thursday.

The report looks at investor-owned utilities’ near-term committed loads and more speculative projects beyond 2035, as well as shifts in where the demand is showing up and uncertainty around the buildout.

"Utilities are committing to large loads ramping rapidly this decade," Ben Hertz-Shargel, global head of grid edge for Wood Mackenzie, said in a statement. "The market will be hard-pressed to supply this new load on that timeframe, which may prevent it from happening.”

The need for electricity in the United States is growing rapidly, following years of flat-line demand. The growth is being driven by data centers, industrial expansion and electrification, but just how much power demand will show up remains uncertain.

Data centers could consume 9% of the United States’ electricity generation by 2030 — double the amount consumed today, according to the Electric Power Research Institute. But experts agree that not all of the proposed data centers will be built.

Investor-owned utilities have over 17 GW of large loads under construction and have committed to another 99 GW, together equal to 15.5% of current US peak demand, WoodMac said in the report. Another 32 GW of capacity “is in advanced conversation or a near-term forecast, resulting in 147 GW of high-probability load, equal to 20% of US peak demand.”

A significant portion of this capacity will come online this decade, WoodMac said, with 60 GW expected to be added through 2030 — or about 8% of current U.S. peak demand. Utilities expect 93 GW to be operational by 2035, “after which little pipeline capacity has been disclosed,” the firm said.

But how much of the longer-lead load is high-confidence capacity in utility forecasts?

"Rather than starting to see a trend toward pipeline certainty, we continue to observe the opposite," Hertz-Shargel said.

WoodMac said its analysis shows “modest increases” in high-confidence capacity at several utilities, but the high-confidence share of the total capacity pipeline “has decreased over the last few quarters as new requests outpace the advancement and withdrawal of existing requests.”

There has also been a shift towards large load development in deregulated markets, the report found.

“While 91% of the current 17 GW of disclosed capacity under construction is located in regulated markets, 54% of committed capacity not yet under construction and 65% of capacity in advanced discussion is planned for deregulated markets,” WoodMac said.

"Committed capacity not under construction as well as advanced discussion capacity fall disproportionately in deregulated markets,” primarily in the Electric Reliability Council of Texas area, said Hertz-Shargel. "Deregulated markets pose risks of inadequate future supply and price increases to non-large load customers, which has prompted market interventions by Texas and PJM and will likely prompt more in the future."