Todd Snitchler is president and CEO of the Electric Power Supply Association, which represents competitive power suppliers that own and operate about 200,000 MW of capacity throughout the U.S.

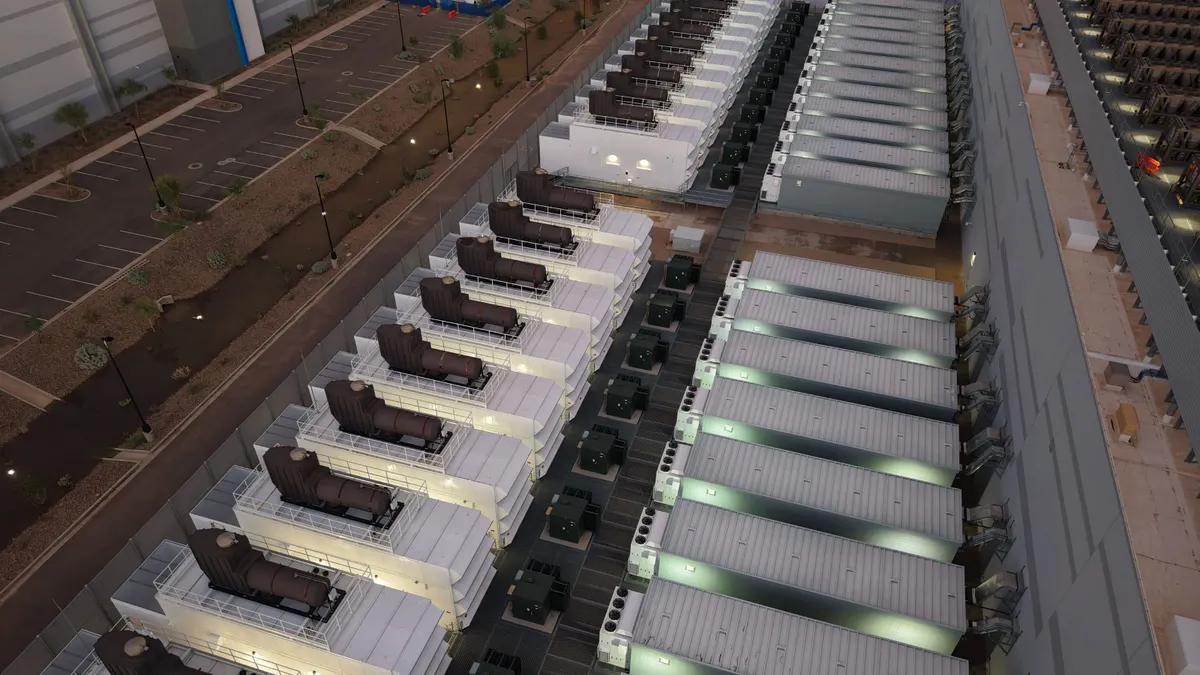

The independent market monitor for the nation’s largest grid operator made waves in early June when it released a report warning that data centers’ power consumption could trigger regional energy shortages as early as next year. While data center growth is a significant factor in rising electricity demand, focusing narrowly on this sector risks distracting from the broader and more persistent challenges facing the grid.

In a brief analysis of PJM Interconnection’s capacity auction held in July 2024 for the 2025/2026 delivery year — the mechanism by which the regional transmission organization procures resources to satisfy demand years in advance — Monitoring Analytics lays the blame for last July’s capacity prices squarely at the feet of data centers. The paper’s brevity can be attributed to the fact that this assessment is technically structured as an excerpt (“Part G”) of a forthcoming comprehensive report that ostensibly will take into consideration the myriad supply and demand pressures confronting PJM.

An observer could question whether dedicating a standalone report to a single, isolated variable that happens to be an emerging focus for regulators inappropriately creates alarm in policy circles. Such posturing ignores other documented demand stressors in the regional transmission organization’s service territory, including the electrification of the nation’s second-largest port (and the broader economy) and the proliferation of electric vehicles in the region, which S&P Global estimates will grow significantly over the next 15 years.

Unfortunately, this suspicion is confirmed by the market monitor’s emphasis on certain key data points throughout the report. One example is a passage lamenting this year’s projection for summer peak load in 2026, which the report explains is a “substantial upward revision (6,678 MW or 4.4%)” from the projected 2026 summer peak load of 152,259 MW in the 2022 load forecast report. The 4.4% upward revision sounds like a lot in the carefully balanced world of wholesale power markets. However, the analysis glosses over the 2026 summer peak load projections contained in the 2024 forecast. When compared with the 2025 figures, the difference narrows to just over a 1% increase. This emphasis diverts attention away from longstanding issues that PJM has been slow to address.

One persistent challenge has been the rash of power plant retirements across PJM’s footprint and the specter of more to come. The RTO petitioned the Federal Energy Regulatory Commission in winter 2014 to keep uneconomic generators online amid the “historic” loss of approximately 11,700 MW of power while adding only 3,800 MW to the system. Fast forward to June 2023, and PJM President and CEO Manu Asthana testified before the Senate that dispatchable resources were retiring at a faster rate than new capacity could be built. Last year, the IMM released a report stating that up to 30% of the RTO’s installed capacity could face retirement by 2030 without a clear path for replacement resources.

Making this underlying supply deficit worse is the gridlock that previously defined PJM’s interconnection queue, the process for energy projects to be approved and plugged into the grid. PJM has undertaken meaningful reforms to process 140 GW of projects since 2023, including 46 GW with signed agreements. It also has taken measures like the Reliability Resource Initiative, which selected more than 9,300 MW of additional power generation to meet the region’s power needs. And PJM recently began harnessing AI tools — powered by the data centers the IMM pinpoints — to accelerate the grid operator’s interconnection regime and get projects through the pipeline faster.

Supply additions are also hampered by regulatory uncertainty, such as PJM’s evolving resource accreditation requirements and whipsawing price floor rules that delayed the organization’s capacity auction for years. The scenarios in the IMM report assume a functional market that responds to price signals, but PJM’s framework for the last auction was plagued by flaws that blunt those signals and deter entry of new resources. What is needed is for the market to be allowed to function and deliver appropriate signals to all stakeholders. PJM’s quadrennial review, which informs the market inputs, is currently underway and may result in better data to deliver sound outcomes.

With these significant challenges in mind, we encourage PJM to lay out an objective assessment of the supply and demand dynamics impacting the 67 million people across its service territory and continue doing the hard work to reform the generation interconnection queue, establish and maintain a predictable regulatory framework and introduce discipline to the load forecast to better reflect the pace and scale of large energy users.

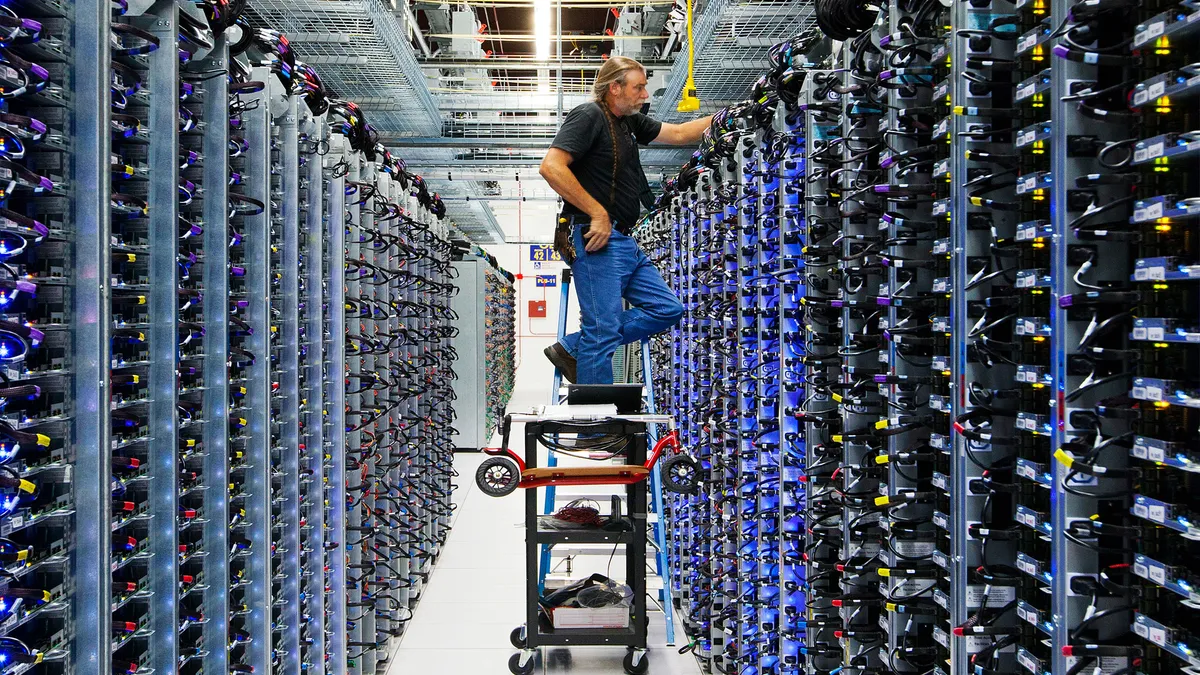

Data centers are not only major energy users — they are also critical to the modern economy. Their growth should be seen in this broader context: as an economic driver that policymakers and grid operators must plan for rather than simply fault.

Data center growth will continue to have a sizable impact on our energy resources. But reliability will not be secured by focusing on a single industry. Instead, PJM and policymakers must take a comprehensive, solutions-oriented approach that acknowledges the essential role data centers play in society while addressing the full range of supply and demand challenges shaping the region’s energy future.

As the voice for competitive power suppliers, we know this is critical to finding solutions that allow our members to continue the investments needed in reliable power generation to support this vital industry.