Dive Brief:

-

Corporate buyers contracted to buy about 20.4 GW of “clean” power from January to September, including 3.4 GW from “clean firm” technologies, the Clean Energy Buyers Association said this week.

-

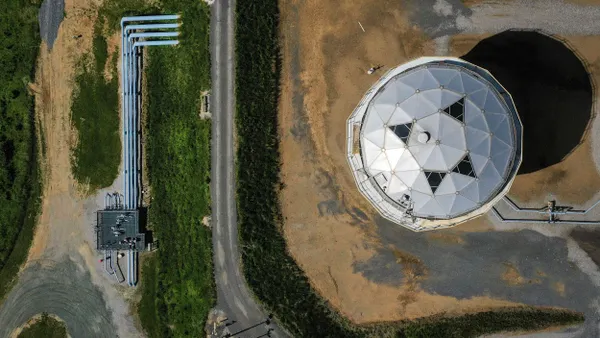

CEBA called the numbers a significant increase in procurement of “clean firm” resources, which the organization defines as resources that can provide consistent power on demand from hydroelectric, geothermal, nuclear, long-duration energy storage and thermal with carbon capture and storage. Some jurisdictions have passed or are considering new large load interconnection rules that require customers to bring their own firm capacity.

-

“We’re on track to have the largest year ever buying carbon emissions-free electricity,” CEBA CEO Rich Powell said in an interview. Members remain committed to the clean energy transition, he said, despite regulatory rollbacks and market changes that have led some to alter their sustainability goals. “The data speaks for itself,” he added.

Dive Insight:

Powell said CEBA members, like everyone, are worried about climbing electricity prices amid escalating demands from artificial intelligence data centers. The organization represents hundreds of energy companies, service providers and corporate buyers, including many tech giants such as Amazon, Google, Microsoft and Meta.

“Our mission is low-cost, reliable, emissions-free electricity systems — in that order,” Powell said.

Many large energy buyers are working to overcome a narrative that data centers and other large loads are raising electricity prices for everyone, he said, adding that the cost increases hitting ratepayers now are largely for transmission and distribution. He pointed to a recent study by the Lawrence Berkeley National Laboratory that found large loads can, under the right circumstances, apply downward pressure on prices.

However, inflation, slow permitting, grid hardening, interconnection queues and other issues driving up costs are problems for which there is no “silver bullet,” he warned.

“Our members are willing to do their fair share and, in many cases, more than their fair share,” Powell said. “Our members have, in many cases, embraced the new class of large load tariffs that are coming in around the country.”

Dozens of states have proposed or adopted rules meant to shield existing ratepayers from the cost to interconnect large loads, including by requiring those loads to curtail during times or grid stress, bring their own capacity or commit to paying for a large percentage of the power they say they will need, even if they don’t end up using that much.

Powell said the challenge of connecting large loads is driving innovation, both in the agreements companies are striking with utilities and in their operations. One of the most promising innovations, he said, is the idea of large load flexibility, despite some controversy over its feasibility in all markets.

“[Flexibility] is very real, and it’s particularly promising because it could happen fast,” Powell said. “It should be performance-based and sort of technology- or approach-neutral.”

Adopting a broad approach to flexibility would allow customers to meet the need in more than one way, he said. That could be by idling operations, paying others on the system to power down or by using on-site storage, for example, he said.

“It’s not a substitute for also doing a tremendous amount of new generation, you know, building and upgrades to transmission systems writ large and things like that,” he said. “We need to do all of those things, but flexibility can absolutely be a strong part of that package.”

As for the future of the clean energy transition, Powell expressed confidence that renewable energy, and solar in particular, will remain available and cost-competitive even without subsidies, but he’s also seeing large energy buyers diversify their strategies.

“Our members are definitely broadening out what they’re contracting for,” Powell said, pointing to the surge in contracts for “clean firm” technologies.