The PJM Interconnection’s failure to buy enough capacity to meet its reliability target in its most recent auction raised alarms among Federal Energy Regulatory Commission members at the agency’s open meeting Thursday.

“It's very concerning,” FERC Chairman Laura Swett said. “These market results suggest that we have to act to ensure that new supply is available to interconnect to PJM quickly enough to meet historically surging demand.”

PJM on Wednesday said it procured about 145,780 MW in its latest capacity auction, about 6,625 MW below the grid operator’s 20% installed reserve margin target — an estimate of how much capacity is needed to prevent more than one unexpected power outage every 10 years. It failed to meet its reserve margin while also setting record-high prices for the third auction in a row.

Several factors could close that shortfall by the time the auction’s capacity year starts on June 1, 2027, according to PJM. Its demand forecast for the auction was based on a load forecast issued in January. PJM is set to release a new load forecast next month that could be significantly lower, partly based on stricter vetting of potential large loads and a reduced economic outlook, said Stu Bresler, executive vice president for market services and strategy at PJM.

Even so, the failure to acquire enough capacity to meet its reserve margin is “unacceptable,” according to FERC Commissioner David Rosner.

“We need PJM to file, without further delay, meaningful changes to its rules to overcome the interconnection and financing barriers to building new generation to close the resource adequacy gap before the end of this decade,” Rosner said.

PJM’s shortfall could be filled by building more power plants, Rosner noted.

“We should be able to build five or six new large power plants in the next few years in PJM, and it's really troubling that we can't,” he said. PJM’s capacity auction drew 774 MW of new generation and power plant uprates.

In a decision on PJM’s colocation rules FERC issued Thursday, the agency gave the grid operator until Jan. 19 to file a report on the status of proposals that were considered in the grid operator’s Critical Issue Fast Path stakeholder process on integrating large loads, including the status of the grid operator’s expedited interconnection process for shovel-ready generation projects.

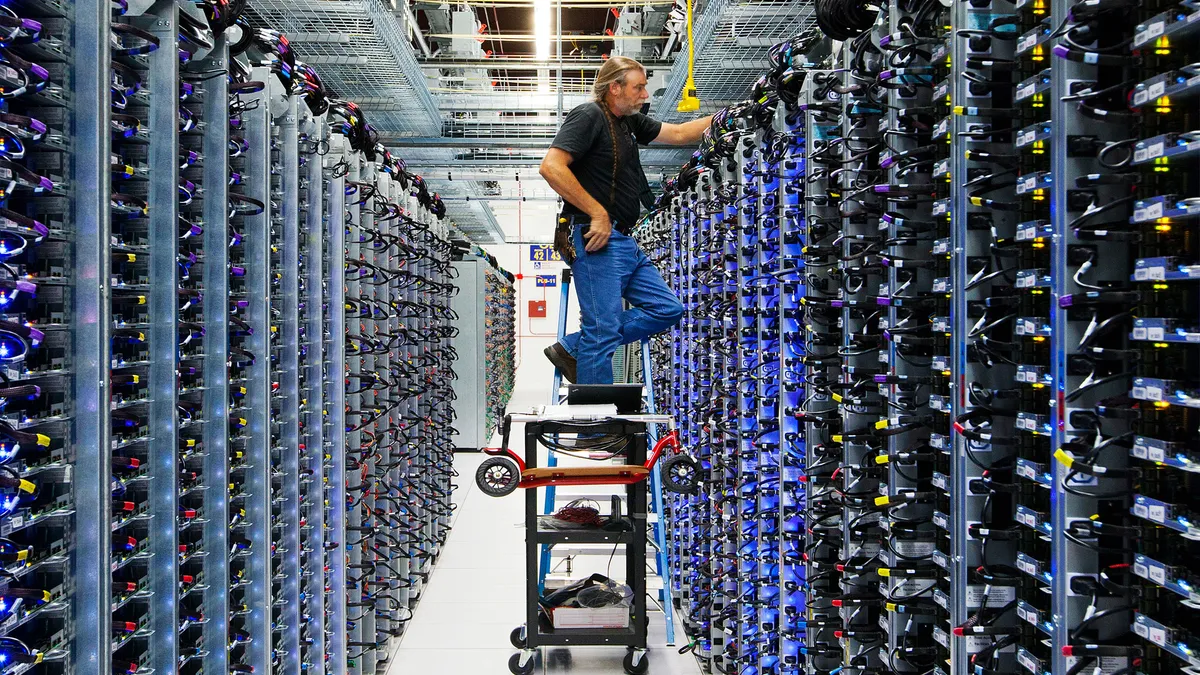

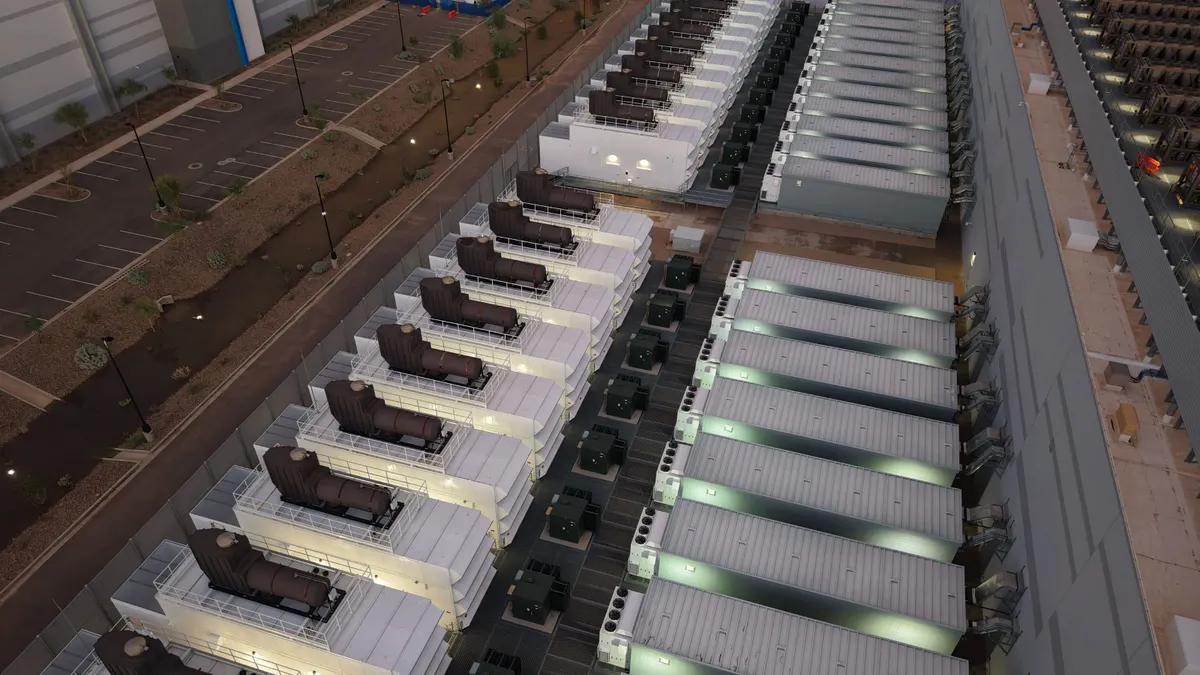

“The informational report also must identify specifically which of these initiatives would support the addition, on an expedited basis, of new generation that is sufficient to serve large loads, like data centers, while meeting PJM’s near-term system resource adequacy needs,” FERC said.

PJM is the largest U.S. grid operator, running the power system and electric wholesale markets in the Mid-Atlantic and Midwest regions where about 67 million people live.

PJM’s 2027/28 capacity auction resulted in a 14.8% reserve margin, below PJM’s 20% target, FERC Commissioner Lindsay See noted.

“It's an understatement to say that those are concerning outcomes,” See said. “The work coming out of PJM’s stakeholder process is more critical and time sensitive than ever.”

FERC Commissioner Judy Chang echoed her colleagues' concerns.

“We're hitting the grid reliability crisis that has been brewing for years, and PJM’s report from yesterday confirms exactly that,” Chang said. “And really, PJM is not alone. We just see it more visibly with PJM.”

The North American Electric Reliability Corp. in a mid-November report said much of the the continent is at an elevated risk of lacking enough power supplies to meet demand in extreme operating conditions this winter.

The tight market conditions in PJM and elsewhere are partly driven by policies implemented by the Biden administration and some states, according to FERC Commissioner David LaCerte.

“Baseload and dispatchable power were suppressed and vilified,” LaCerte said. The issue was made worse by the forced retirement of coal-fired power plants and a lack of gas pipeline capacity, he added.

“Greenhouse gas emissions and carbon footprints ruled the day,” LaCerte said. “[They] became the primary driver, really the only metric, during the Obama and Biden administrations, separating FERC from its economic regulation roots and framing it as an environmental regulator.”

Generation and resource adequacy generally fall under state jurisdiction, LaCerte noted.

“Up until very recently, this has largely been a very successful balance,” he said.

PJM’s capacity auction reached all-time high prices, which will affect tens of millions of consumers, but fell “dangerously short” of the grid operator’s reliability requirement, former FERC Chairman Mark Christie said in a LinkedIn post.

However, he cautioned against federal regulators acting hastily in ways that could infringe on local authority or exacerbate affordability concerns.

“The fundamental problem is that load growth driven by data centers is far exceeding any realistic possibility of new generation,” Christie said. “Now is not the time for FERC to make the crisis worse by incenting the cannibalization of existing generation to serve only co-located data centers, or to pre-empt the states in a rush to interconnect data centers when states are trying to protect reliability and their consumers from cost shifting.”