Emmanuel Martin-Lauzer is director of business development and public affairs at Nexans.

The jury is still out on whether the Inflation Reduction Act (IRA) has helped contain or reduce inflation. Nevertheless, certain provisions have delivered tangible benefits that deserve closer examination before any potential repeal. While some provisions may not have broad appeal, one success of the IRA has been its impact on strengthening U.S. energy production. The bill speaks more to renewable energy innovation and increase in energy independence to support U.S. economic growth than to direct economic impact. Repealing it wholesale risks far more than we might anticipate.

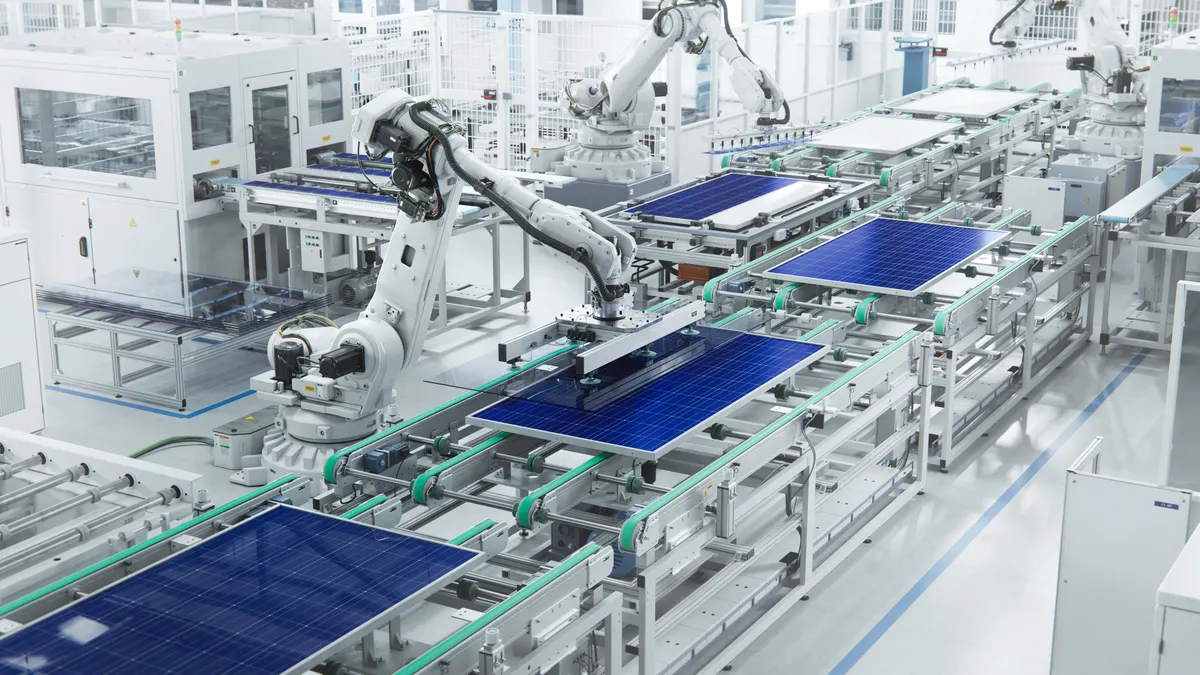

At its core, the IRA tax credits for energy generation are driving significant investment in innovative energy production. Because renewable energy makes up around 21.4% of the energy mix, these incentives have been passed down the chain to the benefits of the ratepayer, while simultaneously sustaining the creation of entire industries. These investments have sparked construction and manufacturing jobs across both red and blue states, proving that clean energy isn’t just an environmental initiative.

These tax credits have also bolstered America’s energy independence. Renewables like solar, onshore wind and offshore wind are integral to our domestic energy supply chain, reducing reliance on foreign sources, and making our own infrastructure more resilient. They’ve also driven initiatives to improve long-term cost competitiveness, incentivizing developers to innovate to reduce costs.

Our current grid infrastructure and energy generation systems are nearing obsolescence and over the next decade the demand on these systems is expected to skyrocket. Data centers alone are expected to double their electricity demand, and by 2035, over 71 million electric vehicles will require around 400 kWh to charge per month. Urbanization trends are compounding this demand as more people move to cities.

Without the IRA tax credits, we risk slowing down our ability to develop more power generation, growing the risk of rolling blackouts and higher energy costs for the average ratepayer, all while increasing our dependence on foreign sources of energy. Today’s decisions don’t impact today’s costs, they impact tomorrow’s ability to grow our economy.

Tax credits are not a new concept — they have been a bipartisan policy tool used for decades to support emerging technologies. From artificial intelligence and quantum computing, to biotechnology, to government investments driving technologies like GPS and the Internet, these investments have repeatedly demonstrated their value. Renewable energy is no exception.

Since the IRA has been enacted, the renewable energy industry has created thousands of jobs and established numerous domestic manufacturing plants on U.S. soil spurred by these domestic supply tax credit incentives. Manufacturing isn’t the only business reaping these benefits either. These credits have helped support better-paying jobs in specialized professions such as those in the maritime industry for offshore wind or wind technician positions.

Energy diversity isn’t just good economics — it’s a good security policy. With a diverse mix of energy sources (nuclear, fuel based, hydro, renewable), we reduce the risk of monopolies that drive up costs, as seen with Standard Oil’s monopoly in the early 20th century. Competition forces developers to lower costs, driving the cost of energy downwards. Furthermore, the energy has to come from somewhere and the question is not about the current costs of renewable energy but the future cost of energy in general to consumers without renewables in the energy mix of the future. There is nothing more damaging than energy you need but can’t find.

From a national security perspective, energy diversification mirrors a sound investment portfolio. Just as diverse assets protect against market volatility, multiple energy sources safeguard against physical and cyber threats. If one source is cut off, others can fill the gap, ensuring a stable energy supply and reducing our reliance on adversarial nations for critical resources. Not only are we safer from attack, but we are also responsible for our own generation. This further helps reduce costs, but also prevents us from being beholden to other countries, especially our adversaries, for energy and tangential resources such as rare minerals.

While there are certainly valid critiques of the IRA and potential benefits to revising pieces of the legislation, full repeal would undermine the significant progress made in clean energy innovation, economic growth and national security. The IRA’s tax credits and investments have delivered tangible benefits that extend far beyond inflation, and policymakers should tread carefully before dismantling them.