Dive Brief:

- The New York electric grid faces increased risk of power shortages over the next five years unless planned projects, including new transmission and offshore wind resources, are brought online, the state’s grid operator said Tuesday.

- Starting next summer, the Independent System Operator anticipates its reliability margins in New York City will be dangerously thin, making the grid more vulnerable to failures. In addition to potentially losing anticipated wind power, the system is strained by generator deactivations, increasing consumer demand, transmission limitations and difficulties in developing new resources, the ISO said in a statement highlighting a pair of reliability reports.

- “The NYISO’s findings should be alarming to residents and serve as another wake up call for the state,” Gavin Donohue, president of the Independent Power Producers of New York, said in a statement. “Electric demand is continuing to drastically rise, and the state needs to look at all possible resources.”

Dive Insight:

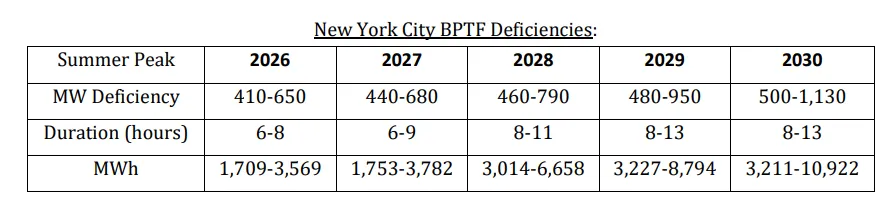

The ISO’s Short-Term Assessment of Reliability examined the five-year period from July 2025 to July 2030 and identified reliability weaknesses beginning in New York City in 2026, in Long Island in 2027 and in the Lower Hudson Valley region in 2030.

The New York City area will be deficient “through the entire five-year horizon without the completion and energization of future planned projects,” the STAR report concluded.

Those projects include the 816-MW Empire Wind offshore project, which was expected to be online by 2027. That timeline was complicated when the Trump administration halted the project in April before allowing it to resume a month later. Since then, it has faced additional complications and delays.

The STAR report also cited the importance of the 1,250-MW Champlain Hudson Power Express transmission line, which is slated bring power to the city from Quebec beginning next year.

“Once CHPE, Empire Wind, and the Propel NY Public Policy Transmission Project enter service and demonstrate their planned power capabilities, the margins improve substantially,” the report said.

“The reliability needs identified by the STAR [report] in New York City and Long Island are based on a deficiency in transmission security,” the ISO said. “Transmission security analysis tests the ability of the power system to withstand disturbances, such as electric short circuits or unanticipated loss of a generator or a transmission line, while continuing to supply and deliver electricity to consumers during peak demand when the system is stressed.”

The short-term need is also driven by a combination of forecast increases in peak demand and the assumed unavailability of some generators in New York City affected by the New York State Department of Environmental Conservation’s peaker rule limiting nitrogen oxide emissions.

Zach Smith, senior vice president of system and resource planning for the ISO, said the grid was at an “inflection point.”

“Depending on future demand growth and generator retirements, the system may need several thousand megawatts of new dispatchable generation within the next ten years,” Smith said.

And the ISO added that the risk of deficiencies beyond the STAR report “is even greater when considering a range of plausible futures with combined risks, such as the statistical likelihood of further generator retirements or failures,” the report said. “New York’s generation fleet is among the oldest in the country, and as these generators age, they are experiencing more frequent and longer outages.”

The ISO’s 2025-2034 Comprehensive Reliability Plan, which is not yet final, found the state’s electric system faces “an era of profound reliability challenges” driven by the state’s aging generation fleet, rapid growth of large loads, including data centers and manufacturing, and increasing difficulty of developing new supply resources “due to public policies, supply chain constraints and rising costs for equipment.”

The ISO said it anticipates the CRP will be finalized in November.

The findings set in motion an ISO process to restore reliability margins. The grid operator said it will begin the process immediately by “working with the local utilities and the marketplace to identify and evaluate possible solutions. Transmission, generation, energy efficiency or a combination of each can qualify as solutions through the process.”

“If the right market signals are in place, the private sector will invest in the necessary resources to address these shortfalls. All potential solutions must be on the table,” said Donohue, speaking for independent power producers. “Increasing dispatchable generation must be prioritized so that the state does not go dark.”