Dive Brief:

- In the first half of this year, total project finance lending to the U.S. clean energy industry increased to around $86 billion, up from $80 billion in the first half of 2024, according to a Monday report from Crux, a finance technology company that connects tax credit buyers and sellers.

- The clean energy industry faced considerable policy uncertainty this year after President Donald Trump took office and rolled back some Biden administration policies, then worked with Congress to pass the One Big Beautiful Bill Act, which curtailed many of the tax credits offered by the Inflation Reduction Act.

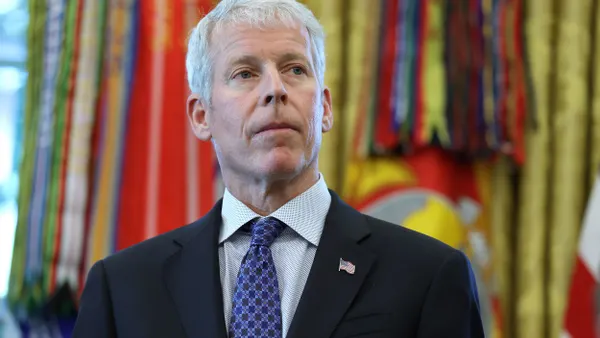

- “The market is growing and becoming much more diverse,” said Crux CEO Alfred Johnson. “We're still seeing a lot of volume from wind and solar, and anticipate to continue to see it as projects are placed into service over the next four years. But the dynamic of increased diversification is definitely going to continue, and we expect to be even more pronounced in the back half of the year.”

Dive Insight:

A lot of that diversity is coming from parts of the industry which saw their tax credits less trimmed by the OBBBA, which targeted benefits to wind and solar in particular. Storage tax credits made it through largely unscathed, and transactions on those are “booming,” Johnson said.

Crux’s report estimates that the total transferable tax credit market exceeded $20 billion in the first half of this year, almost doubling from the first half of 2024.

“A critical driver of this growth was the broadening range of technologies and sponsors active in the market, with energy storage projects in particular gaining market share alongside established solar and wind deals as well as newly eligible credits from advanced manufacturing, clean fuels, geothermal, and other sectors,” the report said.

Johnson noted that there is “continued bipartisan support for categories like advanced manufacturing, critical minerals, nuclear, biofuels, that continue to see significant amounts of investment, and that is materializing in the tax credit market.”

Crux’s report said that not all technologies face “the same accelerating investment as storage.” Onshore and offshore wind energy, which have been targeted by the Trump administration, “face headwinds to new investment. The proportion of wind PTCs sold in the transfer market declined to 9.5% during 1H2025 from 33.0% in 1H2024.”

Tax credits benefitting wind and solar are winding down earlier than anticipated, and are subject to new and onerous foreign entity of concern requirements.

“The market has some real pockets of financial distress as some developers that premised their business on a prior reality of policy and development are having to come to terms with the new reality,” Johnson said.

Johnson said there are numerous and cross-cutting forces at work in the current clean energy market, making it “difficult to discern the net effects – which is why I find the conclusion that the market grew so materially from the first half of 2024 to 2025 to be so interesting.”

“It suggests that there are a lot of forces that drive this development, and we are in a moment of categorical expansion of energy need and domestic manufacturing, and that will play out through trillions of dollars being invested in energy infrastructure and manufacturing over the next decade,” he said. “It's just going to be shaped somewhat differently than it might have been in a prior policy environment.”

Crux estimates that the tax credit market is likely to shrink from the first half of the year to the second, a forecast that Johnson called “admittedly conservative.” Part of the reason for that, he said, is that much of the volume in the second half of 2024 came from transactions on future year credits.

“Given some of the dynamics in policy and what we are seeing in terms of buyer bidding behavior, with tax liabilities reduced somewhat … We have not yet called the ball on there being as much forward investment and tax credit purchases as there were in the second half of last year,” he said.

Crux also found that nearly all of the wind tax credits — and around two-thirds of the solar tax credits — that the company expects to transact in 2025 have already been sold.

Around half of anticipated storage credit transactions haven’t taken place yet, and “production tax credit categories like nuclear and advanced manufacturing, which are quite large and substantial, will see a ton of volume transact to the back half of the year,” Johnson said. “So the diversification story will become even more prominent in 2H than it was in 1H.”