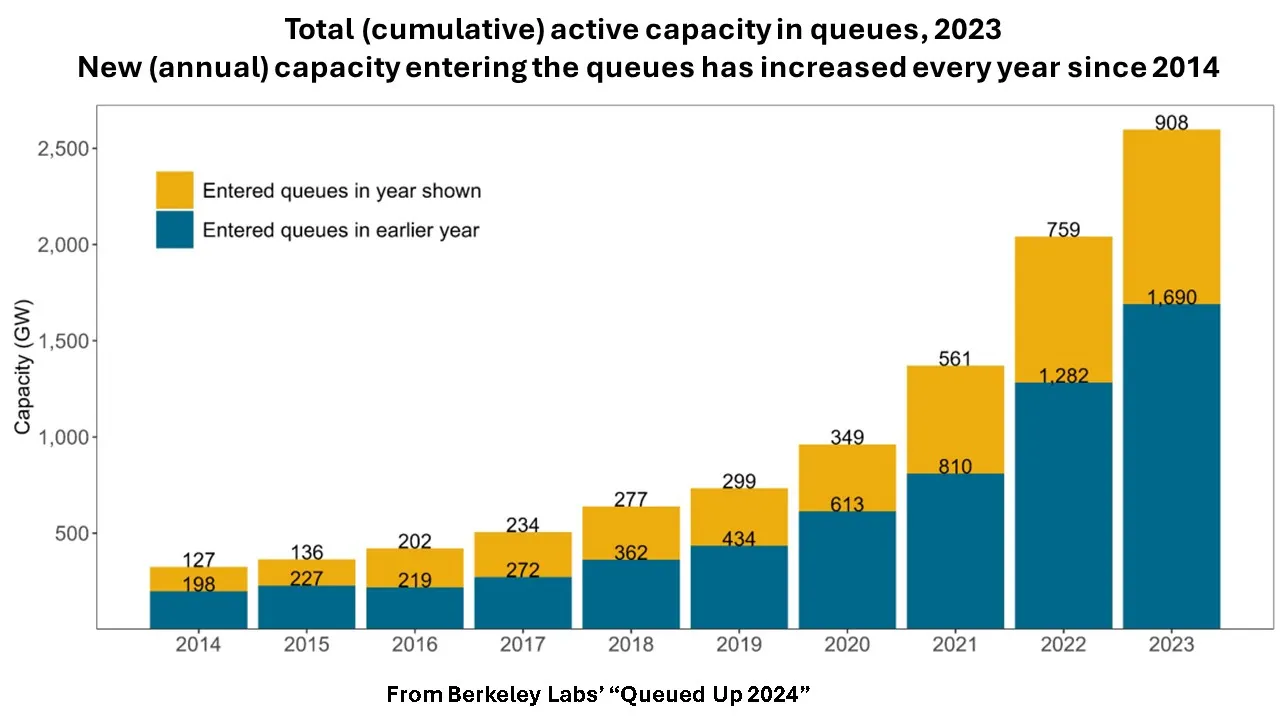

The need to speed interconnection of new generation continues to grow more urgent, but the Electric Reliability Council of Texas may have the solution, some analysts say.

ERCOT uses a unique connect-and-manage, or C&M, interconnection process that is adding new generation faster than any other U.S. system, data shows. C&M may meet the current Texas spiking electricity demand but other markets need more price and reliability certainty from streamlined interconnection processes, stakeholders outside Texas said.

ERCOT’s C&M approach “allows generators to enter the market as energy-only resources because it manages them as part of its proactive transmission planning process,” Duke University Nicholas School of the Environment Fellow Tyler Norris said. But those generators “face the financial risk of curtailments,” he added.

Unlike ERCOT, most system operators’ reliability requirements and allocation of upgrade costs force detailed and redundant studies of generators seeking interconnection that result in backlogged queues, studies show.

“Most regions do studies to ensure generation is deliverable when and where it’s needed, which slows interconnection approvals,” said Carrie Bivens, vice president of Southwest Power Pool's market monitoring unit and former director of ERCOT market monitor Potomac Economics. Dropouts from generator applicant clusters “force redundant studies and slows the process more,” she added.

System operators are finding ways to streamline interconnection processes, analysts and regulators agree. But more flexible interconnection approaches could bring energy-only projects online quickly and then re-evaluate them as reliability resources, a two-step process which would allow time for interconnection costs to become clearer, other stakeholders said.

Why connect and manage?

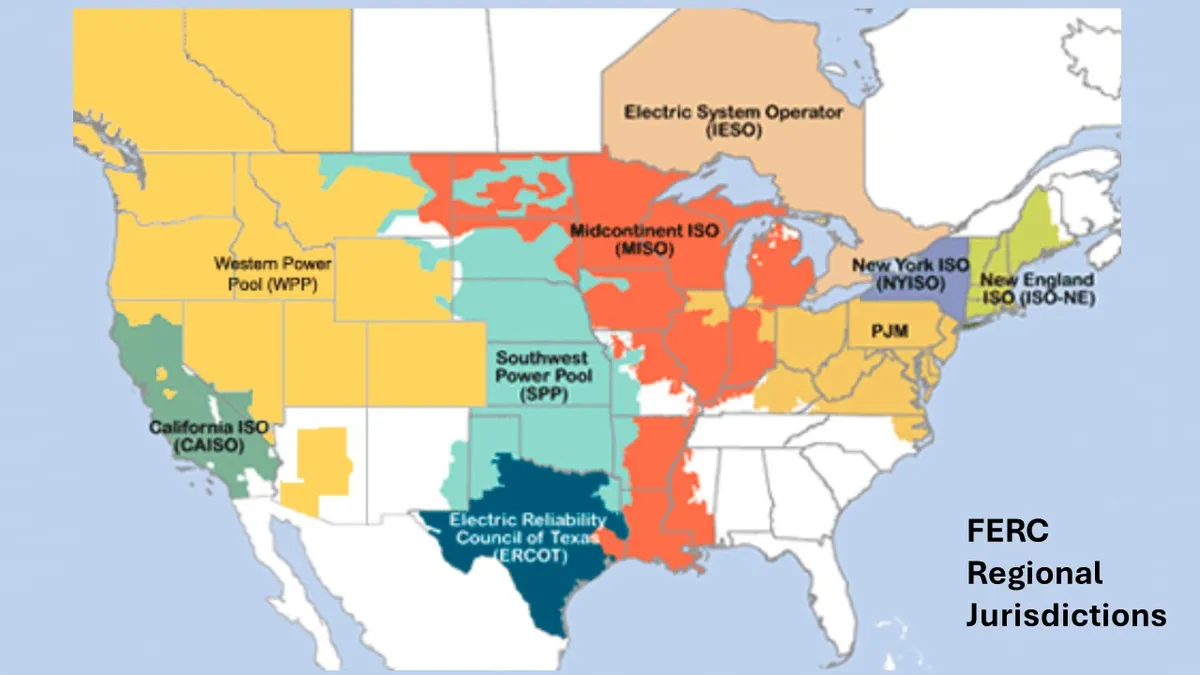

Parts of New England, the Midcontinent Independent System Operator, SPP and ERCOT all “face risks of electricity supply shortfalls during periods of more extreme summer conditions” this year, the 2025 Summer Reliability Assessment from the North American Electric Reliability Corp. found in May.

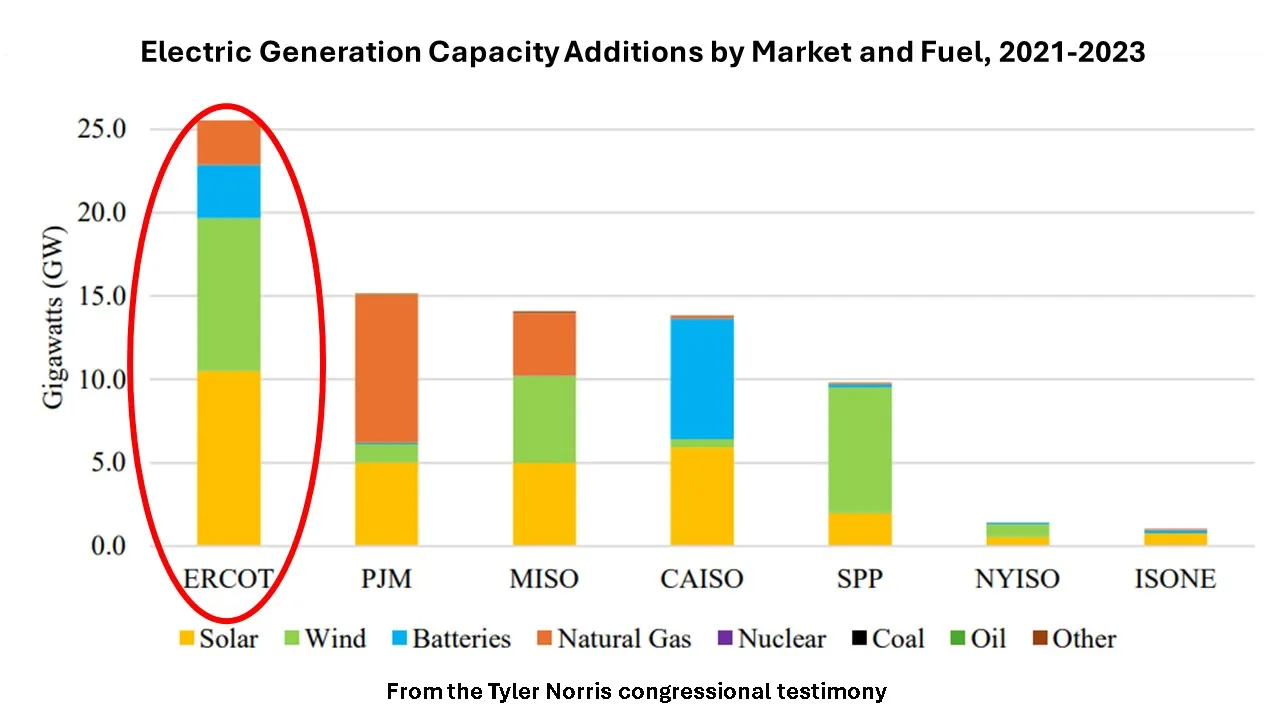

But data shows unequivocally that ERCOT’s number and speed of interconnections exceeds every other market substantially, Norris said.

The key feature of ERCOT's C&M that differentiates it from other region’s interconnection queues is an “absence of rules,” said former CEO of the ERCOT market monitor Beth Garza, now a senior fellow at think tank R Street Institute.

ERCOT’s initial studies of interconnection applications ensure “there is adequate generation,” but it has no capacity market, resource adequacy requirement, or other means to ensure deliverability, Garza continued. It “makes a sort of leap of faith that the competitive energy market will meet the need,” she said.

“Most of the interconnection costs are paid by energy users through ERCOT’s transmission cost allocation charge,” Garza added. “The generator assumes the main risk by accepting curtailment if the transmission system can't absorb the output,” she said.

“Markets curtail renewables generators all the time,” said Grid Strategies President Rob Gramlich. “In some places, more than 20% of hours have curtailments,” and in ERCOT generators can choose to risk any revenue losses, he added.

But most markets are currently putting increased value on deliverable resources that can meet spiking demand peaks, and generators want that value, market executives and analysts said.

Deliverability or flexibility?

System operator studies differentiate between resources deliverable when and where needed and energy-only resources for use when system conditions allow, Garza, Norris and others said.

“The primary cause of the massive interconnection queue backlogs is this binary choice” between an energy-only and a deliverable interconnection, Norris told the House of Representatives Energy and Commerce Energy Subcommittee March 5. Projects must wait in queues while studies determine the cost of system upgrades to make them deliverable under all system conditions, he added.

To qualify for capacity markets or resource adequacy requirements, generation must have a Network Resource Interconnection Service, or NRIS, review, Norris said. A generator that is willing to be interconnected as energy-only and risk curtailments and reduced revenues can have the less rigorous Energy Resource Interconnection Service, or ERIS, review, he added.

The NRIS review is “a barrier to entry” for new generation because it takes time and can impose significant system upgrade costs on the developer, Norris wrote in his 2023 paper on Federal Energy Regulatory Commission, or FERC, Order 2023. In Texas, there is no binary choice because all resources are energy-only, he added.

Other markets’ NRIS studies “often make unreasonably restrictive assumptions” and ignore “redispatch and curtailment opportunities” or technology solutions, Norris said. Some systems may use “worst-case” scenarios or require NRIS studies “even when those generators don’t contribute to resource adequacy,” and modeling shows that leads to more expensive network upgrades, he added.

Transmission providers could allow resources to come online with a provisional ERIS review and then establish deliverability with an NRIS review and the necessary upgrade investments, Norris said in a 2024 FERC workshop filing.

And ERIS-reviewed energy-only resources could be “a reserve” that could more quickly achieve “deliverable status” to meet new demand, or they could provide local capacity value or meet resource adequacy requirements, Norris told the workshop.

“Entering as ERIS and waiting to move to NRIS is not technically wrong because it would bring resources online faster, but it overlooks project finance realities,” said David Mindham, director of regulatory affairs for independent power provider EDP Renewables North America. Developers “cannot raise capital with an unknown amount of curtailment and unknown future interconnection upgrade costs,” he added.

Outside ERCOT’s deregulated market, financing is less of a factor for projects owned by regulated utilities that earn a regulator-set return on invested capital and are indifferent to curtailments, Mindham said.

C&M or an ERIS to NRIS process “might be workable for regulated utilities, but it also might tend to drive out more competitively priced projects,” Mindham said. The uncertainty with either option “would make independent developers’ projects unfinanceable or financeable only at higher interest rates,” he added.

But ERCOT’s success has put pressure on other regional markets to design more flexible and streamlined interconnection processes, Garza, Mindham and Norris said.

Regional market innovations

Integrated planning, provisional interconnections and upfront upgrade cost certainty for developers can streamline interconnection processes, market analysts said.

PJM is working on integrated planning.

“The notion that new load can just connect and be managed is highly unrealistic” and the risk in Texas “is not really imposed on new generators,” said Joseph Bowring, president of PJM independent market monitor Marketing Analytics. C&M incentivizes load “to locate where new transmission paid for by consumers” makes new generation accessible, he added.

In fact, recent concerns in Texas about congestion led ERCOT to propose new transmission lines that were approved by the Public Utilities Commission of Texas April 24, Bowing noted.

PJM’s alternative is planning that integrates generation, transmission, and operations and incentivizes “deliverable megawatts” to locate at resource-rich locations with low interconnection costs, Bowring said.

MISO has used provisional interconnection processes successfully.

The alternative in MISO to generators paying for system upgrades needed for deliverability or socializing upgrade costs is a provisional generation interconnection agreement, said Clean Grid Alliance Vice President of Transmission and Markets David Sapper. As Norris suggested, it brings generators online with an ERIS review and an agreement to eventually pay for upgrades to meet NRIS deliverability requirements, he added.

Streamlining interconnection comes with trade-offs between the ease and efficiency of a C&M approach and the certainty and complexity of deliverability requirements, but SPP may bridge the gap, Mindham and Bivens said.

SPP’s breakthrough alternative

SPP’s Consolidated Planning Process, or CPP, is designed to meet the integrated planning, provisional interconnection, and cost certainty challenges and preserve deliverability standards.

Bringing interconnection and transmission planning processes together will “ensure the right transmission upgrades are built at the right time and costs are shared based on benefits,” SPP staff reported to its board May 6.

It will also provide accurate estimates of ERIS and NRIS upgrade costs, staff said. Upfront and certain cost commitment by generators to a significant “GRID Contribution,” or Grid-C, fee can reduce the average 60% withdrawal rate from backlogged queues, it added.

The CPP will use SPP long-term planning studies of load, generation and transmission to accurately estimate the Grid-C fees for each proposed project’s share of new transmission costs, said Steve Gaw, senior vice president for infrastructure and markets with the Advanced Power Alliance and a member of SPP’s CPP task force. That “upfront cost certainty” will limit queues to committed applicants, he added.

CPP will also provide load serving entities cost certainty, increase system operator reliability, and reduce electricity user rates, staff said. To ensure transmission upgrade costs are shared, all generators will pay an ERIS GRID-C fee and those that request deliverability status can pay for an NRIS GRID-C fee to ensure their output is eligible for resource adequacy revenues, it added.

Bivens first instinct, on moving from ERCOT’s market monitor to her new executive position with SPP’s market monitor, was “why doesn’t SPP use connect and manage?” she said. But “it is now clear” that CPP addresses the multi-state system deliverability and cost certainty issues that C&M omits, she added.

CPP would be “a comprehensive change from the way planning has been done in any other multi-state region,” said Gaw. SPP states and stakeholders “have endorsed the concepts” and “if they continue making the incremental decisions to balance the region’s multiple interests, CPP could be something other regions can use,” he added.

Enacting CPP will require SPP stakeholder collaboration, EDP’s Mindham agreed. But the upfront flat fee commitment can “align the market operator and the generator on the need to move only viable resources into the queues,” he added.

These potential revisions were inherent in the original FERC Order 2003 standardizing interconnection, said Grid Strategies’ Gramlich, who was on the FERC staff when the order was written.

Generators have likely always considered interconnecting as ERIS resources and moving to NRIS status, Gramlich continued. But transmission providers “could be more flexible about making that process and the upfront price information needed available, encouraging it, and accommodating it to get more power on the grid faster,” he said.