This is the latest installment in Waste Dive’s Biogas Monthly series.

Environmental groups are opening up new forms of opposition to clean fuels credits that reward farm biogas in two states. If successful, they could reduce the strong incentive farm owners receive to convert biogas from manure into renewable natural gas.

In California, a coalition of environmental groups led by Food & Water Watch sued the California Air Resources Board on July 25. They allege that the Low Carbon Fuel Standard amendments that went into effect on July 1 unlawfully expand support for farm biogas and lock in negative impacts to communities near factory farms. The groups specifically hope to reverse avoided methane crediting, a policy that gives factory farm biogas particularly strong carbon intensity scores that boosts the price they charge for the credits they generate.

“This new suit aims to bring CARB back in line with its obligations to honestly and equitably address the climate crisis under California’s climate laws,” Tyler Lobdell, staff attorney at Food & Water Watch, said in a statement. “CARB doubling down on false climate solutions like factory farm biogas is bad for the climate and bad for Californians, and now we’re arguing it’s illegal as well.”

Food & Water Watch is joined by Central Valley Defenders of Clean Air and Water, the Animal Legal Defense Fund and Center for Food Safety in its lawsuit. The California Air Resources Board did not respond to a request for comment about the lawsuit.

Clean fuel standards have become subject to increasing political pressure in recent months as state and federal lawmakers — encouraged by the Trump administration — have prioritized gas prices for consumers over aggressive climate action.

In a related update, the LCFS appears to have survived an attempt to cap credit prices at January 2025 levels. That proposed change was included as part of SB 237, a bill introduced in the California legislature to make gasoline more affordable. The language was removed from the bill, which is still making its way through the legislature, in July.

Food & Water Watch is also pressuring New Mexico regulators to not include avoided methane crediting in the state’s own that state’s clean fuels policy. New Mexico’s Clean Transportation Fuel Standards are still being shaped by the state’s Environmental Improvement Board. The CTFS program was created through a bill signed into law by Gov. Michelle Lujan Grisham in March 2024.

New Mexico’s agency staff have released multiple draft proposals for the fuel standards, with the more recent proposal making carbon intensity scores for factory farm biogas less lucrative, Lobdell said on a recent webinar.

The environmental group is urging New Mexico residents to keep up pressure on the Environmental Improvement Board ahead of its late September meeting where it will next debate the fuel standards. The board could finalize the standards at that time.

“We cannot afford to enrich and entrench factory farms,” Emily Tucker, New Mexico organizer with Food & Water Watch, said on the webinar. “We must not import this policy from California into New Mexico, especially when that policy has led to numerous legal challenges and is opposed by environmental justice advocates across California.”

Despite activist pushback, new biogas projects and deals progressed in July. Below are a selection of updates from the industry.

Republic Services brings sixth facility online

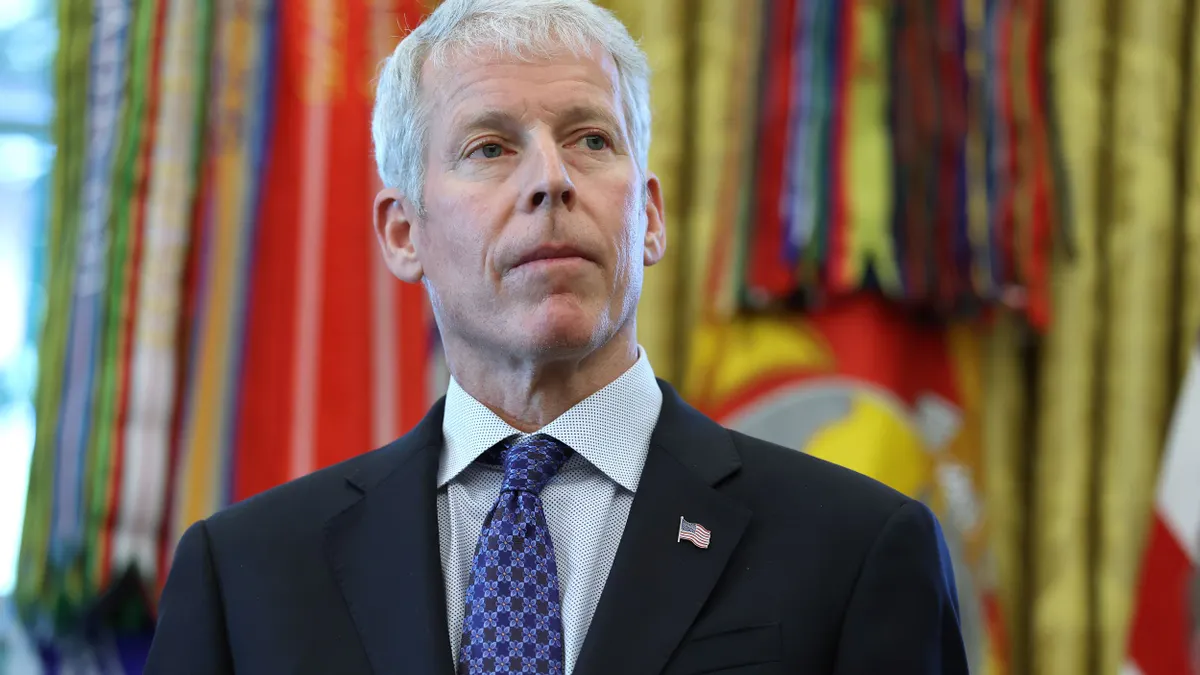

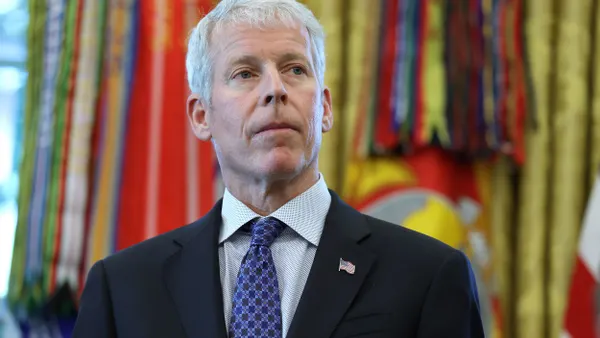

Ameresco partnered with Republic Services to open a landfill-gas-to-RNG facility in Dixon, Illinois, the companies announced in July. It's Republic's sixth such facility to open in 2025, with one more scheduled to come online by the end of the year, CEO Jon Vander Ark said on the company's earnings call last week.

Located at the Lee County Landfill, this is the 15th facility produced by the two partners. They expect it to produce 1.2 million mmBtus of RNG annually.

Republic continues to progress on its RNG production goals, part of its broader emissions reduction activities. The company said it beneficially reused 76.9 billion standard cubic feet of landfill gas in 2024, per its most recent sustainability report.

Sagepoint Energy adds landfill facility

Sagepoint Energy reached a deal with North American Power Systems to acquire a landfill-gas-to-electricity facility in Birch Run, Michigan. Sagepoint will convert the Peoples LFG plant to an RNG-producing facility.

“The acquisition of Peoples is a strategic advancement in expanding and strengthening our RNG portfolio,” Sagepoint CEO Aaron Johnson said in a release. “By converting this landfill gas-to-electricity plant into an RNG facility, we are enhancing our operational capabilities and driving increased renewable natural gas production.”

Sagepoint plans to begin construction in 2025 and start commercial operation next year.

This is the third acquisition by Sagepoint in 2025. The Indiana-based company was formed by Ares Management in April. Sagepoint is working to increase its portfolio of landfill gas projects through M&A this year, Johnson told Waste Dive.

Waga Energy refinances Canadian facilities

French RNG company Waga Energy closed a $25 million (Canadian) loan to refinance three Quebec facilities, the company announced. This is the company's first refinancing transaction in Canada.

Equitable and the Empire Life Insurance Co. provided the 19-year loan. The company will pay down construction debt with some of the proceeds. It says the loan will strengthen Waga's cash position and allow it to pursue new facilities in Canada and internationally.

Waga has been expanding rapidly in North America in recent years, with seven plants in operation and 13 under construction. The company continues to negotiate with EQT Transition Infrastructure, which offered to acquire a majority stake in Waga in June. Waga's board of directors previously expressed unanimous support for the deal. If they agree to proceed, the parties would file the offer with French regulators by year’s end.

BTS Bioenergy expands Maryland footprint

BTS Bioenergy, which runs the Maryland Bioenergy Center, opened a new satellite facility to assist with feedstock consolidation. The new Maryland Organics Recovery Center takes palletized food waste from distribution partners and separates organics for processing at the MBC.

BTS Bioenergy, formerly known as Bioenergy Devco, is in the process of improving operations in Maryland, where it's operated an anaerobic digestion facility since 2021. CEO Nick Thomas told Waste Dive in June that he was looking to refocus the company's mission this year and double down on revenue-generating facilities like MBC.

“MORC represents a strategic expansion of our infrastructure that enables BTS Bioenergy to better serve the food distribution sector while advancing our mission of landfill diversion,” Thomas said in a statement announcing the Maryland expansion.