Dive Brief:

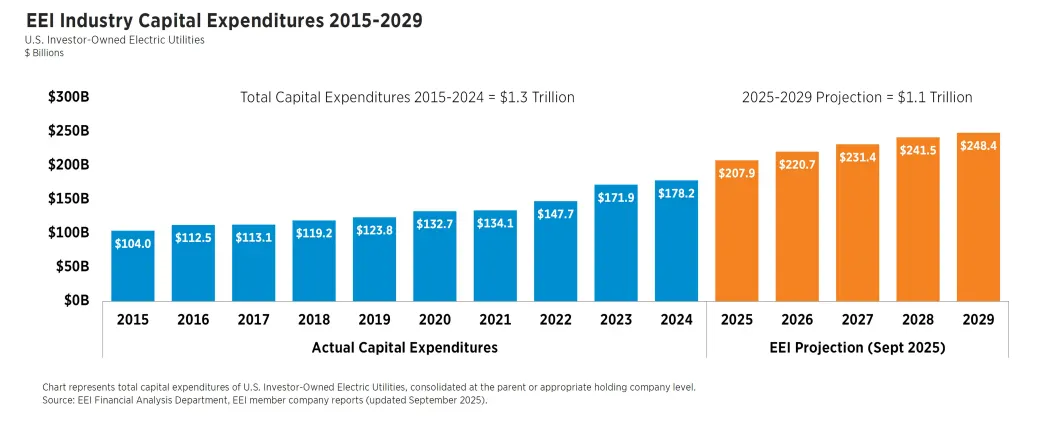

- Electric utilities are on pace to spend nearly $208 billion on grid upgrades and expansions this year, the highest amount ever, the Edison Electric Institute said Tuesday. The group represents investor-owned utilities.

- And more growth in capital expenditures is on the way, as the sector rushes to meet growing demand, according to EEI’s 2024 financial review. The group’s members are projected to make capital expenditures of more than $1.1 trillion between 2025 and 2029.

- U.S electricity generation rose 3% in 2024 “and is expected to rise for the foreseeable future,” EEI said. Generation investments as a share of the industry's total capital expenditures have risen for four straight years, it said.

Dive Insight:

After years of relatively stagnant growth, the electric sector is moving quickly to meet new demand from AI data centers, industrial expansion, electrification and other sources.

The U.S. generated 4.3 million GWh in 2024, “the largest annual jump in five years,” EEI said. The group anticipates an annual growth rate of 1.7% through 2040, when domestic generation could surpass 5.4 million GWh.

Meeting the new demand requires significant grid investments. IOU capital expenditures grew more than 16% from 2024 to 2025, based on anticipated investments, EEI said.

“Our capital expenditures are higher than any other sector in the U.S. economy, outpacing transportation, retail, and other capital-intensive industries,” EEI President and CEO Drew Maloney wrote in a letter accompanying the report. “As always, we remain committed to keeping customer bills as low as possible as we work to deliver the reliable, secure electricity that is enabling innovation and enhancing the energy leadership of the United States.”

But some experts say retail consumers are footing the bill for the grid buildout.

Average residential electricity rates jumped 6.6% over last year as of June, with the largest increases in Maine, up 25.5%, the District of Columbia, up 23.3%, and New Jersey, up 21%, according to data from the U.S. Energy Information Administration. EIA expects national average residential electricity prices to rise from 16 cents/kWh in 2023 to 17.9 cents/kWh in 2026, almost a 12% rise.

“State regulators have a duty to hold utilities accountable and ensure that all utility investment and cost recovery prioritizes the public interest,” Tyson Slocum, director of Public Citizen's Energy Program, said in an email. “Regulators should maximize opportunities for consumer advocates and other voices representing the public interest to meaningfully participate in these utility rate proceedings.”

In the PJM Interconnection, the largest organized electricity market in the U.S., the independent market monitor has put the blame squarely on data centers driving up capacity prices in recent years. Data centers drove up revenue in the PJM Interconnection’s last capacity auction by $7.3 billion, or 82%, to $16.1 billion, Monitoring Analytics said in a report published Oct. 1.