Dive Brief:

- Reliability risks are spreading across the bulk electric system, driven by soaring peak demand forecasts and lagging resource additions, the North American Electric Reliability Corp. said Thursday in its annual Long Term Reliability Assessment.

- Summer peak demand across the bulk system is forecast to grow by 224 GW over the next 10 years, a more than 69% increase over the 2024 LTRA forecast and a 24% increase from 2025 peak demand, NERC said. New data centers account for most of the projected increase. Winter demand growth is even higher, with 246 GW of growth forecast over the next decade.

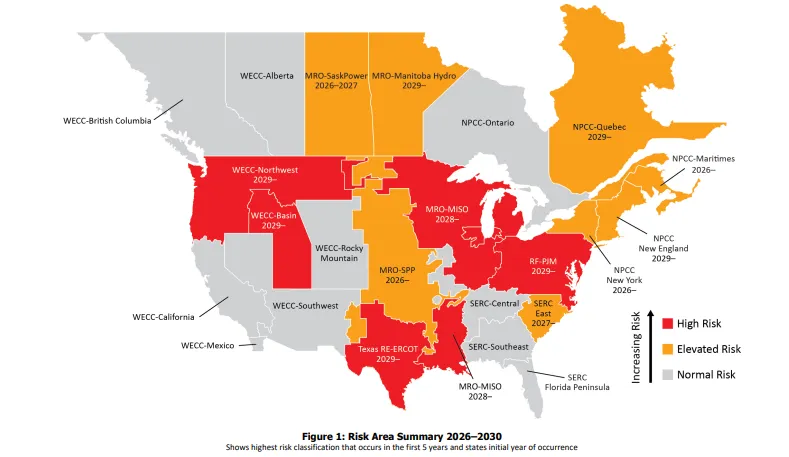

- The Midcontinent Independent System Operator, PJM Interconnection, Electric Reliability Council of Texas and parts of the Pacific Northwest all face a high risk of insufficient reserve margins or exceeding unserved energy criteria at some point within the next five years, according to the report.

Dive Insight:

“The system is changing faster than the infrastructure needed to support it,” John Moura, NERC's director of reliability assessments and performance analysis, said in a call with reporters. We are “in a period here where future electricity supply has never been more uncertain.”

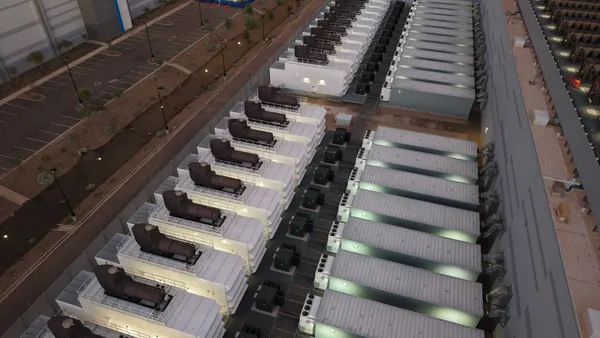

From 2024 to 2025, existing capacity from fossil-fueled generators fell by 21 GW, while bulk power system capacity for peak demand hours from battery, wind, and solar resources increased by 23 GW, according to the report.

Bulk power system capacity “fell short of projections this year,” said Mark Olson, NERC’s manager of reliability assessments. “And that was the case last year as well,” he added. Delays in connecting new resources and unanticipated generator retirements are the cause of the miss.

In a change from last year’s LTRA, NERC said solar PV is no longer the sole, predominant generation type planned over the next 10 years.

“New battery resource projects have grown to match solar projections, and, together, solar and battery capacity additions represent two-thirds of the Tier 1 and Tier 2 resources in this year’s 10-year LTRA study period,” the report said.

“Those provide good capability for meeting summer peak demand, but the capability of resources in the winter is very different,” Olson noted.

Natural-gas-fired generator additions represent 15% of the projected capacity additions followed by wind and hybrid resources at 8% each.

Projected generation retirements have shrunk from the 2024 reliability assessment. Confirmed and announced potential retirements over the next 10 years “remain high and total over 105 GW in peak seasonal capacity,” NERC said, but that is “roughly 10 GW lower than the 10-year retirement projections last year.”

All areas are adding resources and working to ensure grid stability, NERC said. But some face high risks over the next five years.

In MISO, projected resource additions “do not keep pace with escalating demand forecasts and announced generator retirements,” NERC said. In PJM, the grid operator’s anticipated resource margin will fall below a reference level starting in 2029.

In ERCOT, NERC said probabilistic unserved energy metrics for 2026–2027 have improved since the 2024 LTRA, “but continued rapid load growth outpaces projected resource additions in later years.” In parts of the Northwest, near-term resource additions “are predominantly solar PV, leading to a more variable resource mix,” and there is a growing unserved energy risk in summer and winter.

Industry groups responded, calling for policies to speed resource development and maintain existing plants.

“Poor grid operator interconnection processes, as well as overly cumbersome state-level siting and permitting rules, need urgent attention,” Caitlin Marquis, a managing director at Advanced Energy United, said in a statement. State leaders and grid operators “need to remove the red tape blocking deployment of the most cost-effective and fastest-to-build resources, including solar, energy storage, and demand-side resources.”

The Electric Power Supply Association, which represents competitive generators, said the industry is focused on adding new resources but also needs policies to keep existing plants online.

“Reliability is best served by competitive electricity markets that send clear, durable development signals — not by policy interventions that create misalignment between supply and demand,” EPSA President and CEO Todd Snitchler said in a statement. “In order to address the warnings NERC’s LTRA sets out, it will require getting market signals right while addressing permitting and siting delays, supply chain bottlenecks, and other barriers to development.”

America’s Power, which represents coal generators, called NERC’s assesment “another sobering wakeup call.”

“Utilities have announced plans to retire more than a fourth of the nation’s coal power plants over the next five years. Most of these retiring coal plants are located in high-risk regions,” America’s Power President and CEO Michelle Bloodworth said in a statement. “Unless these retirement plans are reversed, the grid will lose an energy-secure, affordable, and reliable source of baseload power.”