Public Service Enterprise Group reported its quarterly earnings — up 20% to $620 million from a year ago — on Monday, a day before New Jersey voters elected Mikie Sherrill, a Democrat, to be the state’s next governor.

During the campaign, Sherrill promised to declare a state of emergency on utility costs and freeze utility rates on her first day in office. She said she would “massively” build clean power while requiring more transparency from utilities, including PSEG’s Public Service Electric & Gas Co., and the PJM Interconnection.

“Prices are spiking because of a huge power shortage — I’ll transform New Jersey’s energy picture to build new, cheaper, and cleaner energy generation, bring down families’ bills, and put the Garden State on track to hit our emissions and clean air goals,” Sherrill said.

During a call with analysts before the election, Ralph LaRossa, PSEG chair, president and CEO, said the Newark, New Jersey-based utility company was used to working with both Republican and Democratic governors.

“We stand ready to work with the incoming administration to do our part to keep rates as low as possible in the short-term and work on longer-term solutions to add supply,” he said.

PSEG's potential willingness to work with the Sherrill administration and the New Jersey Bureau of Public Utilities to support customer bill affordability — through mechanisms such as extending cost recovery timelines — could help establish regulatory and policy support for PSE&G to participate in rate base initiatives as the state's energy construct evolves, equity analysts with Jefferies said in a note on Thursday.

PSE&G has the highest electric bills in New Jersey, with a roughly 36% increase last summer compared to a year earlier, not counting the benefit of temporary rate credits, the analysts with the investment bank noted. “We expect management to offer rate concessions,” they said.

Potentially, PSE&G could increase its spending on battery storage, transmission and energy efficiency to support the Sherrill administration’s energy goals, the analysts said.

Utility owned generation?

Like other utilities in New Jersey, PSE&G isn’t allowed to own generation. But in the face of tightening power supplies across PJM, that could change, according to LaRossa.

There is a “broad recognition” in New Jersey that the state, which imports 40% of its electricity, needs to add more generation, LaRossa said. Companion bills have been introduced in the New Jersey Legislature — S4306 and A5439 — that would allow utilities to own power plants, he noted.

“We are supportive of legislation that would increase competition for generation supply should New Jersey decide to pursue new in-state generation,” LaRossa said.

Utility-owned solar and storage could be options, according to LaRossa. “We've done large scale solar on some brownfield sites, some landfill sites, in the past,” he said. “So we could do more on the solar front. We think there's an appetite now for some regulated storage and we're looking forward to taking part in that.”

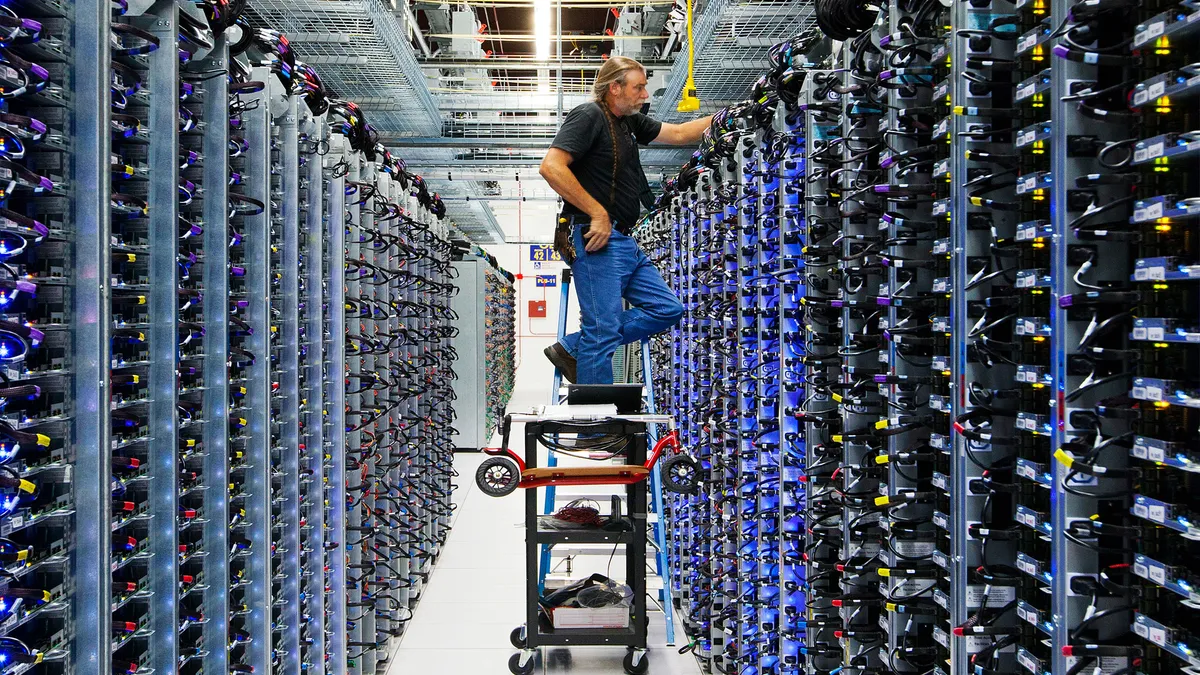

Data center pipeline grows

PSE&G’s “mature” data center interconnection applications grew to 2.8 GW in the third quarter from 2.6 GW, according to LaRossa. Data center development in PSE&G’s service territory hasn’t included large hyperscaler projects, he said.

As an example, PSE&G is working on the Kenilworth area data center, a “supplemental” project that was discussed at a PJM Transmission Expansion Advisory Committee meeting on Tuesday. The data center customer aims to bring the 100-MW facility online in 2027 and expand it to 300 MW two years later.

The company continues to talk with data center developers about buying electricity from PSEG Power’s 3,758-MW nuclear fleet in New Jersey and Pennsylvania, LaRossa said.

PSEG plans to add 200 MW to the 2,285-MW Salem nuclear power plant in southern New Jersey in the 2027 to 2029 timeframe, according to LaRossa.

“This kind of baseload, carbon-free dispatchable power continues to increase in scarcity value,” he said.

LaRossa underscored the possible benefits of the U.S. Department of Energy’s proposal for interconnecting data centers and other large loads, which is under consideration at the Federal Energy Regulatory Commission.

“There are many positive elements to this proposal, but it will take a while before we see the ultimate impact of the rulemaking,” LaRossa said.