The Trump administration and a bipartisan group of governors on Friday asked the country’s largest wholesale electricity market to hold a one-time “emergency” auction to provide data centers with new sources of power.

They urged the PJM Interconnection to hold an auction so data center owners could bid on 15-year power purchase agreements in what would be a stark departure from how the grid operator normally operates. The auction could support $15 billion in new power plants, according to a U.S. Department of Energy fact sheet on the agreement.

The data centers would be required to pay for the new generation built for them, whether they use the power or not, DOE said.

PJM is reviewing the proposal, the grid operator said in a social media post. The grid operator said it will work with its stakeholders to see how the emergency auction proposal aligns with a plan for handling data center interconnections that PJM’s board is set to release today.

PJM was not invited to a White House event Friday to announce the move, according to Jeffrey Shields, a spokesman for the grid operator.

Any emergency auction would need to be approved by the Federal Energy Regulatory Commission. At her first open meeting as FERC chairman in November, Laura Swett said connecting data centers to the grid was her top priority along with ensuring grid reliability at reasonable rates.

Capstone analysts said in a client note after Bloomberg News first reported the initiative Thursday that the statement from the governors and the federal officials lacks binding authority, “reinforcing that this is policy signaling, not an imminent market reform.”

They suggested a six to 12 month timeline before an auction could be held, “at the earliest.”

Why hold a special auction?

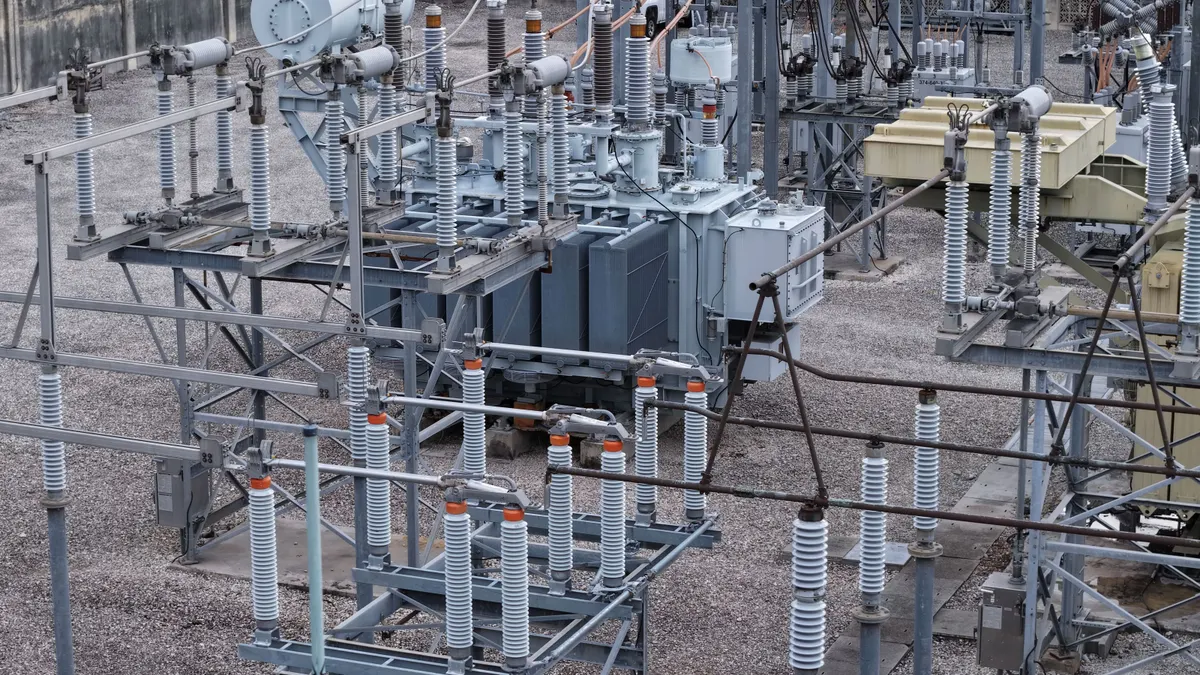

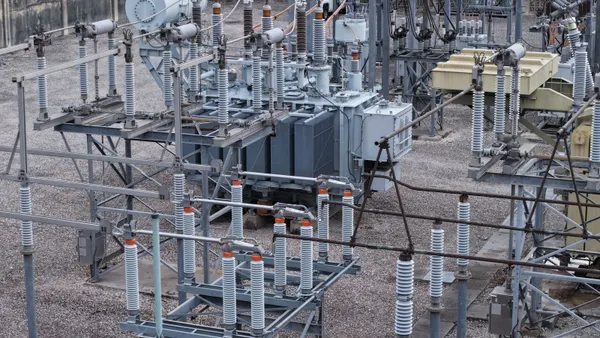

The U.S. has seven major grid operators, each with its own structures, covering most of the country.

PJM runs the grid and wholesale power markets in 13 Mid-Atlantic and Midwest states and in the District of Columbia, where about 67 million people live. Normally, it ensures that it has enough power supplies to meet its needs through capacity auctions held in advance of when the power is actually needed.

Under that system, power plant owners are paid to be available to produce electricity in the upcoming delivery year — which normally begins about three years after the auction is held. Because it’s a forward market, the auctions are run based on estimates of how much power will be needed.

Parts of the PJM footprint, such as northern Virginia, have seen massive data center development, leading to growing demand for electricity. Some of that demand is based on existing or confirmed load, but much of it is based on projections.

This mismatch between the sudden increase in demand — both real and predicted — and power supply has caused capacity prices to spike in the last three auctions PJM held.

The role of data centers in those price increases has become a focus in the debate over affordability in PJM.

Existing and planned data centers accounted for $23.1 billion, or nearly half, of the $47.2 billion in cost from PJM’s last three capacity auctions, according to a report released earlier this month by the grid operator’s independent market monitor.

Monitoring Analytics, the market monitor, has called for PJM to require data centers to only get electricity from new sources of power so they don’t reduce existing supplies. The market monitor contends that unfettered data center development threatens grid reliability. It has also voiced concern over the speculative and uncertain nature of the load forecasts.

What are they asking for?

PJM’s most recent auction, held in December for the 2027-28 delivery year beginning June 1, 2027, saw the same record-high prices as its previous two.

Now, Trump officials and governors want PJM to hold a separate “emergency” auction for data centers.

They also called on PJM to reimpose a price cap and floor on its annual capacity auctions. The temporary mechanism was originally developed through an agreement between PJM and Pennsylvania Gov. Josh Shapiro, D.

In the two auctions in which the price floor/cap was in effect, it reduced capacity costs by $13.1 billion, according to the market monitor’s estimate. Currently, the mechanism won’t be used in PJM’s capacity auction for the 2028/29 delivery year that is set to be held from June 30 to July 4.

Capstone said any change to PJM’s reliability backstop or capacity procurement framework would require tariff revisions, either proposed by PJM under the Federal Power Act’s Section 205 or initiated by FERC under Section 206.

Proposal supported by IOUs, some environmental advocates

The Edison Electric Institute, a trade group for investor-owned utilities, said it supported the auction initiative, as did some environmental groups.

“We support President Trump and the Governors' focus on swift changes to help lower energy costs for customers and get more power plants online,” EEI President and CEO Drew Maloney said in a statement. “We look forward to working with FERC and the state commissions to be part of the solution.”

EEI in October urged PJM to support ways to add more generation in its footprint, including through utility-owned power plants and greater procurement flexibility outside the grid operator’s capacity market.

Paul Segal, CEO of LS Power, an independent power producer, said hyperscalers should pay for new capacity they need.

“An emergency auction funded by large loads can be a useful bridge if it’s truly competitive,” he said. “That means no price-cap extensions, real performance requirements (not paper capacity), and a competitive, technology-neutral process that prices grid access upfront and uses pathways suitable for new load.”

The Sierra Club is also backing the plan, saying it will help protect consumers from data center-related costs.

“We have been working continuously with lawmakers, advocates, and PJM, to ensure that our communities aren’t forced to pay Microsoft or Meta or any Big Tech company’s power bills,” Sierra Club Senior Advisor Jessi Eidbo said in a statement.

The share prices of independent power producers with power plants in PJM fell Friday morning. Constellation Energy’s stock plunged 9.7%, Talen Energy fell 8.7%, Vistra Corp. dropped 7.4% and NRG Energy dipped 3.3%.