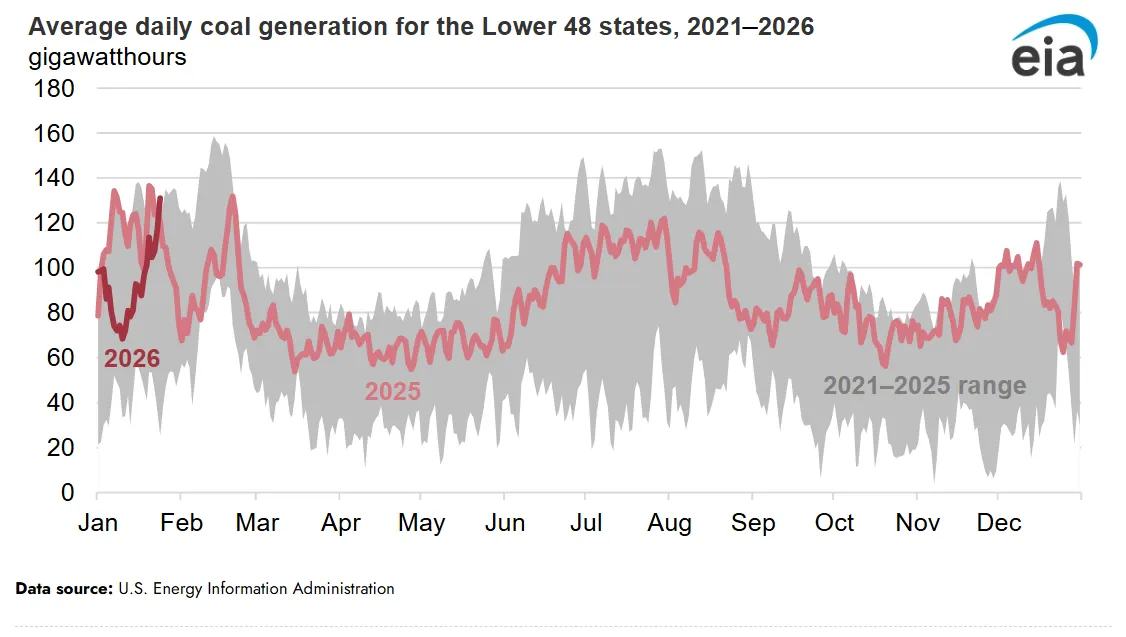

The U.S. electric grid leaned heavily on fossil fuels during Winter Storm Fern, with coal generation in particular jumping 31% for the week ended Sunday, the U.S. Energy Information Administration said Tuesday.

Beginning Friday, Fern brought snow, ice and frigid temperatures to a swath of the U.S. from Texas to New England.

Coal generation has surged in the second half of January, from a mid-month low of around 70 GWh/day to about 130 GWh/day, according to EIA data. During the week of Fern, gas generation in the Lower 48 also increased 14% from the previous week while generation from solar, wind, and hydropower declined.

“Grid operators can call upon the coal fleet to increase electricity generation in extreme weather events and other times when demand surges or output falls from other generation sources, a pattern also evident in severe cold snaps in February 2021 and January 2025,” EIA said.

The U.S. Department of Energy on Saturday and Sunday issued emergency orders to keep some generation sources running during Winter Storm Fern, regardless of emissions limits, in New England, Texas and the Mid-Atlantic. Additional 202(c) waivers were issued Monday as cold temperatures remained and the outlook turned arctic.

ISO New England and PJM Interconnection have authorizations to run necessary generation through Saturday, and the New York ISO has similar approvals through Monday, according to DOE’s list of waivers published this year.

On Monday, the New England grid operator said it anticipates operating conditions “will continue to tighten in the coming days.” The latest 21-day forecast “indicates narrow energy margins from Friday, Jan. 30, through Sunday, Feb. 1, although the region is still expected to meet consumer demand and required operating reserves.”

The persistent cold weather has spiked both peak demand and overall energy consumption, ISO New England said.

“Meeting this consumer demand is requiring significant usage of the region’s stored fuel oil and liquefied natural gas inventories,” it said.

Electricity prices in the region are closely tied to natural gas prices.

Last year, EIA said it expected natural gas prices to average $4/MMBtu in 2025 and jump to $4.90/MMBtu in 2026, up from $2.20/MMBtu in 2024. On Monday, Natural Gas Intelligence reported natural gas spot prices had hit an all-time high, with a daily average of $30.565/MMBtu.

Oil-fired generation surpassed natural gas in New England during the winter storm, EIA said Thursday. Generators operating dual fuel plants can switch away from gas when prices are high or supplies are obligated for residential heating customers.

While oil generation is less than 1% of total U.S. utility-scale power generation, from midday on Saturday to early morning Monday, “petroleum was the predominant energy source” for generation in New England, EIA said. Since then, oil and gas have “been fluctuating as the primary energy source.”