Dive Brief:

- The U.S. energy storage sector is poised to grow significantly now that federal policy on incentives has been finalized and the impacts of trade tariffs are becoming clearer, according to a report from law firm Troutman Pepper Locke published Tuesday.

- The versatility of energy storage resources has “untethered it from the fate of wind and solar to a meaningful degree,” report co-author and Troutman Pepper Locke partner Vaughn Morrison said in a statement. Renewable resources saw federal tax credits cut by the One Big Beautiful Bill Act, enacted in July, but storage incentives were left in place.

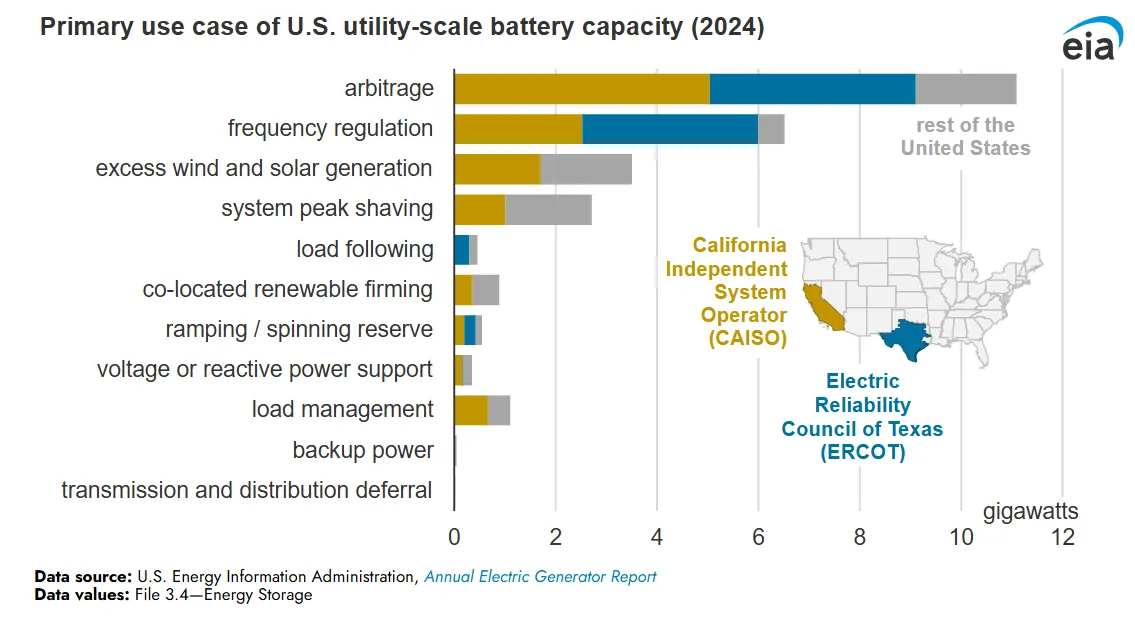

- Price arbitrage is an increasingly popular use case for utilities adding energy storage resources, the U.S. Energy Information Administration said Monday. In 2024, two-thirds of all utility-scale battery capacity had arbitrage among its uses, and 41% of the total capacity was primarily used for arbitrage.

Dive Insight:

The Troutman Pepper Locke report does not make specific predictions about the energy storage market, but paints a narrative of optimism across the sector.

“Power prices are going to rise dramatically,” said Andrew Waranch, CEO of Spearmint Energy and one of several energy executives interviewed for the report. The company has 20 storage projects, totaling more than 13 GWh of capacity, under development in 10 states.

Waranch sees the post-OBBBA clarity, and the rising cost of electricity, as drivers of the storage market.

“So much of the power market and power price is set by expensive and old generators that only need to operate for the narrowest of windows during ramp times in the morning and evening,” Waranch said. “In contrast, batteries can solve that quickly and cheaply with extremely high reliability.”

Following arbitrage, EIA says frequency regulation is the most common use case for utility-scale storage.

Frequency regulation was the primary usage for 24% of battery capacity last year, EIA said.

“In previous years, operators had reported that frequency regulation was the most common use case for their battery systems,” it said.

While energy storage fared better in OBBBA than wind and solar incentives did, there are still challenges, the Troutman Pepper Locke report warned. The bill included Foreign Entities of Concern provisions for storage projects that limit access to tax credits when components coming from adversarial nations, particularly China, are used in batteries.

OBBBA’s impact on energy storage “is less severe than some feared,” John Leonti, partner and chair of the energy department at Troutman Pepper Locke, said in a statement. However, the FEOC provisions “issue significant supply challenges for the industry moving forward.”

The FEOC rules are “really handicapping the industry pretty significantly,” said Prevalon CEO Tom Cornell in the report. “There’s just not enough time to move the supply chain that quickly, especially around the battery cells, so that’s really our big concern.”