2026 will be a year of reckoning for the electric power industry.

Major policy changes in the One Big Beautiful Bill Act, which axed most subsidies for clean energy and electric vehicles, are forcing utilities, manufacturers, developers and others to pivot fast. The impacts of those changes will become more pronounced over the coming months.

Market forces will also have their say. Demand for power has never been greater. But some of the most aggressive predictions driving resource planning may not come to pass, leading some to fear the possibility of another tech bubble.

At the same time, each passing day brings more distributed energy resources onto the grid, increasing the opportunities — and expectations — for utilities to harness those resources into a more dynamic, flexible and resilient system.

Here are some of the top trends Utility Dive will be tracking over the coming year.

Large loads — where are they, and who controls their interconnection — dominate industry concerns

Across the United States, but particularly in markets like Texas and the Mid-Atlantic, large loads — mainly data centers designed to run artificial intelligence programs — are seeking to connect to the grid, driving up electricity demand forecasts and ballooning interconnection queues.

That’s led some states to introduce new large load tariffs to weed out speculative requests, with more states expected to follow suit.

The Department of Energy is now pushing federal regulators to take a more active role in regulating how those loads get connected to the grid, setting the stage for a power struggle between state and federal authorities. The DOE asked the Federal Energy Regulatory Commission to issue rules by April 30, a deadline many say will be hard to meet.

In addition, some observers warn that the data center frenzy could lead to an unnecessary infrastructure buildout like the one that occurred at the turn of the 21st century. At that time, the tech and energy industries massively overestimated how much power the Internet would need, leaving utilities and ratepayers on the hook for underutilized assets.

In 2026, power sector participants will be closely watching exactly how much data center load comes online and whether current forecasts are accurate. There are already signs that data center demand will grow more slowly than expected.

Some utilities that introduced more stringent interconnection rules for data centers have already seen their large load queues shrink by 50% or more.

Last month, the U.S. Energy Information Administration revised down its generation growth forecast for 2026 “based on how much large load electricity demand has come online so far this year ... and its implications for near-term growth.”

And the PJM Interconnection, the largest U.S. grid operator, which is under tremendous pressure over prices and capacity, has suggested that its new load forecast, slated for release in January, could be significantly lower than the previous one based on stricter vetting of potential large loads and a reduced economic outlook.

Renewables remain a large and growing resource, despite federal policy U-turn

Renewables continue to make up the vast majority of new generation resources coming online every month, and the immediate demand for more power means they will grow their share in the power system, industry sources say.

That’s despite a hostile federal policy environment created by the Trump administration, whose leaders have said explicitly that they favor oil, gas, coal and nuclear over wind and solar.

The renewable energy sector is reeling from a rollback of clean energy tax credits and new foreign entity of concern rules affecting their supply chains. The administration has also introduced new layers of approval for renewable energy projects, revoked previously issued permits and frozen construction on all offshore wind farms.

As the investment tax credit the OBBBA curtailed approaches its new phaseout deadline, Dan Smith, vice president of markets at DSD Renewables, said he anticipates a trend toward the renewables industry reducing its soft costs, such as those associated with permitting, surveys, legal fees and financing.

“Some of the industry’s current development methods became the standard in the context of tax credit financing,” Smith said. “But lower-cost alternatives will allow for successful project development while minimizing costs.”

Large and small load flexibility will play a more active role in grid management

New generation capacity takes years to build, but large commercial and industrial customers want power now.

Some hyperscalers and utilities are exploring ways for data centers and other large loads to connect to the grid faster by agreeing to flex during the few hours or days each year a system reaches peak demand. They can do this by powering down their operations, powering up their own generation or storage, or paying other users on the system to reduce consumption.

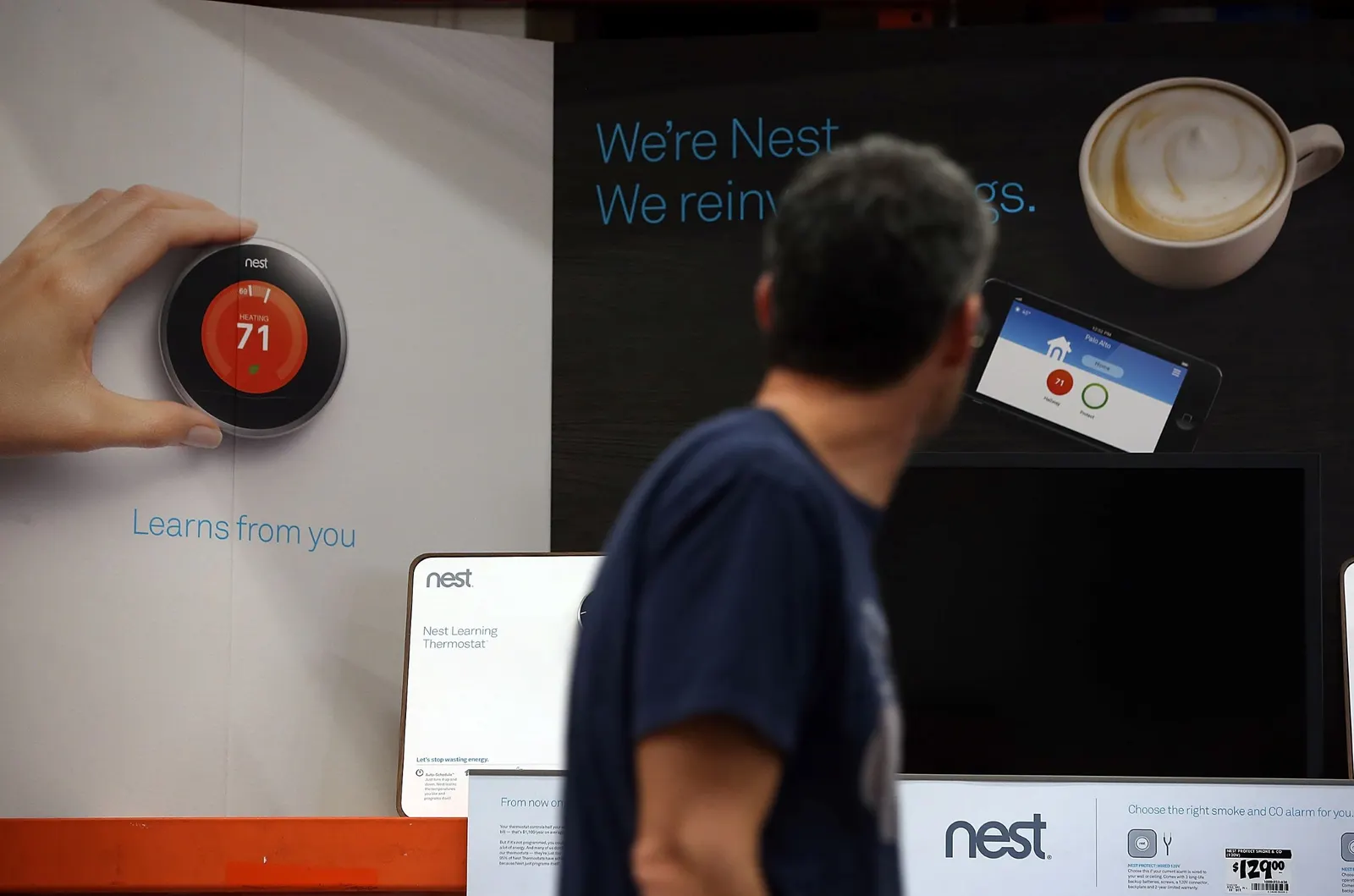

The idea of load flexibility is not limited to data centers. The proliferation of distributed energy resources, such as rooftop solar, home batteries, electric vehicles and smart appliances, as well as more sophisticated tools for managing those resources, have given rise to the virtual power plant, in which thousands of individual utility customers can participate.

Harry Godfrey, a managing director with Advanced Energy United, said he sees the trend toward distributed resources and demand response technologies growing, especially with rapid demand growth raising the pressure on utilities to squeeze more out of existing resources.

“I think we are starting to see more awareness of the value that these resources can provide [and] the speed with which they can provide that value — the value both to the grid, but also to individual consumers,” Godfrey said.

Super-cycle of utility spending draws increased scrutiny

Throughout 2025, investor-owned utilities touted their growing data center pipelines as they entered an infrastructure investment “super-cycle.”

Industry groups and analysts project utilities will spend between $1.1 trillion and $1.4 trillion by 2030 — roughly doubling what they spent in the previous 10 years, by some estimates.

However, utilities face challenges and risks that could affect their spending plans, including growing backlash from ratepayers, regulators and elected officials.

The regulated utility sector’s main funding avenues — rate cases and issuing debt and equity — may not be adequate to fund the planned investments, Deloitte Research Center for Energy & Industrials said in a report in late February. Rising electric bills in recent years could leave less room for further rate hikes, the Deloitte analysts said.

Not-for-profit utilities face many of the same pressures. S&P Global in early December said public power and cooperative utilities face a negative outlook in 2026.

“This view reflects converging, substantial, and costly infrastructure financing needs and diminished consumer rate affordability that can erode the benefits of autonomous ratemaking authority, frustrate some utilities’ cost recovery, and weaken financial margins and ratings,” S&P analysts said.

Electricity prices hit new highs and are still climbing

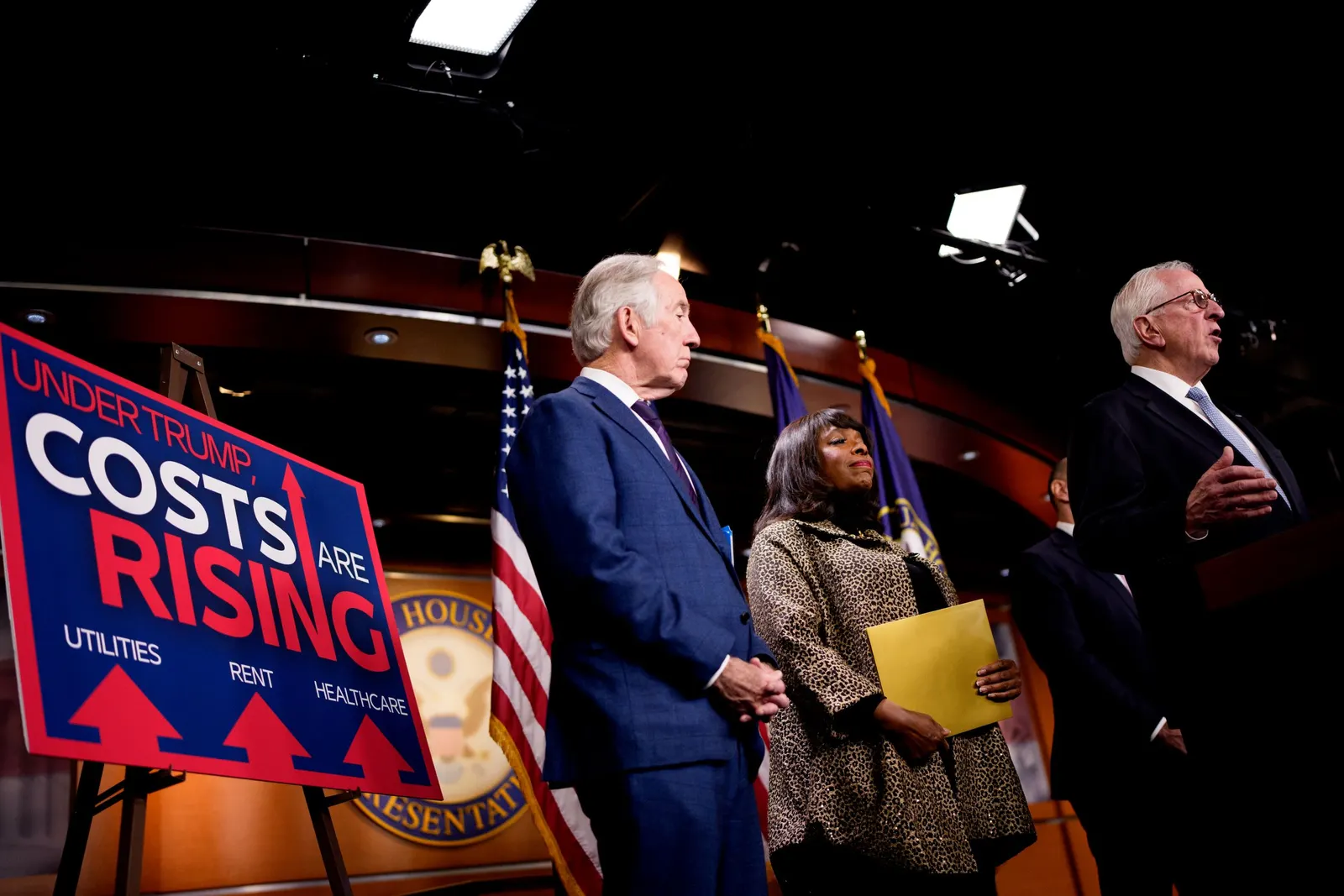

On the campaign trail in 2024, President Trump promised to slash energy and electricity prices by half in his first 18 months in power. But data from his administration show prices are continuing to rise, and experts do not see an easy solution.

The EIA’s most recent outlook puts the national average residential price per kilowatt hour in 2026 at 18 cents, up approximately 37% from 2020.

The increases are not distributed evenly across the country, however, and experts are divided on the underlying reasons — particularly the role of data centers.

One influential study from the Lawrence Berkeley National Laboratory found that while retail electricity prices increased sharply in nominal terms, the average masked substantial differences between states. Researchers concluded that, after adjusting for inflation, 31 states saw real price declines from 2019 to 2024, while 17 saw increases.

They also found load growth tended to depress retail electricity prices.

What customers see on their bills, however, is determined by more than the straight retail rate per kilowatt hour. And regardless of how increases compare with overall inflation, residential rates have risen faster than those for commercial and industrial customers, shaping public perceptions about fairness.

“Rising rates and capital costs are colliding with customer expectations for choice and control,” consulting firm West Monroe said in a November note.

It said customer affordability is “at a tipping point,” requiring utilities to engage in “data-driven affordability strategies and transparent communication.”

Storage has nowhere to go but up

Once considered a niche add-on to renewable generators, storage systems are now a standard part of system planning for utilities, independent power producers and large energy users alike. 2025 saw record energy storage additions as battery prices fell, according to an analysis from the American Clean Power Association and Wood Mackenzie.

The most common use of utility-scale storage systems is price arbitrage, according to the EIA. But they are also being deployed for frequency regulation, system peak shaving, load management and backup reliability.

This trend is likely to continue as large loads like data centers are either incentivized or, increasingly, required to be flexible and dial back usage during times of peak demand or grid insecurity.

Storage also emerged relatively unscathed from the OBBBA, compared with renewables, although it faces supply chain complications from tariffs and new foreign entity of concern rules.

The “continuing credit window” for storage and its ability to help data centers ensure uninterrupted power support its continued integration, said Keith Adams, Deloitte's U.S. renewable energy leader.

"There's about 18 gigawatts under construction that are expected to be completed by the end of [2026]," Adams said.

“We expect an even larger pipeline, maybe upwards of close to 200 GW, by the end of 2030," he added.

The U.S. Energy Storage Monitor report said despite near-term year-over-year declines in the utility-scale and residential segments, it projected 92.9 GW of storage will be installed in the U.S. over the next five years.